Chinese PV module manufacturer Haitai Solar has announced the termination of a 10GW TOPCon solar cell project and the cancellation of its R&D centre expansion plan.

Capital raised for the venture will be reallocated to construct a 3GW cell and module manufacturing facility in Indonesia.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

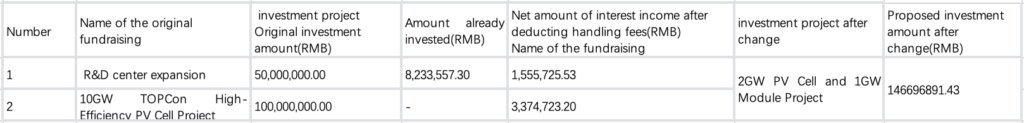

In October 2023, Haitai Solar disclosed plans to invest raised funds in constructing a “10GW TOPCon high-efficiency PV cell project” with a total estimated investment of RMB5 billion (US$695 million), including RMB100 million from previously raised funds. However, as of early May, there had been no progress on the 10GW TOPCon project.

Regarding the termination, Haitai Solar said that market conditions shifted significantly in 2024. The new capacity built in recent years was commissioned in 2024, leading to periodic overcapacity as capacity was released. According to CPIA statistics, China’s effective PV cell capacity is expected to exceed 1,030GW by the end of 2024, while the actual annual demand for cells is estimated at about 660GW, representing an overcapacity rate exceeding 56%.

Severe industry overcapacity has led to intensified internal competition. The PV supply chain has experienced fierce price competition, with significant across-the-board price declines. The price of n-type TOPCon cells has dropped from RMB0.47 /W at the beginning of 2024 to RMB0.28/W by the end of the year, representing a decline exceeding 40%. The cell manufacturing segment has fallen into a period of negative gross margin. The competition driven by persistent overcapacity has kept domestic cell prices at persistently low levels, making continued investments unlikely to achieve expected returns.

Consequently, the company plans to terminate the use of raised capital for the 10GW TOPCon High-Efficiency PV Cell Project and reallocate the remaining funds to a new investment project – the construction of a 2GW PV cell and 1GW module project” in Indonesia.

The Indonesian project requires a total investment of approximately RMB600 million, of which the phase-one investment is RMB300 million. The construction period is set at 15 months from commencement, to be implemented by Haitai Solar’s wholly owned subsidiary PT GREEN VISION SOLAR. The project will utilise the most advanced fully automated production lines to manufacture PV cells and modules, according to the company.

Haitai Solar said that besides targeting the Indonesian domestic market, the new facility will also target international markets as a key strategic objective.

In 2024, constrained by evolving trade barrier policies (such as the US imposition of additional tariffs on PV products from Southeast Asian countries including Cambodia, Malaysia, Thailand, and Vietnam), many PV enterprises have shifted their production capacity to Indonesia to mitigate policy risks. As a result, Indonesia has emerged as a golden hub for entering Southeast Asian, Middle Eastern and European/American markets.

According to TrendForce data, Indonesia currently has approximately 25.1GW of operational PV module capacity and an additional 20.5GW of planned capacity yet to be constructed.

TrendForce noted that due to retaliatory tariffs, Indonesia’s planned PV capacity may face delays in implementation. However, compared to other Southeast Asian countries, Indonesia’s 32% tariff rate remains relatively low, providing a certain cost advantage for PV module exports.