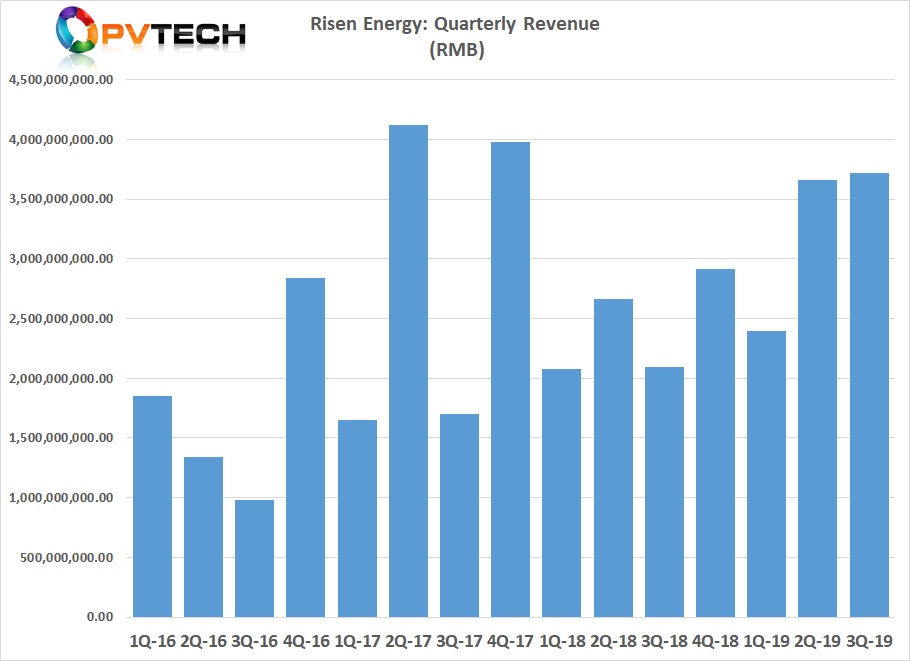

‘Solar Module Super League’ (SMSL) member, Risen Energy Co has continued to grow revenue in 2019, after shifting module sales and PV project development overseas after the China 531 New Deal in 2018, impacted its business.

Risen Energy recently reported third quarter 2019 revenue (operating income) of RMB 3.718 billion (US$526.9 million), up slightly from RMB 3.664 billion (US$519.3 million) in the second quarter of 2019.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Increased overseas PV module sales as new high-efficiency PERC (Passivated Emitter Rear Cell) and module capacity continued to ramp, as well as increased PV power plant projects also supported the revenue increase, despite lower module ASPs.

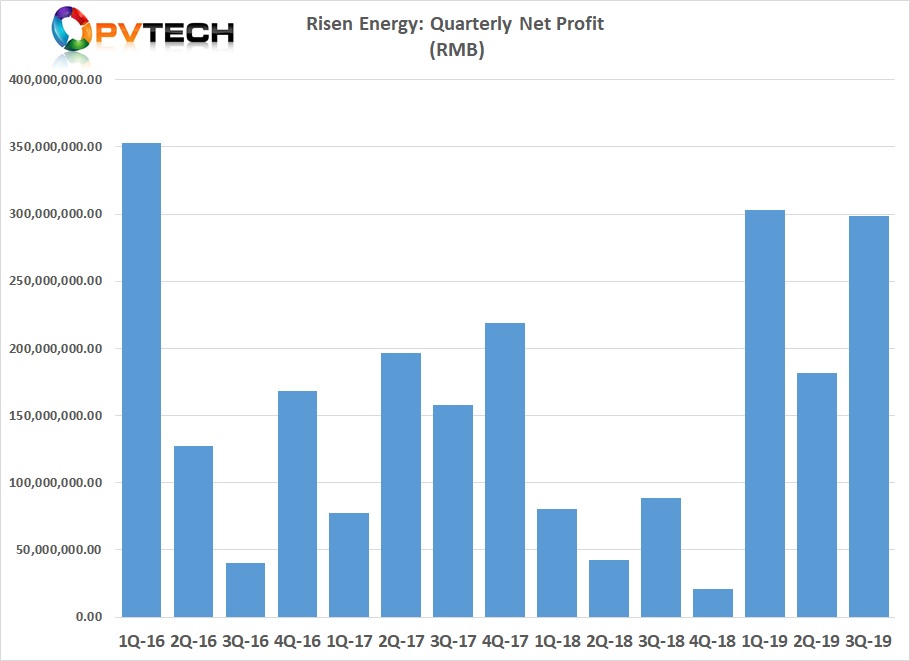

Net profit attributable to shareholders was RMB 298.5 million (US$42.3 million), up from RMB 181.5 million (US$25.7 million) in the second quarter of 2019. Gross margin was 7%, up from 5.8% in the previous quarter.

Revenue in the first nine months of 2019 reached RMB 9.77 billion (US$1.38 billion, surpassing revenue of RMB 9.75 million for the full-year 2018 an increase of over 42%. Net profit attributable to shareholders reached RMB 783 million yuan (US$111 million).

