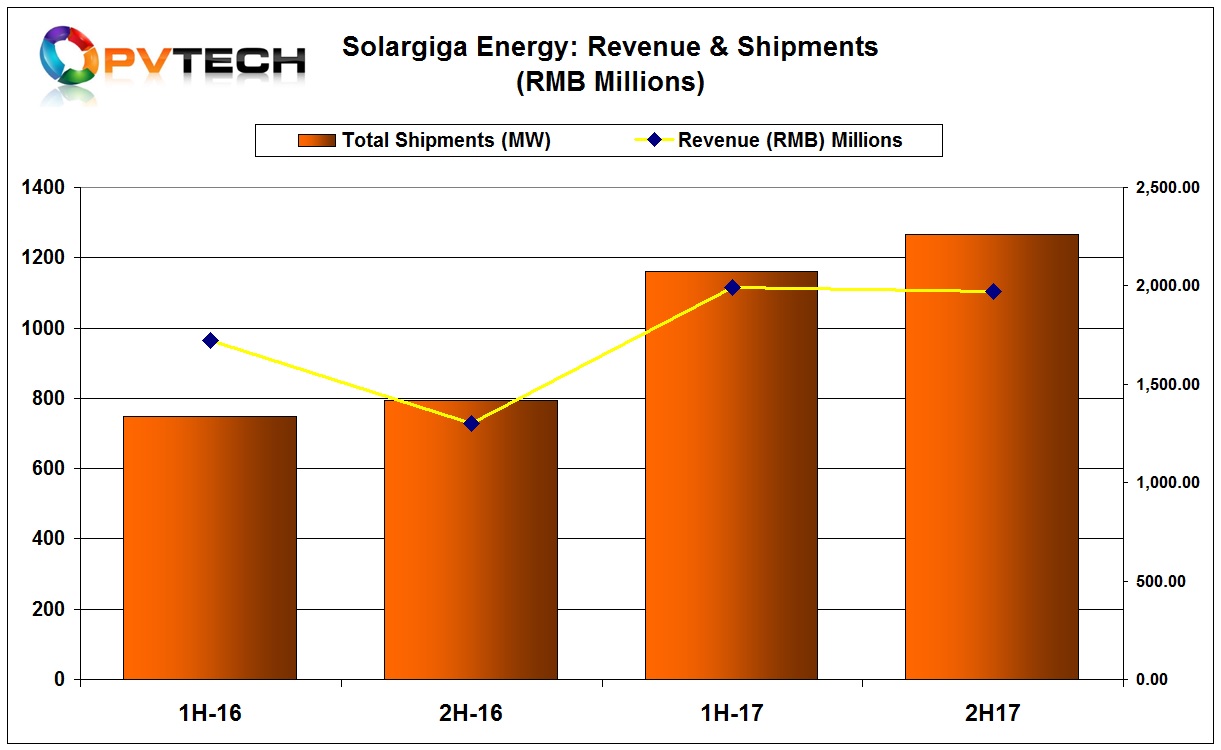

China-based integrated monocrystalline PV manufacturer Solargiga Energy Holdings has reported preliminary 2017 financial results, highlighting a record 57.3% increase in external product shipments.

Solargiga reported preliminary total 2017 revenue of RMB 3,964 million (US$616.2 million), up 31.2% from the previous year.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Total external product shipments (silicon ingots, wafers, cells and PV modules) reached 2,427.8MW, up 57.3% from the previous year shipments of 1,543.4MW.

PV Tech had previously highlighted that the company had seen a strong rebound in demand in the first half of 2017 as demand in China increased for high-efficiency wafers including N-type wafers for ‘Top Runner’ PV power plant projects.

In mid-2017, Solargiga had monocrystalline ingot and wafer manufacturing capacity of 1.2GW and had external PV module shipments of 616.5MW. Total shipment volume increased from 749MW in the first half of 2016 to 1,161MW in the first half of 2017, representing an increase of 55%.

Second-half product shipments were around 1,266MW, while revenue was RMB 1,974 million, relatively flat with the first-half of 2017.