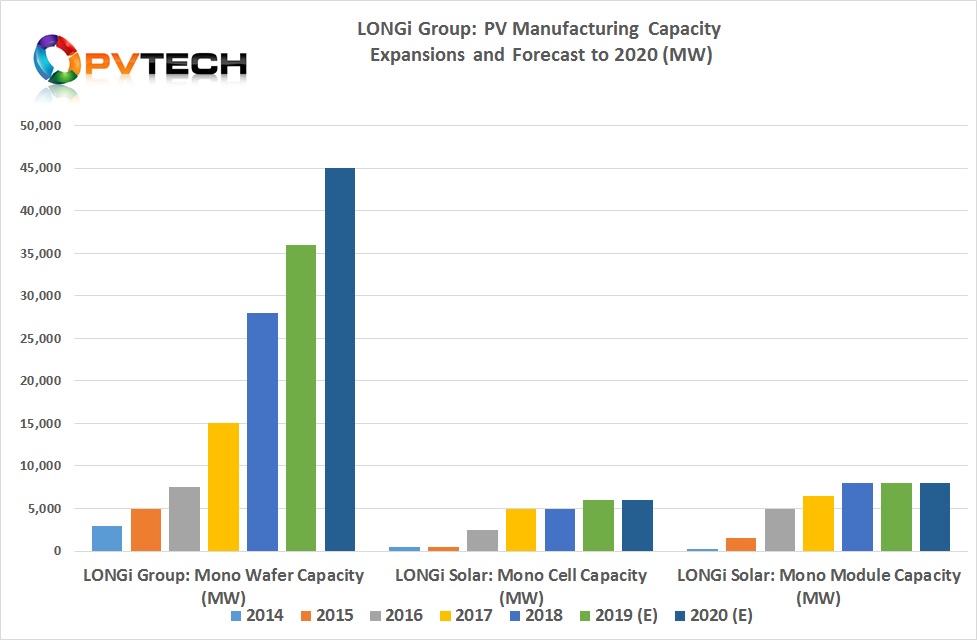

Leading monocrystalline wafer producer and ‘Solar Module Super League’ (SMSL) member LONGi Green Energy Technology plans to invest approximately US$773 million in expanding monocrystalline ingot and wafer capacity at three sites in China.

LONGi Group noted in financial filings that it would expand monocrystalline ingot production by 6GW at facilities in Baoshan, China at a cost of approximately RMB 1.749 billion (US$261.4 million), while adding a further 6GW at facilities in Lijiang, China at a cost of around RMB 1.937 billion (US$289.5 million).

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The company also announced that it increase monocrystalline wafer production by a further 10GW as part of a Phase 2 expansion at facilities in Chuxiong, Yunnan, China. Capital expenditure for Phase 2 was put at around RMB 1.486 billion (US$222.1 million).

The company had also announced separately that it was expanding monocrystalline solar cell capacity by 1GW at a new facility at the Shama Jaya Free Industrial Park, Kuching City, Sarawak, Malaysia at a cost of approximately RMB 840 million (US$125.5 million), which brings total investments planned of around US$898.5 million, so far in 2019.

The investment in the ingot facility in Baoshan is expected to be carried out through July, 2020, while the Lijiang project will take through May, 2020. The 10GW mono wafer project is expected to be completed in March, 2020.

LONGi said that it was continuing to expand capacity to meet future projected demand for high-efficiency mono wafers, while targeting production in Yunnan Province, due to the availability of hydro-electric power.

The company had previously announced that it had near-term plans to expand wafer production to 45GW by the end of 2020. The latest expansion announcements would take nameplate capacity to 38GW in 2019.