The recent domestic content regulations and trade policies have prompted caution in the US from suppliers for long-term projections, according to a report from solar and storage software company Anza.

In its report, Anza Q2 2025 Domestic Content Insights, it highlighted that the recent tariffs – including the 25% tariff on steel and aluminium, China’s 145% tariff and the paused “reciprocal” tariffs – have not only created pricing uncertainty for manufacturers, but also for developers and buyers. Moreover, according to Anza, it has prompted parties to delay procurement decisions and even some to re-evaluate sourcing strategies.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

And this is without taking into account the recent steep antidumping and countervailing duty (AD/CVD) tariffs set against Thailand, Vietnam, Malaysia and Cambodia, as the report did not cover these tariffs.

Gap widens between US solar cells and imported cells

In terms of manufacturers, some have accelerated their US production timelines to take advantage of domestic content incentives and avoid tariff exposure, while others have cancelled previously announced plans due to financial or logistical constraints.

“Notably, domestic inventories are contracting and prices are rising as available stocks are deployed to backfill impacted purchase orders subject to the new tariff measures,” wrote Anza.

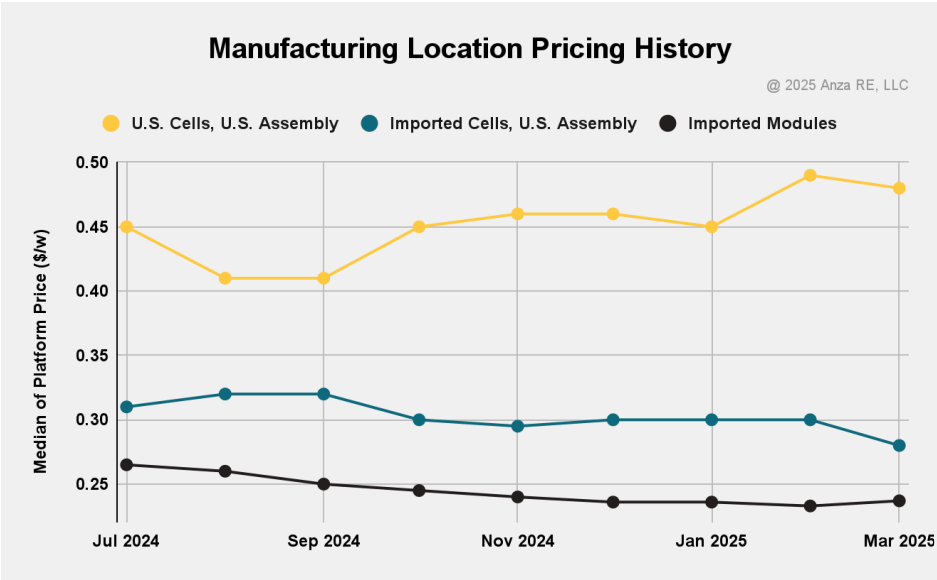

Indeed, the price of solar cells made in the US has seen a price increase during the first quarter of 2025, which has widened the price gap with imported solar cells. Between December 2024 and March 2025, the price of US-made solar cells has increased by 4.3%, according to Anza’s data. This was driven by a tight domestic supply.

On the other hand, the price of modules assembled in the US with imported solar cells did not rise as anticipated, said Anza. Prices have generally been flat with a slight decrease of 0.4% between the end of 2024 and March 2025. According to Anza, this is due to buyers requiring higher domestic content points, which would be provided through domestic modules made with domestic solar cells.

Finally, imported modules have experienced a 6.7% price decrease between December 2024 and March 2025. “Uncertainty due to evolving universal and reciprocal tariffs will likely drive upward pricing pressure across many product segments. Current pricing data extends through March 2025, before the full effects of these tariffs are reflected,” wrote Anza.

Another report from Anza recently highlighted how the origin of solar cells has had an impact on the price of US solar modules in the past few months (Premium access).

Domestic solar cell suppliers to double in two years

Availability of suppliers assembling modules and solar cells in the US will fluctuate over the coming years, explained Anza. Solar cell suppliers will see the highest growth by doubling its numbers from 5 in the first half of 2025 to 10 in the first half of 2027. Module suppliers on the other hand will fluctuate from 17 in H1 2025 to a high of 20 in the first half of 2026 and then dropping to 18 in H1 2027.

According to Anza, the temporary increase is due to short-term commitments that some manufacturers are “unwilling to extend further out”. The recent tariffs are prompting suppliers to be more cautious about long-term projections.