The inaugural PV ModuleTech 2017 event takes place in Kuala Lumpur, Malaysia, on 7-8 November 2017, and for many of the attendees taking part in the event, the anticipation is growing by the day!

This article reveals the companies confirmed as speakers and attendees so far for the two-day event, segmenting them into the key stakeholder categories needed to fully understand module ‘quality’.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

I also explain why their involvement at the event – both speaking and through networking – is set to provide the industry’s first annual dedicated event for what is possibly one of the most critical issues impacting the industry as a whole.

Which companies are critical to quality and bankable module supply?

To a great deal of solar industry participants, the common misperception is that quality and reliability of module supply falls purely with the company selling the product to the various downstream channels (installers, EPCs, agents, resellers and distributors) that feed rooftop, floating and ground-mounted installations.

Believing this, and often spurious Tier-1 related claims, could not be further from the truth, for a host of reasons we have been discussing on PV-Tech over the past couple of months on the build up to PV ModuleTech 2017.

In order to fully appreciate the range of companies that are vital to understanding module quality, I will talk through these now:

Module supply is the first generic grouping of course that we filter out, from a key stakeholder standpoint, but this has multiple aspects as follows:

• Who manufactures the modules, and in what locations, either in-house or sub-contracted through tolling or OEM contract build?

• Where are the ingots, wafers, and cells produced and what visibility is there on the audit trail on these?

• What production equipment is used for the module assembly?

• What materials and material suppliers make up the bill-of-materials for every module shipped to any specific installation, and how are they qualified and guaranteed?

The final two categories above are grouped now as the second generic grouping: module assembly production equipment and materials supply.

Inherent in the module assembly process are other key groupings that are essential to mitigate risk for all downstream players, including project developers, EPCs, investors (site-related capex, acquisition and refinancing).

This includes companies doing factory audits, panel testing/inspection and certification, and technical and commercial auditing as part of bankability studies. Added to this are companies offering insurance (and reinsurance) services for the modules supplied on-site.

The next category involves the investment side itself, including in-house technical experts employed by institutional investors and banks. Pulled by the site asset owner, this pushes the need for module awareness down through asset managers and O&M contractors.

The final category of course is the R&D component related to key module technology changes that may have a material impact on site yields for projects that are planned to be built over the next 12-18 months (such as PERC or bifacial modules for example). R&D, or new product upgrades or enhancements, resides in-house with the module manufacturers, but often closely aligned with partner institutes and co-funded activities.

This in effect defines the full portfolio of company-types that have an input into the choice of module supplier and module technology used for any large-scale (or utility-based) solar installation, with the involvement of these groupings seeing greater due-diligence as project sizes increase.

Consequently, all of these companies can make a strong business case to be module ‘experts’, or at least understanding the salient points that make their decision-making as diligent as possible.

This essentially defines the scope of PV ModuleTech 2017, and our choice of invited speakers, companies and audience segmentation has been structured to make the two-day event in Kuala Lumpur on 7-8 November, both overflowing with relevance and also of strategic business value to the entire audience.

Revealing the companies speaking and attending

Generally, we can sort the above company types into 8 key stakeholder groups:

1. Multi-GW PV module suppliers (global, with a strong utility focus in particular outside China)

2. Materials and production equipment suppliers

3. Test, inspection, certification, factory auditing

4. Independent engineers

5. Project developers, EPCs, O&Ms

6. Insurance/reinsurance

7. Financing/refinancing, asset management

8. R&D institutes

Many companies of course cover multiple functions, especially across 3) to 7) above, so the quick way of segmenting companies is by 1), 2), 8) and a final category for all functions for 3) to 7) together.

