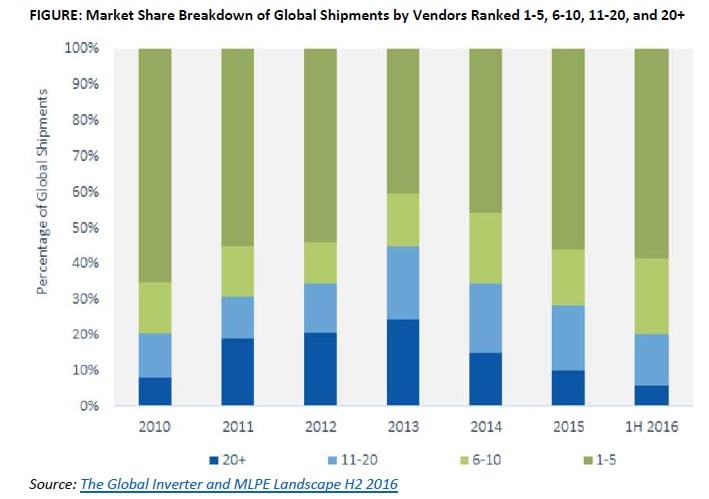

A new report from GTM Research reveals that the top-10 PV inverter manufacturers accounted for 80% of global shipments in the first half of the year, while the top-5 took around 50% of the market.

GTM Research said global PV inverter shipments are expected to reach a record 63.5GW (AC) in 2016, led by Huawei, which is expected to account for 17% of the world’s supply of PV inverters in the first half of the year. However, in terms of inverter revenue, SMA Solar took the top position.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

“We haven’t seen the leading vendors hold share this high since 2010, when solar demand was highly centered in continental Europe,” said Senior Solar Analyst and report author Scott Moskowitz.

According to GTM Research, PV inverter shipments are expected to decline around 5% in 2017 due in part to reduced demand in the world’s three largest solar markets that include China, US and Japan. However, inverter revenue could fall by just 1.2% in 2017, due to increased sales of residential string inverters and module-level power electronics, boosting overall unit sales.

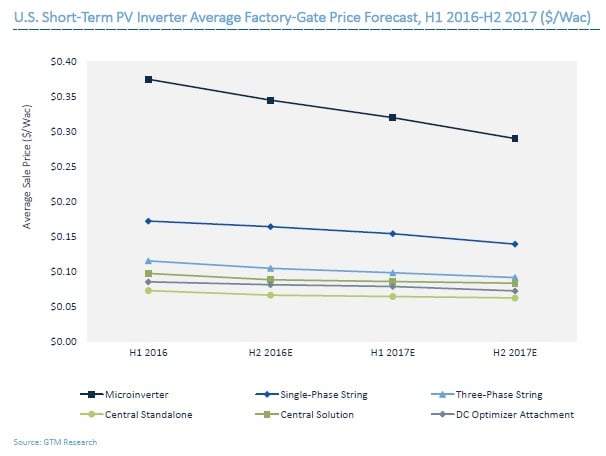

“Pricing pressure remains a constant, unrelenting reality in the maturing solar inverter market,” said Moskowitz. “Central inverter prices in the U.S. have fallen the most half-over-half due to increased competition from string inverters and proliferation of lower cost, 1,500-volt models”.

According to GTM Research, the increased adoption of 1500V inverters with higher power densities has led to around a 10% reduction in unit ASP’s compared to 1,000V inverters.

Long-term, GTM Research forecasts shipments to surpass 100GW (AC) by 2021, still led by China but at a lower level than seen in recent years, while new markets in the Middle East and South East Asia would become the fastest growing regions between 2016 and 2021.