Every new edition of the annual International Technology Roadmap for Photovoltaic (ITRPV) is a good way to learn more about the trends the industry is following or will follow in the coming years.

PV Tech Premium spoke with Markus Fischer, vice president of R&D operations at solar manufacturer Qcells and co-chairman of the ITRPV about some of the latest industry trends in the industry and what to expect with the new edition of the ITRPV.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

A preview of the 2025 edition was presented to the attendees of this year’s PV CellTech Europe, which celebrated its tenth anniversary. In an interview after his presentation, Fischer highlighted several trends that have emerged since last year’s ITRPV edition—covered here on PV Tech—including an increase in the use of rectangular wafers and manufacturers going busbar-less to reduce silver consumption.

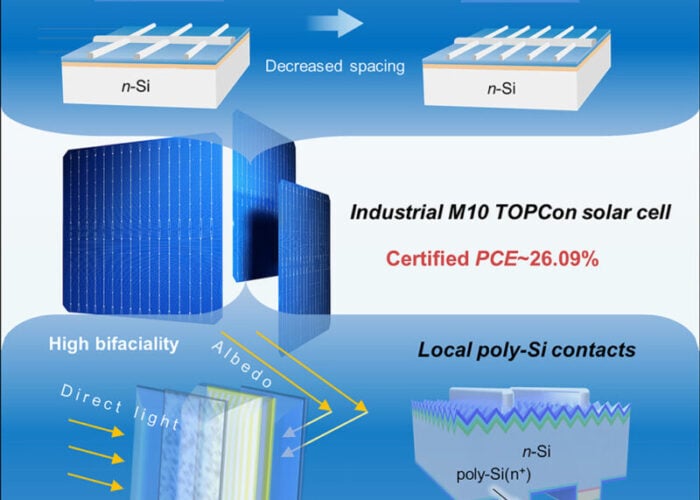

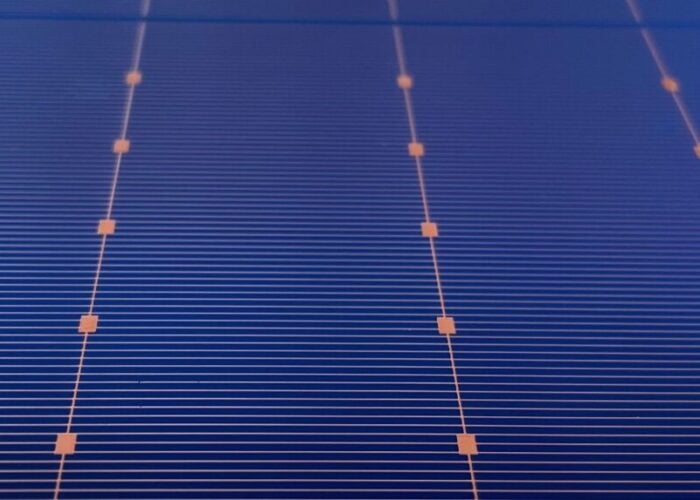

Silver consumption was one of the topics covered in last year’s ITRPV with a recommendation to reduce its use if the industry is to sustain its growth. Fischer said that this explained why more companies are using zero busbars (0BB) – the rectangular strips printed on the solar cell that act as a conduit for the modules – in an effort to reduce the use of silver in both heterojunction and TOPCon cells.

Fischer said that although in China the standard practice continues to be the use of 18BB, “there is a trend to go busbar-less,” which helps reduce the consumption of silver.

“Reduction efforts [on silver consumption] are continuing, and despite the big increase in shipments, we are still in the level of silver consumption that can be handled,” said Fischer.

The emergence of 0BB started with heterojunction technology, but the trend has continued to develop and can also be applied to TOPCon and even future products, such as tandem metallisation applications, said Fischer.

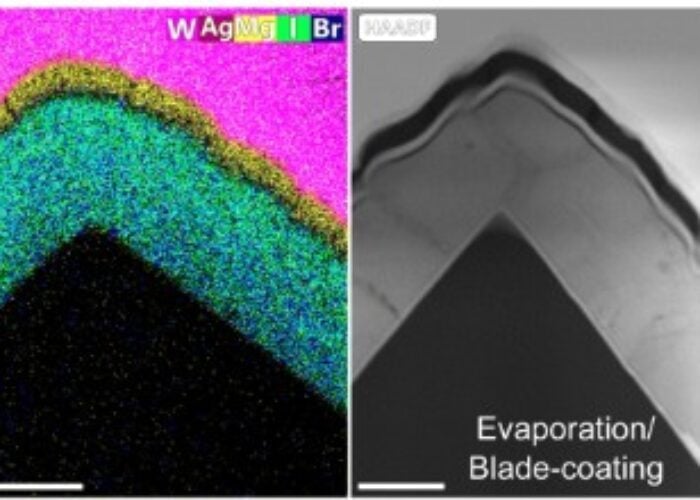

This attempt to reduce silver consumption is not only achieved with current technologies available in the market but also for perovskite.

