Thin-film laser systems equipment supplier LPKF Laser & Electronics suffered from delays in receiving new expected orders from two long-stand customers last year.

Both its long-standing Cadmium telluride (CdTe) solar module manufacturing customer delayed orders and payments from its first Copper Indium Gallium Selenide (CIGS) manufacturing customer based in China were disrupted because of the impact of COVID-19.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

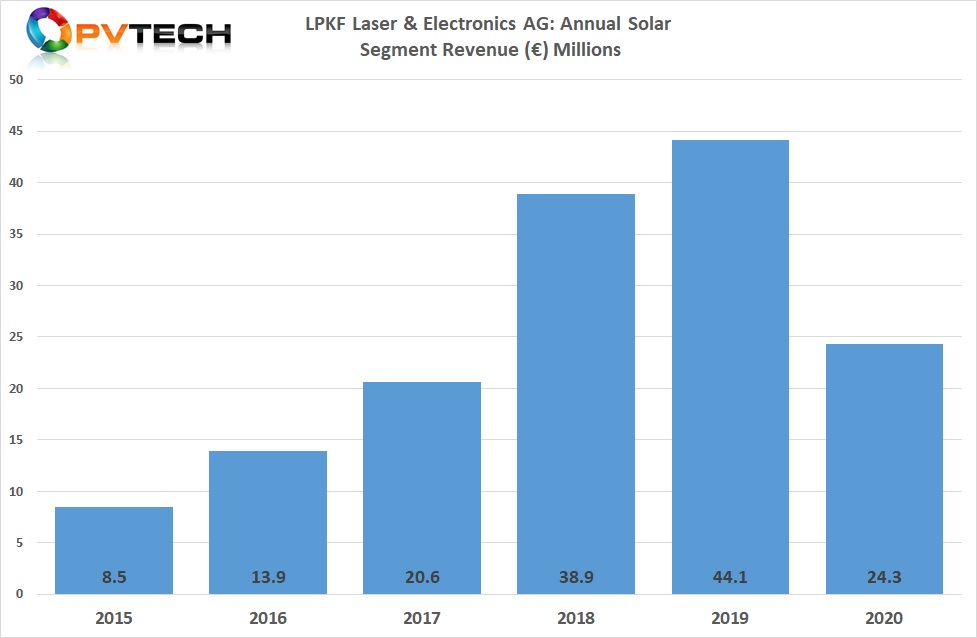

LPKF reported 2020 revenue in its solar business unit of €24.3 million, down 45% from €44.1 million in 2019. Solar accounted for 25.3% of total revenue in 2020.

The solar supplied laser systems for etching solar modules within the scope of a major order executed in 2020, making up the bulk of revenue for the year.

The company noted that its solar business had typically benefited from having the longest visibility in orders of any of its business units, and the company had been expecting stronger orders and sales in 2020 than had materialised.

The problem had been delays and other interruptions with customers’ construction schedules due to COVID-19 restrictions. Key orders were postponed as a result.

But LPKF did note that it was not until late in 2020 that it received one of its largest solar orders from its CdTe customer and its first order for laser equipment from its first CIGS customer. This meant that down payments expected in Q4 for orders were not received until the beginning of 2021, according to the company.

Yet, its solar segment order backlog was slightly above the previous year’s level of €27.3 million.