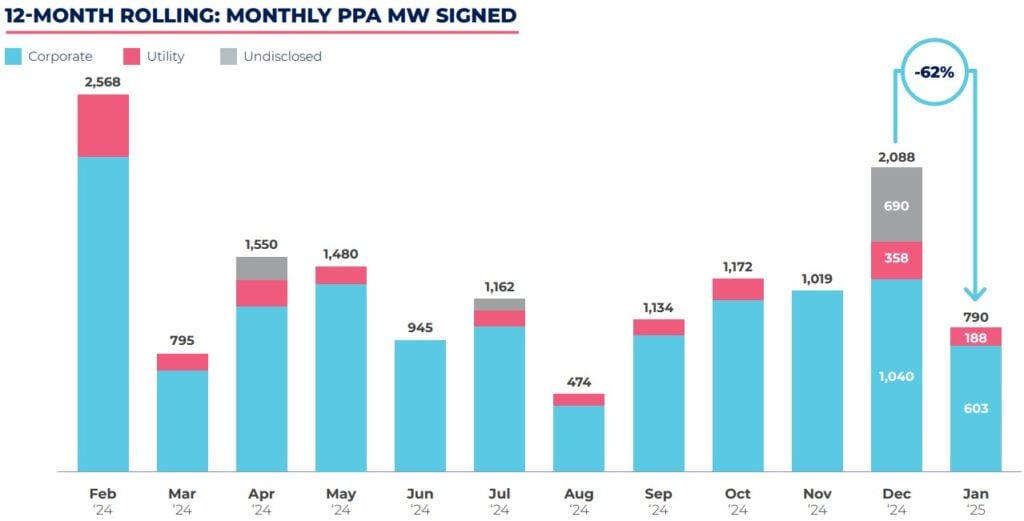

Offtakers signed 25 power purchase agreements (PPAs) in Europe in January of this year, for a total of 790MW of electricity generation capacity, a 62% month-on-month decline in the capacity of renewable power PPAs signed.

This is according to the latest PPA report produced by Swiss consultancy Pexapark, which covers offtake agreements signed in the renewable energy sector. While the contracted capacity has declined considerably month-on-month – reaching the lowest figure for capacity additions seen since August 2024 – January 2025 reported relatively stable figures compared to January 2024. From one year to the next, the number of deals increased by 14%, while the total contracted capacity fell 14%.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Pexapark also noted that the number of deals signed has remained relatively stable in recent months, but that the total contracted capacity has changed considerably, continuing a trend seen in its December 2024 report, which noted that the largest deal of 2024 included just 596MW of capacity, compared to 869MW involved in the largest deal of 2023.

Between September 2024 and January 2025, the number of PPAs signed in a month ranged from a low of 18, in November 2024, to a high of 30, in the prior month. Contracted capacity, meanwhile, hit a high of 2.1GW in December 2024 and a low of 790MW in January 2025.

Legislation driving dealmaking

The latest Pexapark report also pointed to the significant impact national governments can have over a country’s PPA space, pointing to the signing of the first PPA linked to Italy’s Energy Release 2.0 scheme, whereby companies can receive electricity at a fixed price for three years, in return for developing new renewable power projects with a capacity at least double that of the electricity received upfront.

This is a positive development for a market that has been burdened by unsupportive legislation in recent years, with Patrizio Donati, co-founder and managing director at independent power producer (IPP) Terrawatt telling PV Tech at the end of 2024 that “legislative uncertainty” was the biggest obstacle in the Italian solar sector.

Across Europe as a whole, the average price of a PPA signed increased marginally month-on-month, with the composite PPA price increasing from €51.8/MWh in December 2024 to €52.5/MWh in January 2025. This came despite significant declines in the price of deals signed in two key regions: the Nordics and Spain.

The former saw the average PPA price fall by 27% from December 2024 to January 2025, due to wet and mild weather and hydropower output “substantially above the seasonal average”, according to Pexapark; the latter, meanwhile, saw average PPA prices fall by 16.3%.

January 2025 also saw deals dominated by wind power. The top two deals, in terms of capacity – a 170MW agreement between Vattenfall and LyondellBasell and an 80MW deal between Iberdrola and ArcelorMittal – are both for wind projects. The third-largest deal, meanwhile, a 75MW deal between TotalEnergies and STMicroelectronics, will involve a combination of wind and solar capacity.