PV monitoring specialist Solytic has targeted a ten-fold increase in the number of systems it monitors after concluding a Series A funding round led by energy giant Vattenfall.

The Berlin-headquartered company secured what it labelled a “medium seven-digit sum” in the funding round which also saw participation from German energy company EWE and a number of angel investors.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Having been founded in 2017, Solytic’s software-based PV monitoring solution is currently used by around 100,000 solar systems, however, the firm wants this figure to grow ten-fold to one million plants within the next three years.

The company is to use the proceeds of its latest funding round to accelerate product development and help grow into new markets. Having both Swedish state-backed utility Vattenfall and EWE on board, Solytic MD and co-founder Konrad Perényi said, was an “important step forward” in meeting those aims.

“It gives us the necessary clout to further expand digital services in the solar market and to gain a strong market position,” he said.

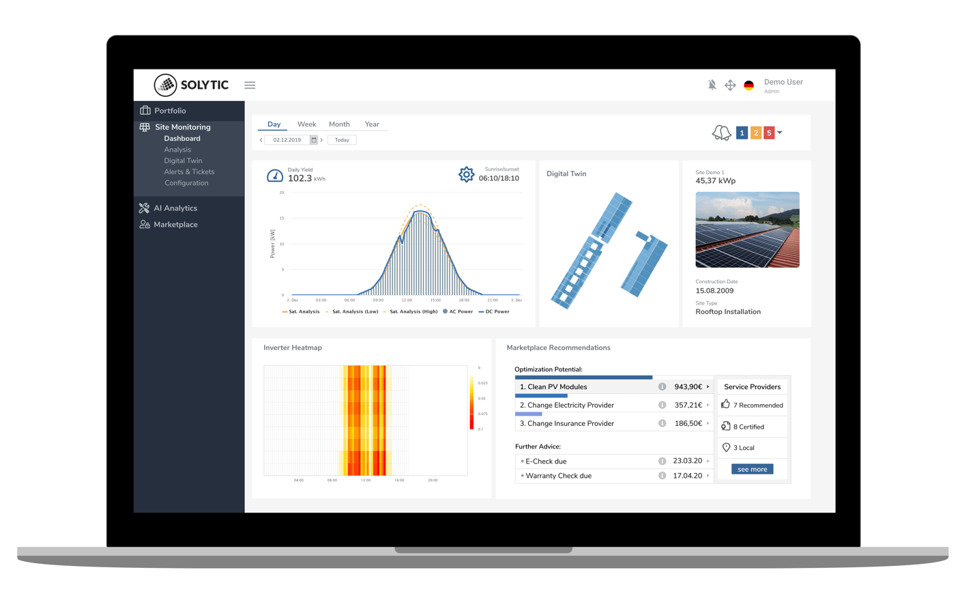

Solytic’s software uses performance data gathered in real time to optimise asset performance. Artificial intelligence practices are used to automate plant monitoring, helping to identify weak points or faults early to reduce down time and repair costs. Analysis can also be compiled based on potential expansions or additions, such as energy storage.

That, in turn, Solytic said, can help utility-scale solar plants reach a break-even point faster, contributing towards the economic feasibility of the technology.

“Most buyers of solar plants are mainly interested in the yields and their degree of self-sufficiency. In order to enable plant owners to minimize their expenses while maximizing their yield, Solytic continuously evaluates the plant data and reports weaknesses and potentials to the operators with concrete proposals for solutions,” Solytic co-founder Johannes Burgard said.

Vattenfall originally invested in Solytic in 2018, providing €3 million of late-seed financing to help further the fledgling company’s product development.

Having now provided the company with further funding, Vattenfall senior vice president Gunnar Groebler said the utility saw “significant growth potential” in the international solar arena.

“However, economic success depends on constructing renewable plants as cost-effectively as possible and operating them with data support. Therefore, the investment in a company like Solytic, which is clearly focused on digital services in this future-oriented area, is a very sensible investment for Vattenfall”, Groebler continued.