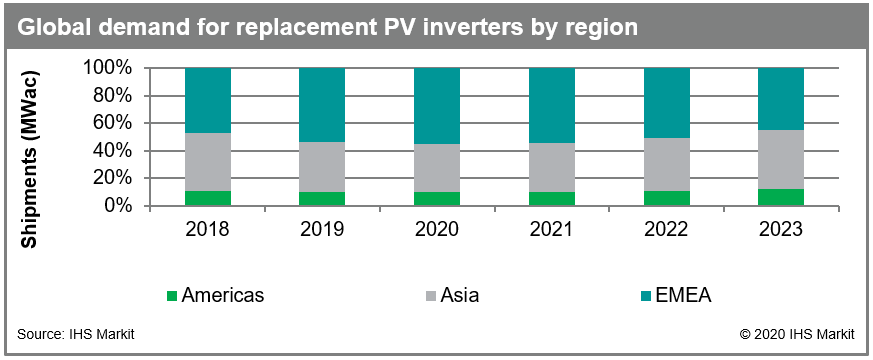

Market research firm IHS Markit believes the PV inverter replacement market will increase by around 40% in 2020, creating an 8.7GW need outside new global installations.

New analysis by the firm shows that Europe has become the largest replacement market for PV inverters, due to early adoption rates in Germany's residential market initially and later in the residential, commercial and industrial and utility-scale segments across Spain, Italy and UK.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

String inverters typically used in the early phase of the European residential market had life expectancies of 5 to 10 years, and so are accounting for a large percentage of the unit replacement market.

However, with a large utility-scale installed base in Europe, central inverter replacement could become a larger market on a megawatt basis, with options to adopt advanced central inverters with energy storage capabilities or adopt the latest in string inverter technology.

According to IHS Markit, the greatest need for inverter replacements lies in Germany, Italy and Spain, which together accounted for over 70% of replacement demand in the EMEA region.

Asia was said to be the second largest region for replacement inverters, driven by China.

Demand is also expected to increase in Japan, which was said to have the largest installed base of residential installations that were more than 5 years old.

However, replacement demand in the Americas region was forecasted to increase at a CAGR of 130% and account for 12% of global replacement demand in 2023.

Presently, PV inverter manufacturers that are publicly listed rarely offer breakdown figures for replacement sales in their financial statements.

Image credit for this story's homepage picture: ABB