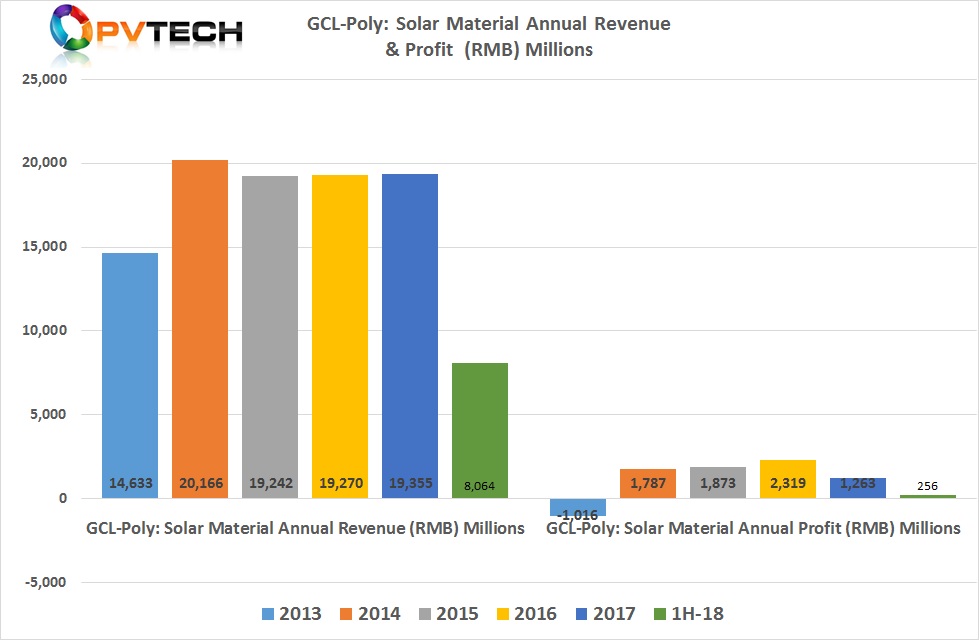

Leading polysilicon and solar wafer producer GCL-Poly Energy Holdings has reported a consolidated loss attributable to owners of the company’s shares of approximately RMB 534 million (US$77.8 million) for the first 10-months of 2018.

GCL-Poly had not issued third quarter financial results before the end of 2018, instead it issued a profit warning and disposal of a subsidiary, potentially offsetting some of the expected losses for the year.

The company said the consolidated loss attributable to owners of the company’s shares were approximately RMB 534 million (US$77.8 million) for the first 10-months of 2018, while noting that It expected that the operating performance of the Group for the full-year 2018, would decline substantially when compared to profit of around RMB 1,974 million (US$287 million) in 2017.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The deterioration in it business performance was said to be due to a decline in the selling price of multicrystalline solar wafers and an increase in finance costs and a foreign exchange loss in 2018.

Asset sale

GCL-Poly also said in the same statement that Suzhou GCL Photovoltaic Technologies Co., Ltd., (Suzhou GCL Photovoltaic), a non-wholly owned subsidiary had entered into a share purchase agreement with Liaoning Huajun Asset Management Co to sell Suzhou Kezhun Photovoltaic Technologies Co for RMB 850 million (US$124 million). Suzhou Kezhun is a major diamond wire manufacturer.

GCL-Poly expects the disposal to generate revenue to the group of approximately RMB 446 million (US$65 million).

The company had previously terminated a framework agreement announced in early June, 2018 with Shanghai Electric Group to sell a 51% stake in polysilicon production subsidiary Jiangsu Zhongneng Polysilicon.