Product Outline: Pexapark, a specialist software and advisory service for clean energy power purchase qgreements (PPA), has launched a ‘freemium’ version of its ‘PexaQuote’ software. PexaQuote is a package of data solutions that systemises quotes, builds forward curves, and analyses PPA prices to create certainty for developers, utilities, and corporates looking to close PPA deals.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Problem: As subsidies across Europe are lifted, PPAs are increasingly important for developers as a strategy to manage risk, in order to obtain financial security for a renewable energy project.

By negotiating a PPA agreement with an agreed offtaker who will guarantee to take some, or all, of the power output at a fixed price and tenor, project owners are able to secure borrowing and investment to complete the development process. Pricing proficiency is therefore of the essence for project owners to conduct an efficient negotiation process.

With an increasing number of private institutions joining utilities in committing to obtaining power sourced from clean technologies, buyers need a mechanism by which to navigate some of the complexity of pricing and contract negotiation. This is critical during a procurement process which can be unfamiliar, and where a significant investment in time and staffing may be required to collect and analyse market data to determine the best price and structure for a PPA.

Solution: Pexapark’s software, data, and advisory services have been developed to create certainty for buyers and sellers as clean energy transitions away from subsidies and toward an open market.

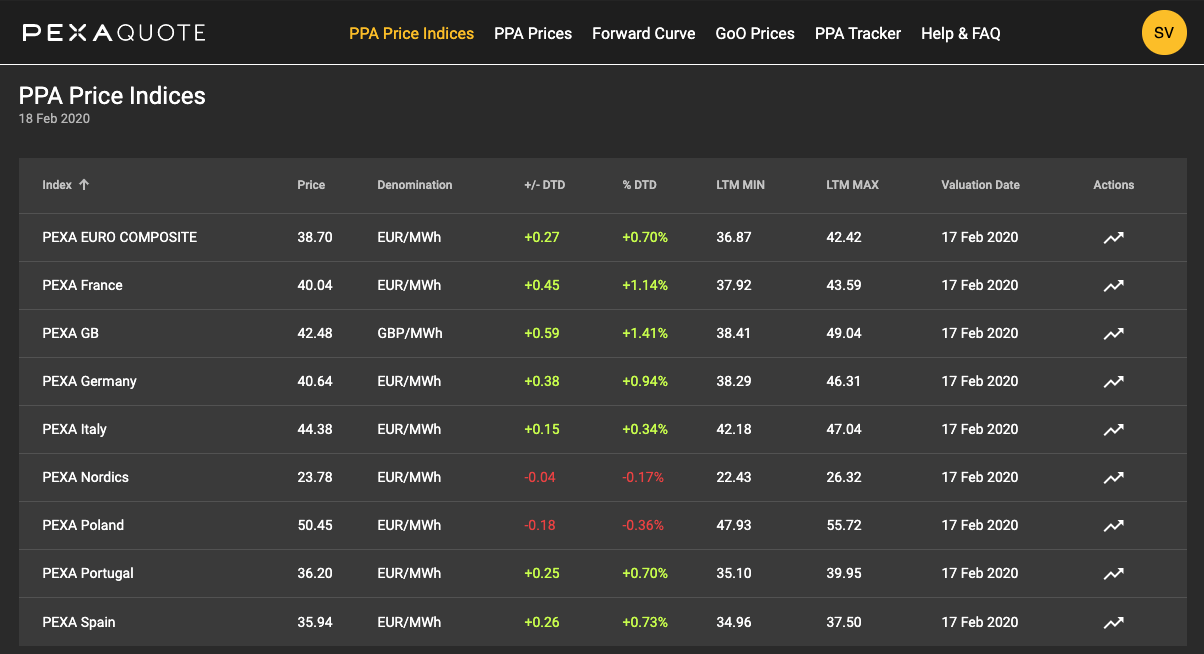

PexaQuote’s freemium edition includes price indices by market and a PPA deal tracker, which records deals closed in the EU as and when they are disclosed. The software allows users to analyse the volume of deals across different technologies and countries. In addition to providing insight into pricing across the market, the freemium version also includes a new feature wherein the user can request a quote for a given PPA structure. If any sell side parties are interested, the software automatically matches them to the user.

Applications: Free access to PPA tools including PexaQuote’s price indices, deal tracker, and quote service.

Platform: Since 2019, the business has used insights from its software and database to support more than 50 PPA deals struck in Europe. Pexapark developed PexaQuote in 2019 to analyse power price data and provide a quote based on real-time energy valuation and the specifics of a given project.

Availability: Currently available.