Solar and storage developer Origis Energy has announced a management buyout of its original shareholders, a transaction it says “solidifies US control” of the company.

Global Atlantic Financial Group, a life insurance company that has held an equity stake in Origis since 2018, provided financing for the deal, increasing its interest in the developer.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The transaction results in the buyout of Pentacon BV, headed by Paul Thiers, who co-founded Origis in 2008, and investment firm Baltisse NV, headed by Filip Balcaen. Both Thiers and Balcaen will retire from Origis’ board of directors.

“Paul and Filip have supported Origis since the beginning and have been instrumental to our success. As we have grown into a leading US renewable energy firm, they felt it was in the best interest of the company to strengthen our ties with Global Atlantic,” Guy Vanderhaegen, Origis CEO, said.

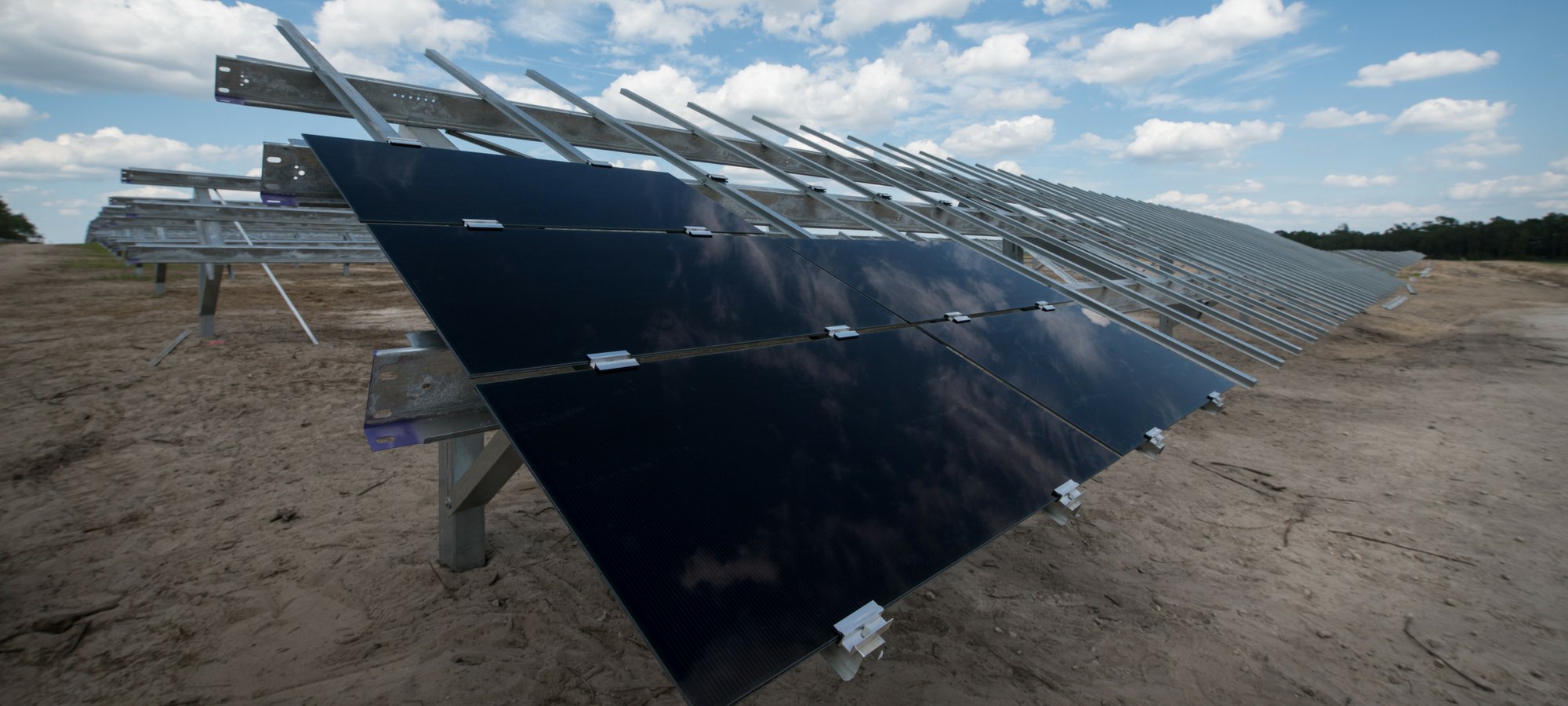

Headquartered in Miami, Florida, Origis Energy has more than 1GW of operational solar and storage assets and nearly 3GW in contracted projects that are set to be developed by 2023. The company last year announced the completion of a 57.5MWac solar project in the US state of Georgia that is owned by Global Atlantic.

“There is more to come as we develop a 15GW clean energy pipeline, with projects now from coast to coast,” Vanderhaegen added.

The transaction sees Global Atlantic boost its US renewables position having bought a minority interest in Southern Power’s PV portfolio in 2018. “Our partnership with Origis is an important component of our US renewable energy investing platform,” said Anup Agarwal, Global Atlantic chief investment officer. “We believe this transaction will further drive our mutual success across the sector.”