Lena Dias Martins explores the UK government’s Contracts for Difference scheme which supports the country’s move to a zero-carbon economy.

The Contracts for Difference (CfD) scheme is one of the UK government’s chief mechanisms for supporting low-carbon electricity generating projects.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

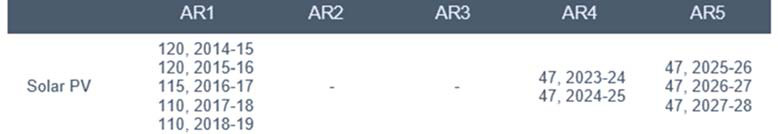

Alongside FIDER (an early form of the scheme) the CfD scheme has supported a total of 26GW of renewable generation capacity across the UK since its first allocation round (AR1) which ran from October 2014 to March 2015.

This includes bolstering the UK’s solar generation capacity to 15GW, according to Chris Hewett, chief executive of Solar Energy UK.

Earlier this year however, market research company Cornwall Insight warned that the support offered by the CfD scheme to solar and other renewable generations projects is threatened by inflation and the consequent rising cost of capital.

PV Tech Power looks at the UK’s CfD scheme’s success to date and explores what threats it faces.

The ‘undeniable’ success of the UK CfD scheme so far

A CfD is a private law contract that is awarded through private auction. Once agreed, the counterparty (which in the UK is the government) will pay the difference between the strike price agreed at auction and the renewable generator’s revenue.

This offers investment security by allowing renewable generators to bid for a guaranteed revenue stream for the duration of the contract; thus, encouraging investments in renewables.

“The CfD scheme has been undeniably successful, I would say. It gives renewable projects the stability they need by providing secure revenues, leading to investor confidence and increased viability, especially when they’re in those early stages of development,” Jamie Maule, research analyst at Cornwall Insight, told PV Tech Power.

“It’s a really good mechanism to allow these projects to become more viable and eventually, perhaps even open up other routes to market. What we’ve seen alongside increasing investor confidence, is that learning rates become more favourable; so as the technologies have developed and been produced, the cost of development has come down quite significantly.”

In February 2022 the government announced that the CfD auctions were to run annually, rather than every two years to accelerate the domestic production of renewable electricity.

The first of these annual allocation rounds was allocation round four (AR4) which ran from December 2021 to July 2022. AR4 was the biggest round to date, with contracts awarded to almost 11GW of renewable generation capacity in total.

AR4 was also the first allocation round in which solar was allowed to participate since the first allocation round in 2015. Alongside wind, solar was able to apply for a share in the £10 million allocated budget from a total of £285 million.

In total, 66 ground-mounted solar projects were awarded CfDs in AR4 with a combined total of 2.2GW.

Solar generation projects will also be able to bid in the current AR5 which opened on 30 March 2023.

This year solar photovoltaic (PV) has been allocated into ‘Pot 1’ dedicated to established technologies and will be able to bid for a share of £170 million budget for projects greater than 5MW.

Other technologies in Pot 1 include hydro and remote island wind.

“It can only be a good thing for the solar sector that it is included in the allocation rounds,” said Mark Williams, senior analyst at Energy UK, the trade association for the UK’s energy industry.

“If you can get a project over the line within the next year, the chances are you’d benefit from prices in the hundreds-per-megawatt-hour for next year, so there’s that trade-off between CfDs and other routes to market.

“It’s broadly going to be a positive thing. We saw 2GW come through for AR4 but for AR5 I suspect will be somewhat less than that. Who knows what future allocation rounds hold but we need tens of gigawatts over the next decade, so [re-introducing solar into CfD allocation rounds] is going to be important.”

The threat of the rising cost of capital

The current volatile macroeconomic and geopolitical climate has caused inflation and interest rates to soar.

These circumstances are exacerbated by the ongoing energy crisis, supply chain issues and labour shortages, ultimately driving renewable projects’ capital expenditure higher and higher.

The CfD scheme indexes the strike price to the Consumer Price Index (CPI) to account for price fluctuations to help protect generators from inflation; however, unprecedented rises in supply chain costs are putting additional strain on renewable energy developers and is affecting the CfD scheme’s ability to guarantee expected returns as much as possible and, by extension, generating investor confidence.

Concerns over the hindering effect this could have on the decarbonisation of the UK’s energy system have been raised by a number of industry players.