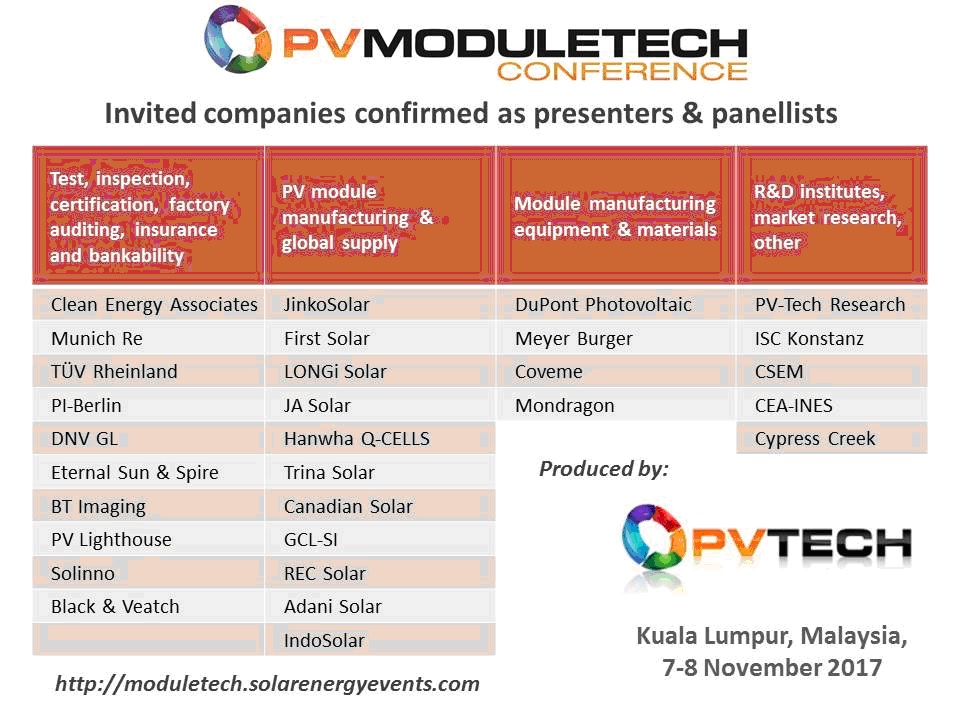

Companies speaking at PV ModuleTech 2017

The invited and confirmed set of speakers and panellists for PV ModuleTech 2017 is shown in the graphic below, and includes the major companies active within the above categories. Hearing what this set of speakers present at the event will be fascinating indeed, and is beyond any doubt the first time ever this set of stakeholders has been gathered with the sole focus on module quality and everything that feeds into this.

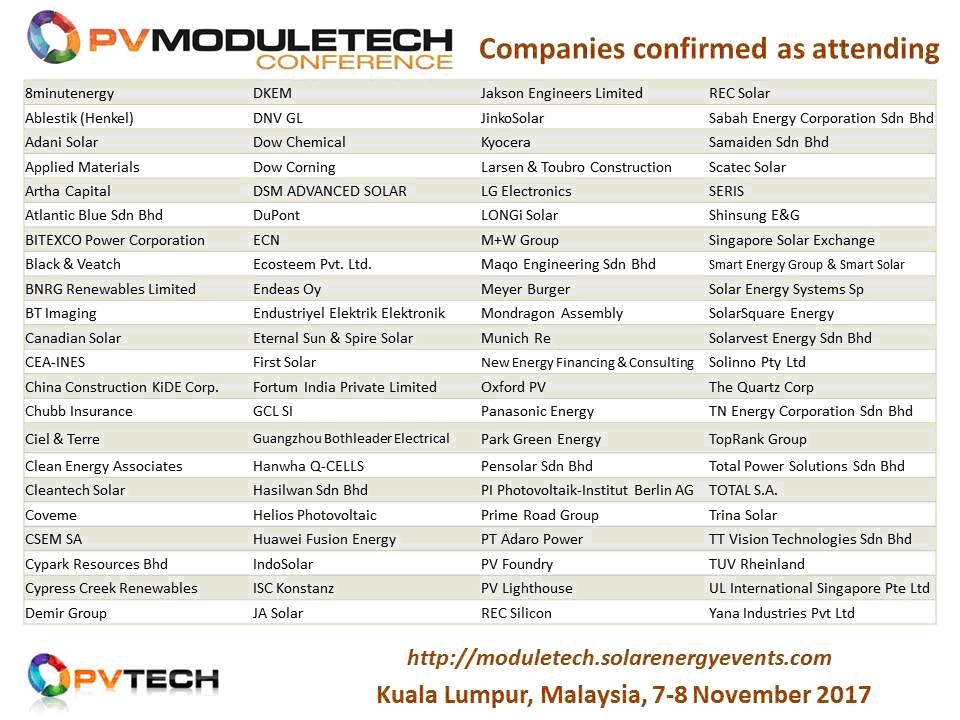

Companies attending PV ModuleTech 2017

The graphic below now shows a partial list of the 100+ companies that will be sending delegates to the PV ModuleTech 2017 event, with many more in addition to the partial updated list (as of 27 October) shown expected to be confirmed over the next 7 days.

Each company can be matched clearly to the list of groupings above, with strong representation from the downstream players in Southeast Asia (developers, EPCs, investors) reflecting the geographic location of the event and the relevance of quality module supply to many of the large-scale utility solar farms set to be built across Malaysia itself and other emerging regions such as Vietnam, the Philippines, Indonesia and Thailand, not to mention India.

With just one week left until PV ModuleTech 2017, on 7-8 November, in Kuala Lumpur, we will be discussing on PV-Tech during this week some of the key themes we expect to be hotly debated during the event.

To register to attend PV ModuleTech 2017, please follow the links at the event website here.