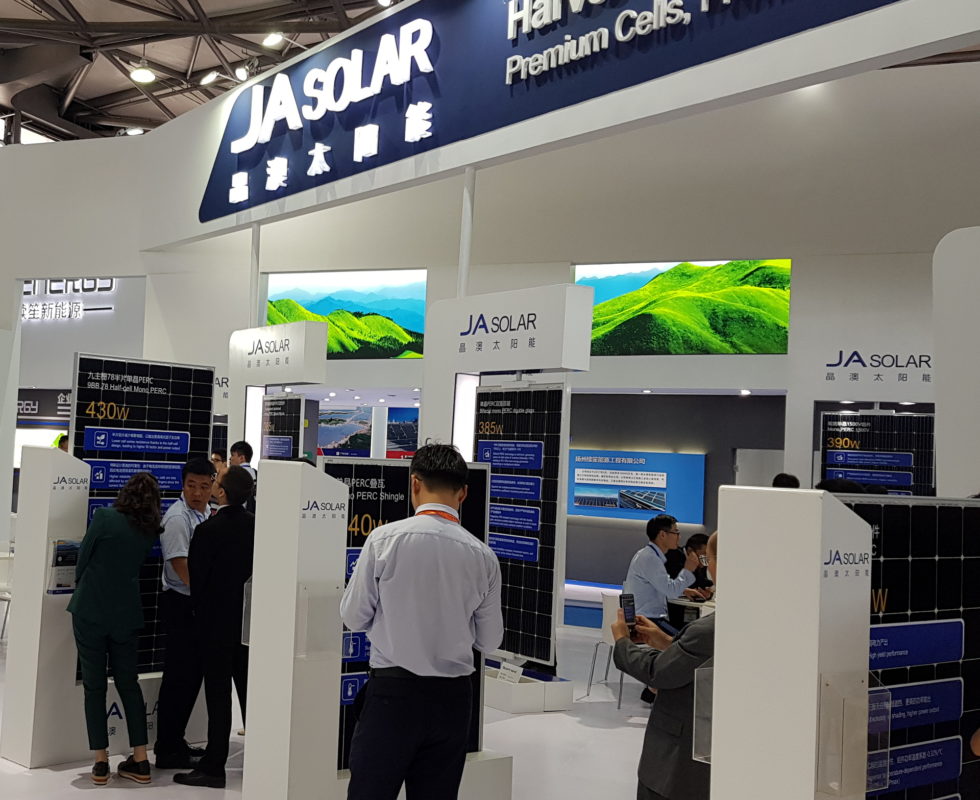

‘Solar Module Super League’ (SMSL) member, JA Solar has completed a buyout of a Shenzhen Stock Exchange (SSE) listed company, after delisting from the NASDAQ in mid-2018.

The buyout of a small heavy lifting engineering firm, Qinhuangdao Tianye Tonglian Heavy Industry Co has taken around a year to complete with a transaction cost of RMB 750 million (US$106.6 million). The small cap had revenue of around US$50.3 million in 2018.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The transaction has been technically completed after SSE documents highlighted the change in the name of the company to JA Solar Technology Co., Ltd.

Another SMSL member, Trina Solar is also going through the process of relisting in China, after delisting from the NYSE in March 2017.

Upon Trina Solar’s relisting, the only SMSL member remaining private after delisting from the NASDAQ earlier in 2019, is Korean-based Q CELLS.

Major China-based merchant solar cell manufacturer, Aiko Solar is also in the process of an IPO in China.