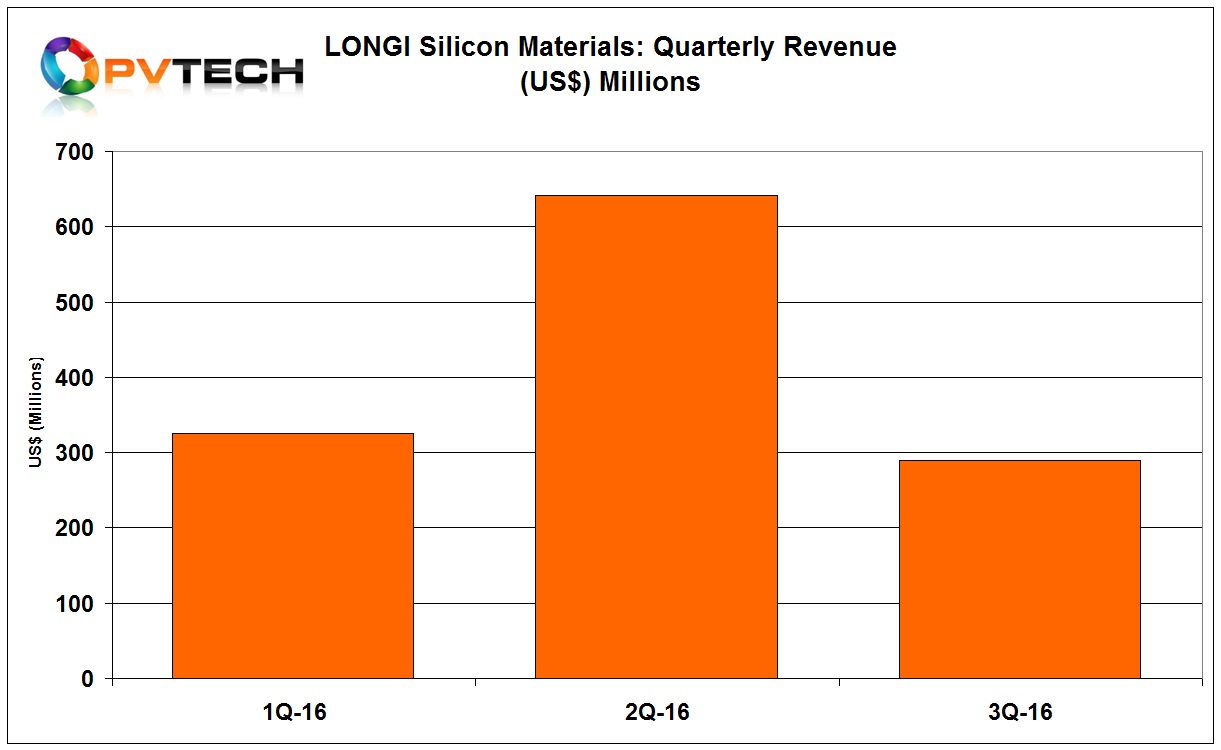

Leading integrated monocrystalline PV manufacturer Xi'an LONGi Silicon Materials has reported a 54.8% decline in third quarter 2016 revenue as the impact of a major demand slump in China after June’s feed-in tariff changes seriously curtailed PV power plant construction in China.

LONGi Silicon reported unaudited third quarter 2016 revenue of around US$290 million, compared to around US$642 million in the previous quarter, a 54.8% decline, quarter-on-quarter, the peak in downstream PV demand in China through the first nine months of the year.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The significant decline in LONGi’s third quarter revenue could be viewed as a benchmark for China-based PV manufacturers that have a major domestic market position.

China could have potentially deployed around 22GW of new solar capacity in the first half of 2016, exceeding government targets of 18GW for the full-year. Major FiT cuts are still being negotiated for 2017, dampening PV project activity in China.

LONGi Silicon reported unaudited revenue for the first nine months of 2016 of around US$1.26 billion, up 204% from the prior year period.