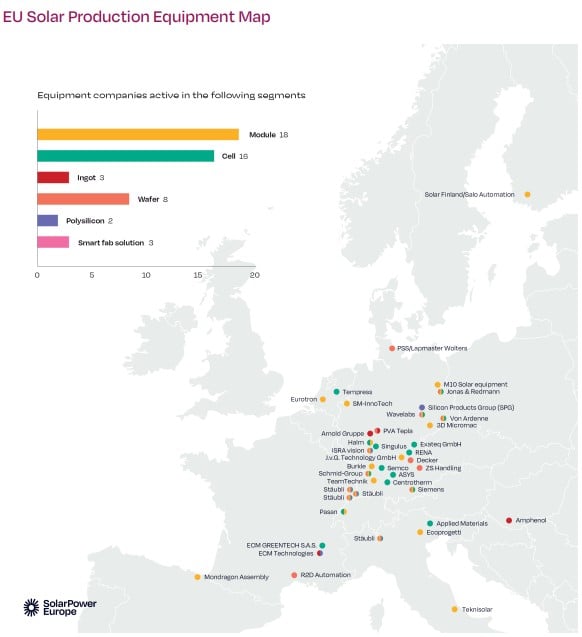

Europe’s solar manufacturing sector heavily favours downstream products such as cells and modules, with 75% of European manufacturers involved in their production, so Europe as a whole would benefit from greater investment into the upstream portions of its solar product manufacturing chain, such as polysilicon, ingots and wafers.

This is a key conclusion from SolarPower Europe’s ‘Solar Production Equipment’ report, published this week, which breaks down the state of European solar manufacturing across five stages – from polysilicon to module – to assess the strength of the industry.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The report notes that Europe is the weakest in the upstream portion of the manufacturing sector, with a lack of available equipment and expertise in Solar Czochralski pullers and diamond wire saws, in particular, key components of the ingot and wafer production process, respectively.

SolarPower Europe states that this technology is “available” in Europe, but not widely available on a commercial scale, and that this has hampered Europe’s ability to compete with other markets, such as China, on upstream solar manufacturing.

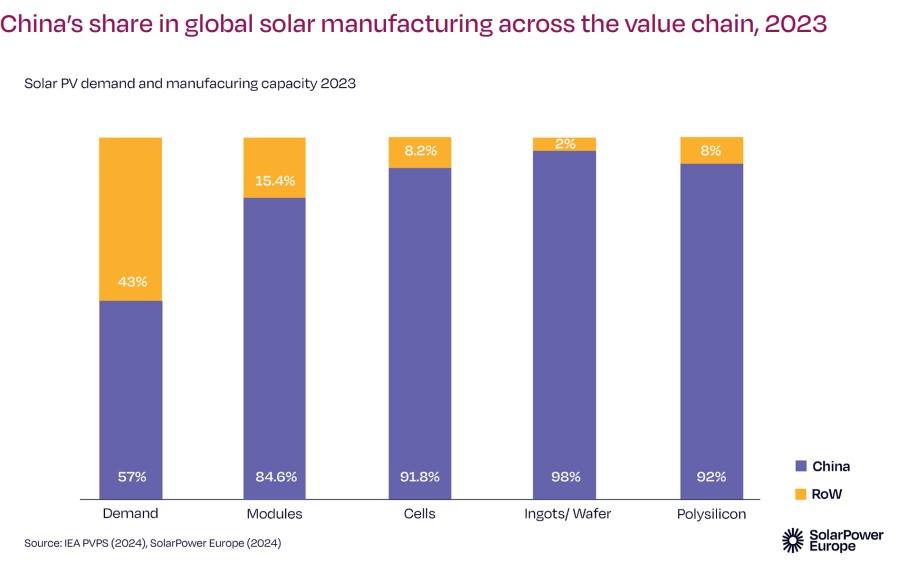

The report notes that China accounted for 92% of the world’s polysilicon production, and 98% of the world’s ingot and wafer production, in 2023, despite only accounting for 57% of the world’s demand for PV products. These trends are shown in the graph above.

Wacker is the only polysilicon producer in Europe, with an annual production capacity of 80,000 tonnes – of which 60,000 are located in Europe – a mere fraction of the 890,000 tonnes of polysilicon that were in demand in the second half of 2024, according to EnergyTrend.

‘Niche’ markets in downstream production

However, the report is slightly more optimistic with regard to Europe’s capacity for the manufacture of downstream products.

SolarPower Europe notes that three-quarters of European solar manufacturers are active in the cell, module and testing stages – or all three – and this is reflected in the distribution of manufacturers across the continent. A total of 34 companies are involved in the module and cell production space in Europe – 18 and 16, respectively – while wafer, ingot and polysilicon manufacturers number just eight, three and two, respectively. This distribution is shown in the graph below.

The report also notes that there are two Europe-based cell manufacturers with gigawatts of production capacity – Meyer Burger and 3Sun – and both have elected to use heterojunction technology (HJT) for their products. While Meyer Burger, in particular, has moved some operations to the US, and endured a number of financial hurdles in the past year, Europe’s relative expertise in a less well-established technology, such as HJT, is notable.

According to the report, module manufacturers are more competitive when providing “‘niche’ PV projects for specific applications”. This reflects a sentiment shared with PV Tech Premium by SolarEdge general manager of Europe Christian Carraro, that Europe will struggle to compete with China on sheer production capacity, but that by focusing on emerging technologies and more specialised deployment opportunities, European solar manufacturing could carve a niche for itself.

The ‘enduring role of Europe’

Much of the report makes reference to Europe’s history in solar research and development, for example noting that wire sawing equipment, one of the types of equipment most lacking in Europe presently, was “originally developed” in Europe. This sentiment is reflected in SolarPower Europe’s commentary on the report, in which it describes the solar sector as an important part of Europe’s “reindustrialisation” efforts.

“Our first Solar Production Equipment report reveals the enduring role of Europe at a key juncture of the solar supply chain—creating the essential equipment that produces solar technology,” said Michael Schmela, director of market intelligence at SolarPower Europe.

“Production equipment is a very important part of Europe’s reindustrialisation story, and the solar sector can tap into its clear potential through efforts like the International Solar Manufacturing Initiative (ISMI).”

SolarPower Europe launched the ISMI earlier this week, to coincide with the publication of the Solar Production Equipment report, to help build a market for European-made solar products beyond the borders of Europe. The ISMI aims to align Europe’s solar manufacturing sector with other pieces of EU legislation, such as the Global Gateway strategy, but questions remain as to how to successfully market European-made products compared to cheaper ones produced in China.