“Perovskite is a challenging new technology; nevertheless, what is an upcoming trend is to reduce its silver use,” explained Fischer, adding that this is done through the silver-coated copper particles that would enable its use with heterojunction technology and in the future for tandem solar cells.

Rectangular wafers are emerging

Another interesting trend according to Fischer is the increased market share of rectangular wafers both in the 182mm size (M10R) and 210 mm size (G12R).

“This is interesting to see, especially the G12R finding its way to the market,” said Fischer, adding that both G12R and M10R are getting more market share and are dominating the market along with M10 solar cells. Fischer also explained that rectangular wafers are well-suited for rooftop applications.

Moreover, “when we have a look at the polysilicon consumption per watt, we see that interestingly, G12R is advantageous. This is obviously a good combination between the widths and efficient use of the ingot.”

In terms of wafer sizes, the ITRPV highlighted another trend with wafers bigger than G12, which are expected to enter the market starting in 2027, while M6 wafers are set to disappear in the coming years.

Module quality

One of the issues in the current landscape of n-type technology is the quality of more recent TOPCon modules, a topic that was recently covered in our quarterly journal PV Tech Power and which can be accessed here.

A recent report from the International Energy Agency’s Photovoltaic Power Systems programme (IEA PVPS) investigated the high breakage rate in thin glass used in modern PV modules, which would require more testing to better understand the issue.

Fischer explains that although the ITRPV does not investigate in detail reliability issues on a single product, a general trend is the increased share of glass-glass modules. However, the roadmap does highlight a degradation rate of modules after the first year of 1%, which is an improvement from the 1.8% registered the year before.

Market share and pricing

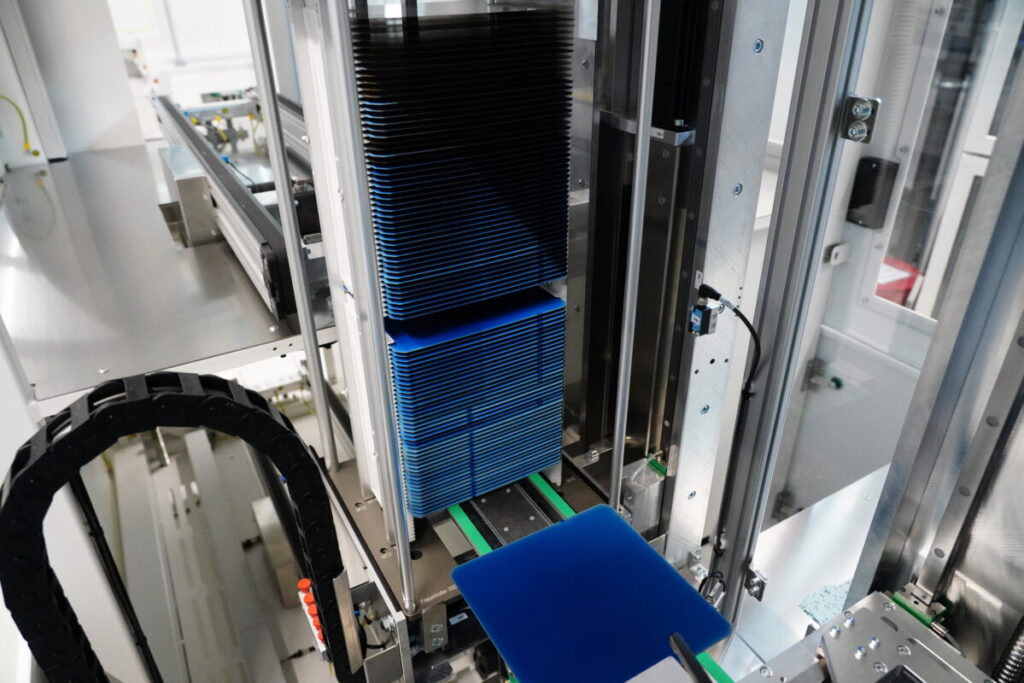

The ITRVP said n-type TOPCOn cells will enjoy a market share of 68% in 2025, while p-type PERC cells will fall to 18% market share this year as their expected phase-out by the end of this decade continues. TOPCOn’s dominance as the industry’s “c-Si workhorse” will continue until 2032, after which back-contact and silicon-tandem concepts will gain a greater market share.

Finally, the price of modules decreased year-on-year from US$0.12/Wp in 2023 to US$0.08/Wp due to the oversupply of module capacity, which reached 1.2TW in 2024, according to a report from BloombergNEF published in September 2024.