All developers active in the US renewable energy sector will increase their renewable energy development this year, while more than 60% of developers will participate in the domestic clean energy manufacturing buildout, according to a report from the American Council on Renewable Energy (ACORE).

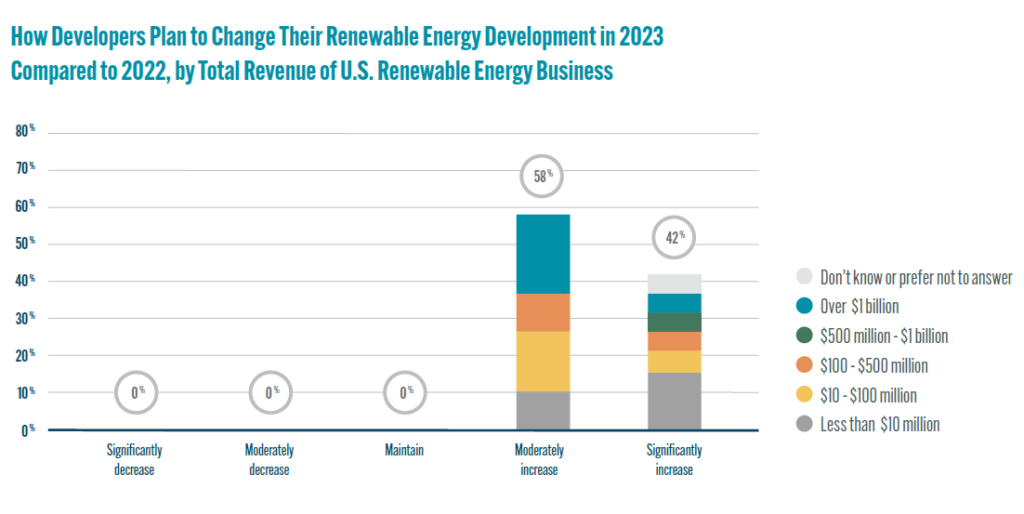

In the study Expectations for Renewable Energy Finance in 2023-2026, which anonymously surveyed 24 investors and 19 developers, 58% of developers said they will moderately increase their renewable energy development in 2023 compared to last year, while the remaining 42% said they would significantly increase the development.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

However, many companies are proceeding cautiously as supply chain constraints, trade restrictions, interconnection queue delays, and insufficient transmission capacity create significant risk challenges. These challenges can lead to delays in deal flow, longer lead times, and increased project costs.

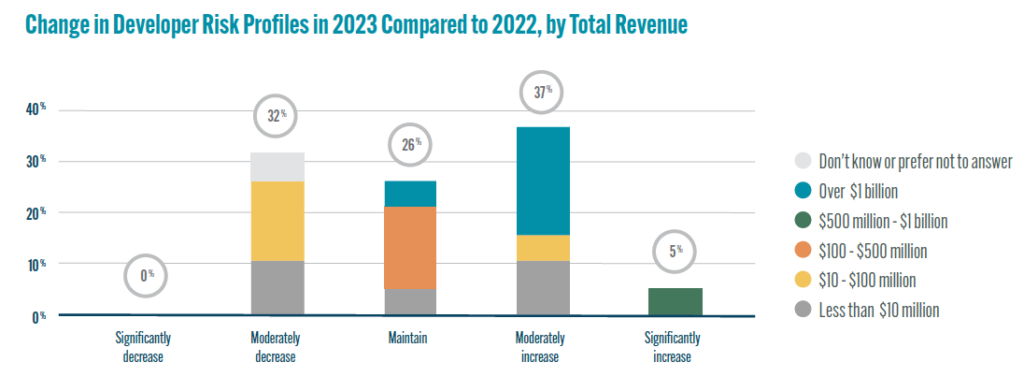

But developers’ attitudes towards the risks vary. 32% of surveyed developers said they will reduce their risk profiles in 2023, but 42% of surveyed developers reported an increase in risk profile compared to last year. Moreover, among larger developers that operate US renewable energy businesses with revenues of US$500 million or greater, 83% reported their risk profile will increase this year.