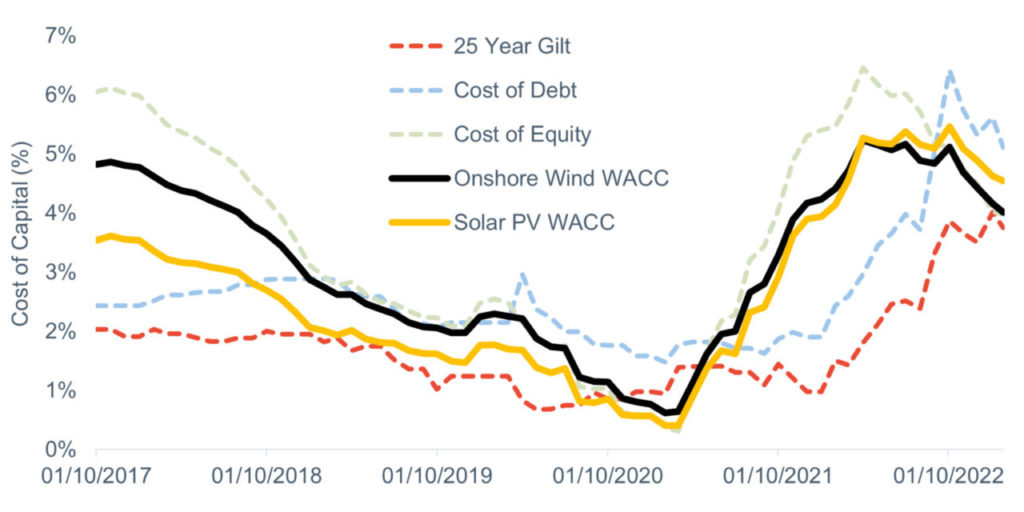

According to Cornwall Insight the current climate has increased the weighted average cost of capital (WACC) of renewable projects by 4% in comparison to early 2021.

Maule explained the effect of the rising cost of capital on renewable projects: “To boil it down, it means that the required rate of return (RRR) to make a project financially viable and secure capital investment is rising – this comprises both debt and equity.

“On the one hand, rising interest rates are raising the ‘cost’ of incurring debt while unfavourable macroeconomic conditions – including an insufficient market risk premium – are causing equity investors to demand higher rates of return.

“So, while projects are subject to inflationary pressures, they are also having to generate higher returns if they want to remain viable and go to market.”

Energy UK warned that the rising cost of capital alongside the Electricity Generator Levy – which imposes a windfall tax of 45% on electricity generators for “extraordinary returns” – has increased the cost of developing low carbon generation projects by 20% to 30%, increasing to as much as 50% for specific projects.

“We are seeing capital costs increasing and this will make it harder to make investment decisions for renewable projects, especially solar,” added Williams from Energy UK.

Investment uncertainty is now a considerable threat for renewable energy projects and the recent budget announced for AR5 has caused some concern within the UK energy sector.

In March 2023, the UK government confirmed the CfD budget for AR5 to be £205 million (including £170 million for established technologies such as solar) – down from £265 million for AR4.

RenewableUK warned that the budget sent “the wrong investment signals”.

“Unfortunately, in the light of global inflationary pressures, the budget and parameters set for this year’s CfD auction are currently too low and too tight to unlock all the potential investment in wind, solar and tidal stream projects which the industry could deliver,” added RenewableUK’s economics and markets manager Michael Chesser.

A lower budget means that the strike prices offered by CfDs – especially for solar – could threaten the effectiveness of the scheme.

As recorded in the UK government’s Contracts for Difference Allocation Round 5 Allocation Framework, 2023, the Administrative Strike Price (ASP) for solar PV in AR5 for projects with delivery years from 2025 to 2028 is £47/MWh (in 2012 prices).

The ASP is the highest strike price limit per MWh of electricity generated that a project of a particular technology can achieve, even if a project clears at auction at a higher price.

In comparison, the Reference Price (the price compared to the strike price in the auction to calculate how much the contracts cost) for AR5 is £48.99/MWh (in 2012 prices).

“It appears that the parameters of the allocation rounds are arbitrarily harsh and I think that’s really worrying,” continued Williams.

“If you look at the fifth allocation round coming up, we are really worried about that, because the budget is much lower.”

Williams warned that current strike prices are “unrealistically low” and that Energy UK is expecting CfD Reference Prices to be much less than wholesale electricity prices to be out to the end of the decade.

Stagnant strike prices that fail to keep up with wholesale energy prices make it more difficult for renewable projects to generate revenue, thus making them less sustainable.

“For projects on a CfD, and thus fixed strike prices (revenues), it may well be that your project is less viable and investable at this point because with everything getting more expensive, you are stuck with stagnant revenues, unable to access the wholesale market, and less able to generate profits,” said Maule.

These effects are already being seen for projects that won CfDs in AR4.

“We’ve already seen some media reports from developers who secured projects during AR4 calling on the government for further support. Some of these projects under AR4 do have the ability to generate higher revenues through the merchant nose prior to their CfD start date but that could be limited by the Electricity Generator Levy,” added Maule.