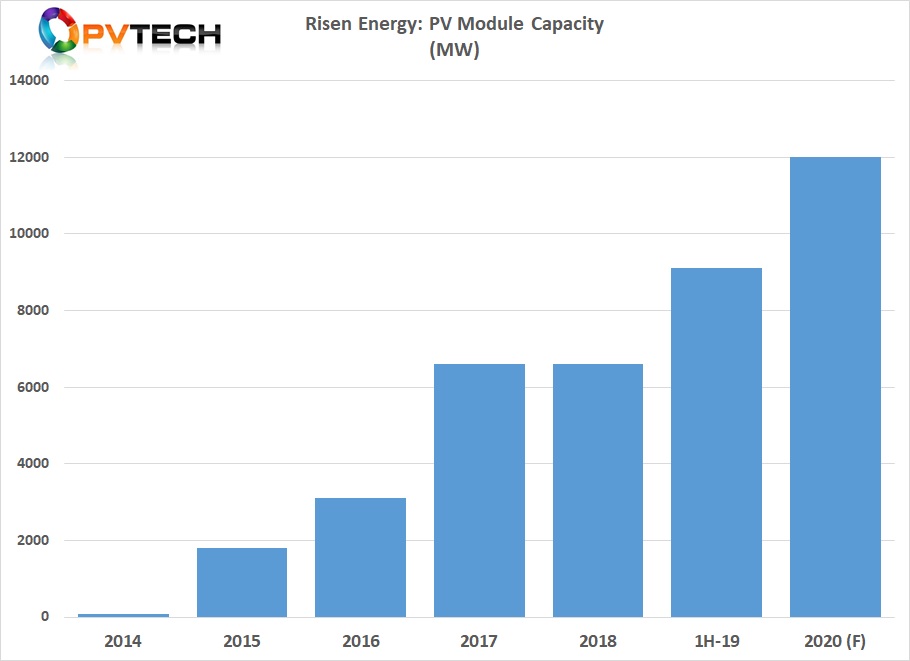

Manufacturing update

Risen Energy starting ramping its Phase II, 2GW high-efficiency mono PERC cell and module plant in Jintan in June, 2019. The integrated Jintan facility is earmarked to be a 5GW facility when fully-ramped.

A 5GW module assembly plant in Yiwu, China is also expected to start production in the second half of 2019.

Recently, Risen Energy announced the start of construction of an integrated heterojunction high-efficiency solar cells and module production base in Ninghai City. Production is expected in 2021.

Total PV module capacity stood at over 9GW at the end of June 2019.

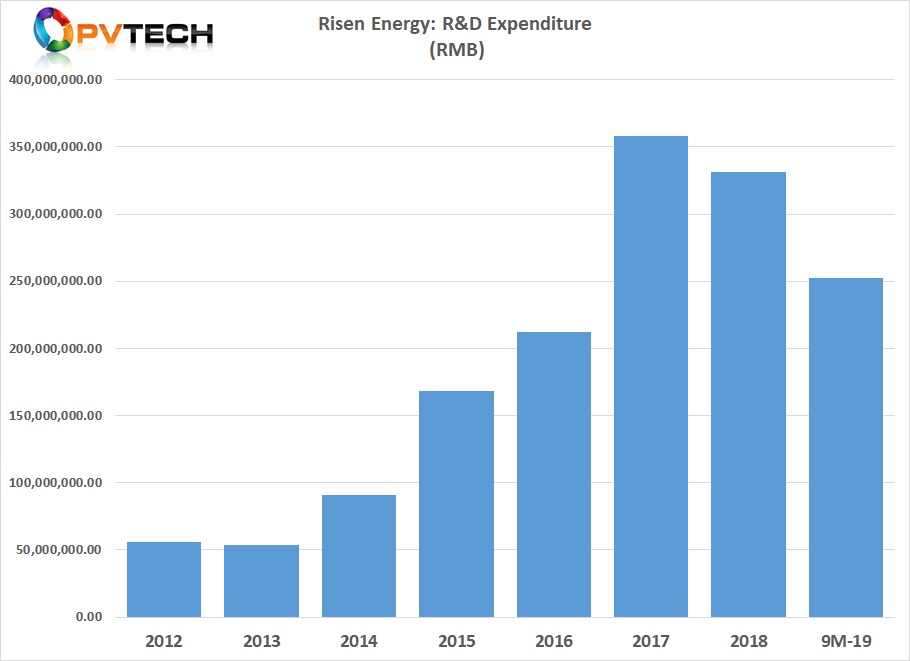

Risen Energy’s R&D expenditure in the first nine months of 2019 has reached RMB 252.5 million (US$35.8 million). Total R&D expenditure in 2018 was US$49.2 million.

The SMSL highlighted that it had successfully developed its second-generation half-cut cell technology that is expected to further lower cell to module power losses and boost performance with an advanced cell passivation process.

In the first half of 2019, Risen Energy reported that TUV SUD had confirmed its Jäger HP 72-cell sized modules reached had reach a conversion efficiency of 21%. The company also reported that the maximum conversion efficiency for its MBB (Multi Busbar) mono cell had exceeded 23%, with an average efficiency reaching 22.73%. The company plans to achieve full mass production of MBB technology in 2019.

The company's subsidiary, Jiangsu Swick which develops and sells EVA film for modules had reached an annual production capacity of 230 million square meters from three manufacturing plants in the first half of 2019.