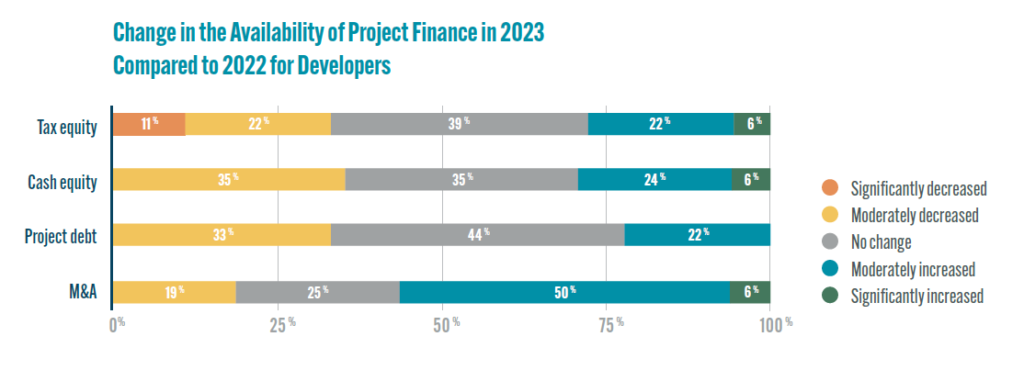

ACORE also asked developers to report on the market’s availability of project financing based on their experiences.

While 39% of developers observed no change in the availability of tax equity this year, one-third of respondents expected a decrease. Meanwhile, more than half the developers reported increased mergers and acquisitions (M&A).

Additionally, 39% of developers said securing power purchase agreements (PPA) with offtakers for US projects could be more difficult this year, but there was the same amount of interviewees saying it would become easier.

When it comes to the most available financing sources over the next three years, developers believed that tax equity topped the list, followed by transferability, project-level debt, and mergers and acquisitions.

A surveyed developer said they will use both transferability and direct pay depending on the nature of the investment.

“You need to have enough cash to support a higher investment tax credit, depending on the structure. When there’s not as much cash, you might use transferability,” the developer said.

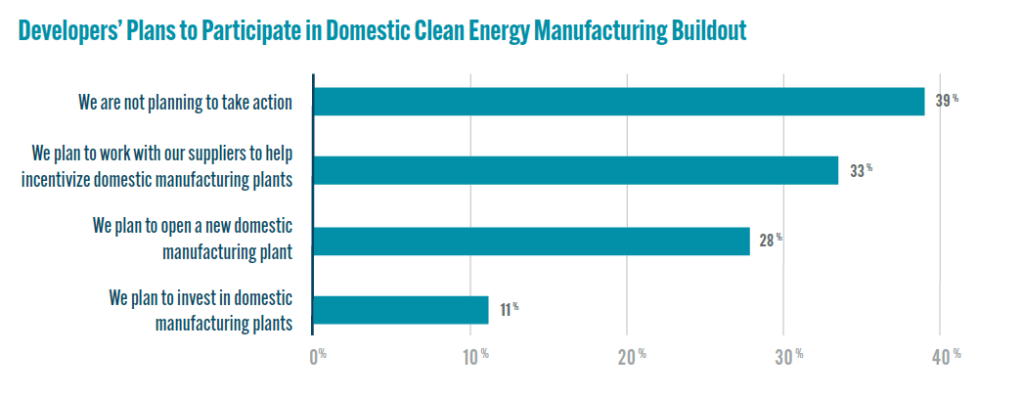

Lastly, 61% of developers said they want to participate in domestic clean energy manufacturing buildout. A total of 33% of surveyed developers said they had planned to work with their suppliers to help incentivise domestic manufacturing plants, while 28% said they had planned to open a new domestic manufacturing plant. Of the remaining 11% of respondents, they had plans to invest in domestic manufacturing plants.