Clean energy pricing in Europe and America is set for a decisive adjustment in 2026 as record deployment levels collide with heightened market volatility and policy headwinds.

The Renewables Market Outlook 2026 report from market intelligence firm Pexapark predicts what it calls a “big repricing” in the EU and US this year, as the commercial assumptions underpinning offtake strategies over the past five years are upended.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

In Europe, although renewables reached nearly half of all generation in 2025, structural volatility and price cannibalisation became “persistent, systemic” features of the market, Pexapark said. In the US, record deployment was undermined by “policy-driven headwinds” as the Trump administration reversed Biden-era support for renewables.

The result is what Pexapark said would be a fundamental reappraisal of the commercial value of renewables assets.

“2025 marked the moment renewables became the dominant technology block in Europe, but that success brings complex new headwinds,” said Luca Pedretti, Pexapark’s chief operating officer and co-founder. “We are seeing a ‘Big Repricing’ where the focus is no longer just on capacity build-out, but on managing structurally higher volatility. The winning model is shifting from asset-centric to revenue-centric.”

In his foreword to the report, Pedretti added that the predicted big repricing was not just a downward adjustment in prices, but a “deeper reassessment” of economic viability in a renewables-dominated system. “As the market adjusts, attention is shifting away from headline prices toward a more nuanced understanding of what different structures, profiles and risks are actually worth,” he said.

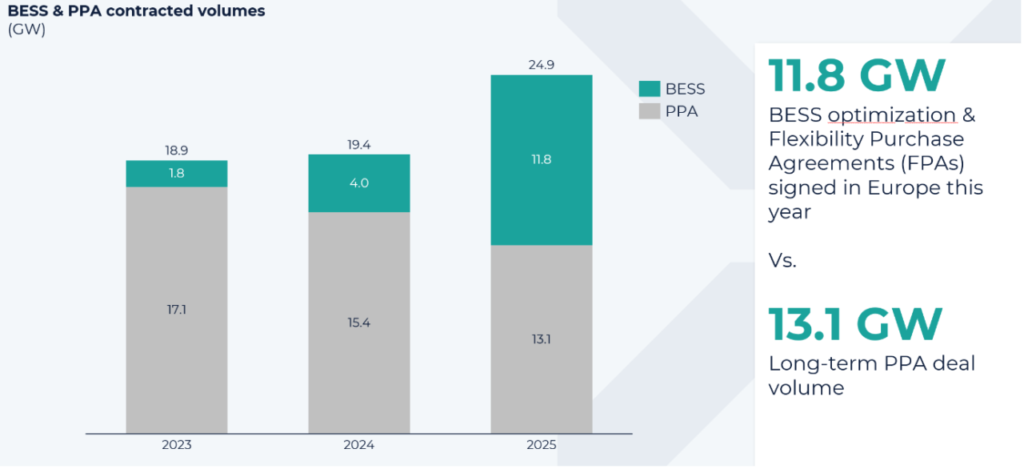

The changes predicted by Pexapark are illustrated by the growing dominance of flexibility purchase agreements (FPAs) in Europe. In 2025, almost 12GW or 23GWh of battery energy storage system (BESS) capacity was contracted under FPAs – three times the volume recorded in 2024.

By contrast, traditional power purchase agreement (PPA) momentum in Europe “cooled”, Pexapark said, falling from 15.3GW in 2024 to 13.1GW in 2025.

Within these volatile market conditions, Pexapark said utilities were taking centre stage. “With diversified portfolios, downstream reach and deep risk management capabilities, utilities are playing to their natural strengths.”

Accordingly, utilities increased PPA offtake volumes by over 200% year-on-year and accounted for 77% of contracted FPA volumes in Europe in 2025, leveraging portfolio scale, strong balance sheets, and flexibility assets, Pexapark said.

For independent power producers (IPPs), Pexapark said the traditional business model was being “rewritten” and the emphasis moves downstream. “Value creation is no longer anchored primarily in development, asset ownership or long-term offtake alone, but in the ability to manage revenues across volatile, fragmented and increasingly punitive power markets,” the report said.

Meanwhile, in the US, although 2025 saw solar deployments increase “sharply”, Pexapark highlighted growing market strain due to policy uncertainties created by the Trump government’s rollback of market support. As a result, PPA deals came under pressure, with Pexapark recording a 22% decline in deal volume in 2025.

Looking ahead, Pexapark said market participants have already started to adapt, with hybrid contract structures evolving to better address capture risk and manage negative price exposure, and flexibility solutions being integrated more systematically into investment and portfolio strategies. Flexibility is increasingly treated as a core value driver rather than an afterthought. Storage, hybridisation, structured offtake and portfolio-level thinking are no longer add-ons.

“Across both Europe and the US, renewable power markets are entering a fundamentally new phase,” Pedretti concluded. “As volatility becomes the dominant market force, flexibility is becoming the real source of value. Storage, optimisation and portfolio-level strategies are no longer just ways to improve returns – they are essential to remaining bankable and competitive in today’s power markets.”