Visibility on the performance of almost all leading PV module suppliers to the end of the first quarter of 2020 (31 March 2020) is now known, providing a first glimpse of what impact the COVID-19 pandemic has had on the sector, as most countries started to impose varying degrees of lockdown impacting businesses and ongoing operations.

However, it will not be until August/September this year that the real impact will be apparent, when companies reveal first-half results, and in particular changes between Q2 and Q1.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

There are many different parts of the PV industry: upstream/downstream, manufacturer/supplier, installer/EPC, developer/owner, O&M/asset-manager, etc.. Each has its own set of challenges from March/April this year. But the group of companies we are most interested in are the module suppliers, and especially those that dominate global utility-scale supply.

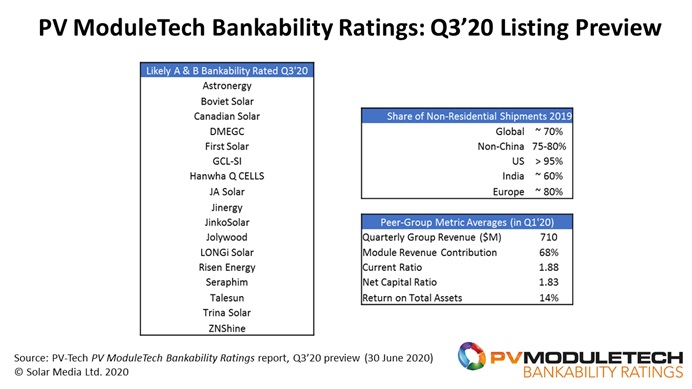

This group of leading PV module suppliers fall into the ‘A’ (AAA, AA, A) and ‘B’ (BBB, BB, B) grades of our PV ModuleTech Bankability Ratings analysis. There are 17 module suppliers here, differentiated from the several hundred others that either don’t serve the utility segments in large volumes or are bankrupt entities awaiting restructuring.

To address the relative strengths and weaknesses of this top grouping of 17 PV module suppliers, I will be delivering a free webinar on PV-Tech next week (Thursday 9 July), discussing some of the key features driving bankability ratings for these companies, and benchmarking some key financial and manufacturing metrics of this leading group.

To register to attend the webinar, please follow the instructions at the link here.

This article discusses some of the topics that will be presented in the webinar next week, and shows how analysing in depth the top AAA to B rated module suppliers allows true peer-group trends to be tracked within the PV industry, something that has been lacking until now.

Like-for-like and peer-group benchmarking

For the past two decades, there have been many attempts (mostly by the financial community) to benchmark listed PV module suppliers being covered. These benchmarking exercises tend to be somewhat polarized as either US or APAC centric in their approaches, and can get rather absorbed in regional data inputs.

However, the main problem with these benchmarking exercises is not being able to compare a large enough pool set, or knowing which companies to analyse when it comes to global module supply. Things get a bit scarier when less solar savvy analysts from the finance community get involved and start comparing PV module supplier metrics with companies that fall into random tags such as electronics, semiconductor or any of the technology-focused exchanges globally.

The only way to benchmark PV module suppliers is to compare them to their correct peer-grouping: or put another way, their competition in the field. (Benchmarking, for example, JinkoSolar to a polysilicon producer or a company making computer parts, is a waste of time.)

This was perhaps the greatest motivation in creating the PV ModuleTech Bankability Ratings analysis at PV-Tech, and releasing the quarterly report on this every three months. (See here for more information on how to subscribe.)

The top peer group is clearly coming from companies with AAA/AA/A and BBB/BB/B Bankability Ratings. There are 17 PV module suppliers in this group, and these are listed below in alphabetical order.

Of the 17 companies in the leading peer group, 15 are currently public-listed. Collectively these module suppliers account for about 70% of global shipment volumes (excluding residential segments). This increases to 75-80% of volumes outside China, greater than 95% to the US market, and with India being the main country with lower shipment levels (about 60% of the Indian market).

At any given time, strengths and weaknesses of a specific module supplier should be made to the averages across this peer group. Comparison to other sectors or module suppliers outside this listing is meaningless.

This type of extended analysis will now be included in the quarterly releases of the PV ModuleTech Bankability Ratings report, from the Q3’20 release onwards.

Being able, for example, to rank Canadian Solar against the other 16 competitive PV module suppliers for global utility projects is incredibly useful, especially when looking at different financial and manufacturing metrics. More on this during the webinar next week.

Another topic to be discussed relates to changes seen when analysing Q1’20 data. At this point, our analysis suggests extremely little actually changed for the leading companies. In fact, for the 17-strong peer group, almost every financial metric is basically unchanged Q/Q and many better Y/Y. A few of these are shown in the figure above, from the dozens that we are tracking at the company and peer-group level each quarter.

Finally, the webinar will discuss more about the ‘module-share contribution’ ratio that we track for all the module suppliers: how dependent is each company on making money from selling modules. Or put another way, which companies have the luxury of stable profitable non-module business units (within the PV sector or outside) that can shield the stand-alone performance from module sales. It remains a fascinating metric to track, especially looking at historic performance of module suppliers and the ultimate fate of the companies.

Use the link here to sign up free to hear my webinar next week (Thursday 9 July) on Q3’20 bankability.