“For many of these projects, the changing and unforeseen macroeconomic conditions have resulted in an inability to generate the sort of profits that they were expecting. The strike prices they previously agreed were viable at the time but now they are proving to be too low.”

Another factor curbing the success of the CfD scheme is the now limited option for renewable projects to enter the merchant market before the start of their contract.

“The Low Carbon Contract Company now has more power to enforce CfD start dates within the delivery year when projects are seen to have begun commercial operations,” continued Maule.

“Prior to these changes, generators could enjoy greater access to wholesale markets before their CfD start date, allowing for a period of higher revenues that allowed them to generate a faster return on investment and insulate themselves from unforeseen rises in supply chain and/or commodity costs.”

AR5 to provide useful insight

The UK government has indicated that the outcome of AR5 will provide a useful insight into the current costs of technologies that can be used to inform future allocation rounds.

“Our flagship renewable energy auctions are hugely successful in strengthening Britain’s energy security, securing last year a record capacity of reliable, affordable and clean energy – enough to power around 12 million homes,” commented a government spokesperson.

“The Contracts for Difference scheme also plays a critical role in attracting large scale solar projects and investments to the UK. Solar energy will be key as we go further and faster to power Britain from Britain and increasing our solar capacity five-fold by 2035.”

The UK’s renewables landscape has seen promising growth making the nation one of the prominent players in the European market, and the CfD scheme has been a significant constituent in this success.

To continue this upward trajectory, the UK will need to keep building on the CfD scheme to ensure it remains relevant to the current volatile market.

In April this year, the UK’s Department for Energy Security and Net Zero (DESNZ) said it would consider a “major reform” to the CfD scheme by allowing applicants to be awarded wider benefits offered by their projects.

These ‘non-price factors’ include: addressing skills gaps; supply chain sustainability; helping drive sector investment; and supporting the UK’s energy security.

Responding to the announcement Ana Musat, RenewableUK’s executive director of policy, commented:

“Designing the right framework for Contracts for Difference is absolutely crucial if we’re to attract the billions of pounds of private investment we need to build more clean energy projects faster – at the very time when international competition for capital and expertise has never been more intense.

“Going forward, it’s clear that awarding CfDs shouldn’t just be based on a race to the bottom on prices, but it should also take account of the wider economic and environmental benefits which this industry can deliver.”

In light of the current volatile macroeconomic environment, re-assuring and re-engaging renewable investors is paramount to continue the growth of UK solar power.

“One thing that the energy market absolutely hates is uncertainty – it provides a really difficult investment landscape,” said Tom Faulkner, head of asset & infrastructure and networks at Cornwall Insight.

“The CfD scheme and the renewables landscape in general in GB has been very successful in terms of getting up the curve. The next step will be ensuring certainty for investors, ensuring that people are able to access the revenues they want.”

One route to investor confidence is to increase the CfD budget to provide a more attractive alternative to the merchant market.

“A higher CfD budget would certainly help,” said Williams from Energy UK.

“This is because if, through the Electricity Generators Levy, you are taking away those more merchant routes to market, which is what we’re expecting to see, unless those projects can go through the CfD route instead, what you’re going to have is projects not progressing. That’s not what we want, and higher budgets are an important part of that.”

Further updates to the CfD scheme are also in the pipeline as the UK government continues its Review of Electricity Market Arrangements (REMA).

Launched in July 2022, REMA seeks to explore changes in the UK’s wholesale electricity market to help protect against volatile gas prices and bolster the nation’s energy security.

The first part of the review constituted an initial REMA consultation, with the majority of respondents being generators and developers, to establish a holistic vision and a set of objectives for the UK electricity market.

A summary of the consultation responses was released in March 2023. It found that 67% of respondents felt that the current form of the CfD discourages provision of ancillary services.

Some respondents suggested additional options to reform the CfD, including extending contract lengths, auction process reform and allowing existing generators to bid for CfDs.

With the first step of the review now completed, REMA will collate both professional and consumer inputs in order to make an informed decision on the future of the UK energy market, including deciding what the future CfD scheme will look like.

“We’re in a very different world now, where gas prices are going to be structurally higher as we shift to more energy coming from liquified natural gas (LNG) across Europe. We should try to deliver all possible renewable projects where the CfD strike price is lower than the expected price of gas, and that is not what upcoming allocation rounds are currently set up to deliver,” summarised Williams.

“The best thing for consumers, the thing that will bring down bills, reduce carbon emissions and help energy security, is to have as much capacity as possible come forward. And I don’t think that’s currently what the main motivating factor behind the CfD scheme is. It’s still about driving down those prices.

“We’re probably now in a world where we’ve driven down prices to almost as low as they will go and it’s now about sustainably delivering capacity; that requires a slight change in thinking that I don’t think we’re quite seeing yet.”