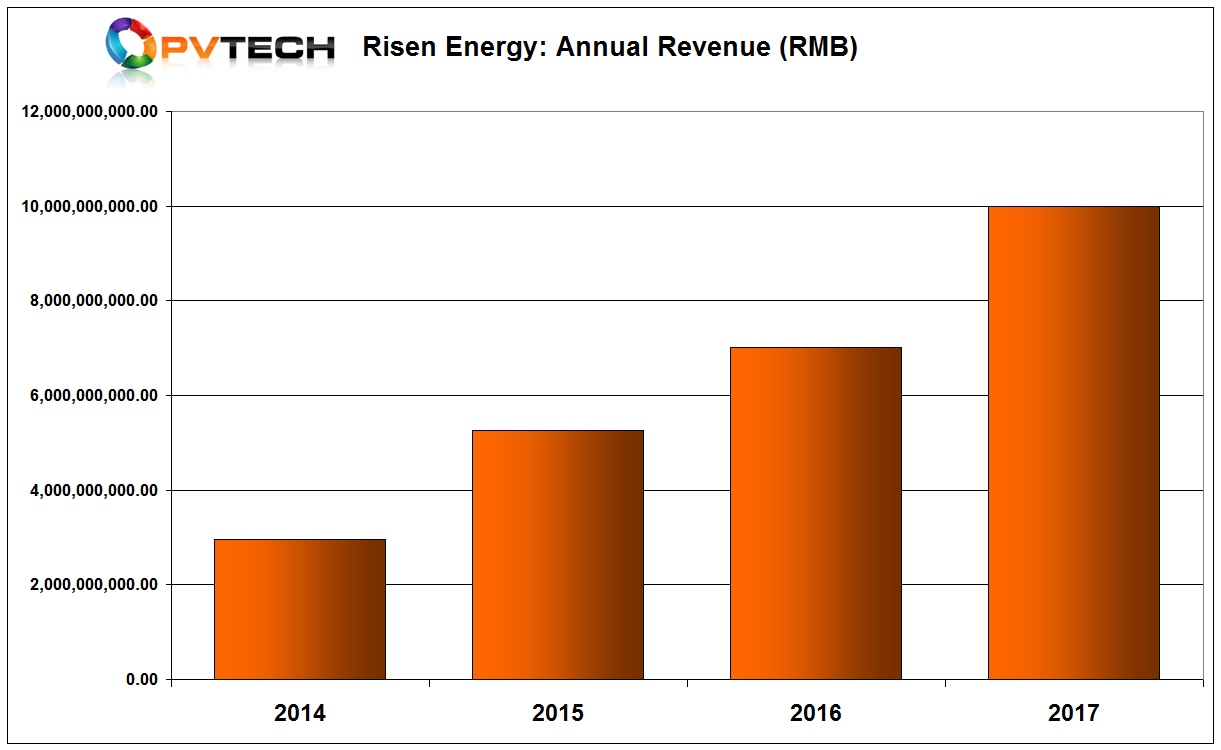

Major China-based PV module manufacturer Risen Energy, which entered PV Tech’s Top 10 module manufacturer’s rankings for the first time in 2017, has reported that its operating income exceeded RMB 10 billion (US$1.56 billion) in 2017, a new record for the company.

Risen Energy said in a financial filing announcing preliminary 2017 revenue and profit results that its net profit would be in the range of approximately RMB 645 million to RMB 705 million (US$100 million to US$110.1 million in 2017, down by 8.54% to 0.17% from 2016.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The company had an operating income of around RMB 7.0 billion in 2016, indicating sales increased around 45% in 2017.

Despite the significant increase in module shipments and revenue year-on-year, Risen Energy noted that PV module Average Selling Price (ASP) declines and higher operating costs, due to opening new markets for the company impacted net profits in 2017.

However, the increase in polysilicon prices would have also impacted margins and profitability.

The company recently reported signing a framework agreement to build and operate a 5GW monocrystalline cell and module plant in Changzhou City, Jiangsu Province, China.

The JV framework agreement calls for Risen to provide RMB 1.5 billion (60% stake) and its partner RMB 1.0 billion (40% stake) towards establishing the new manufacturing facilities. Risen also noted in a separate press release that total capital expenditures for the JV to reach the 5GW nameplate capacity of both cells and modules, as well as R&D activities would be approximately RMB 8.0 billion (US$1.23 billion).

The company had a solar cell nameplate capacity of 1.5GW in mid-2017, while module capacity stood at 3.1GW.