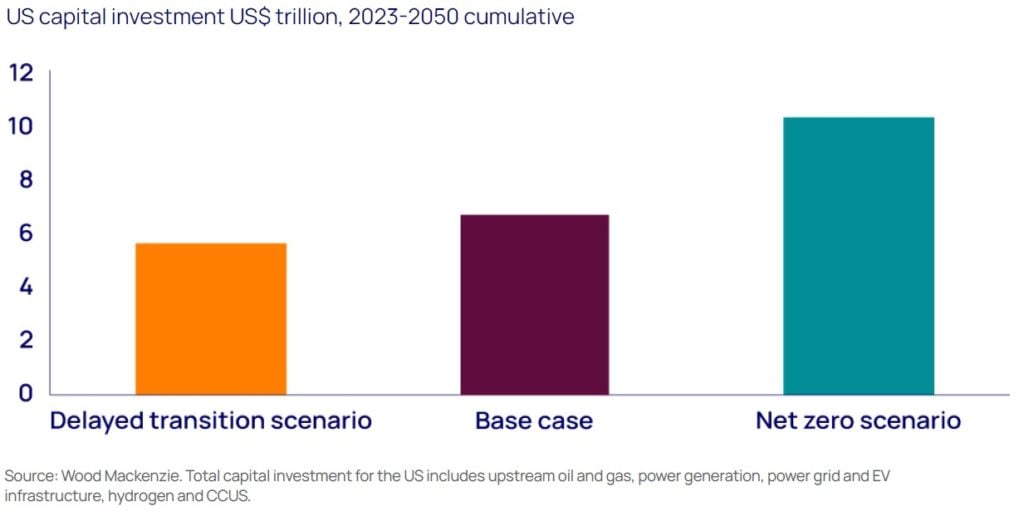

A win by the Republican Party in this year’s US presidential election could decelerate the country’s energy transition and reverse decarbonisation policies, according to Wood Mackenzie.

A recent report from the analyst highlights that US$1 trillion in energy investment could be at risk of being lost, were Donald Trump to win the November election. This would not only affect energy investments during the next five-year cycle but also until 2050.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

In a base case scenario, investments in the energy sector would be about US$7.7 trillion between 2023 and 2050, whereas in a net zero scenario investments would rise up to US$11.8 trillion.

However, both production (PTC) and investment tax credits (ITC), provided by the Inflation Reduction Act (IRA), would unlikely be halted, according to Wood Mackenzie, despite support for the act from the US renewables sector.

David Brown, director of Wood Mackenzie’s energy transition research, said: “It is not likely that the IRA will be fully repealed.

“However, a second Trump presidency would likely issue executive orders that would abandon the 2035 net zero target for the power sector, establish softer emissions goals from the Environmental Protection Agency (EPA), and issue tax credit regulations that could favour blue hydrogen.”

Deployment of solar PV, wind and energy storage could be 25% lower than in the base case scenario, with such a forecast predicting 500GW of installed capacity by 2050. On the other hand, the base case scenario predicts solar and wind to grow sixfold by 2050.

US-China trade tariffs

Alongside concerns that a Republican victory could alter the pace at which clean energy investments are made, the report mentions the ongoing relationship between the US and China.

Last week, the Biden administration made several policy-driven announcements, starting with the increase of solar cell tariffs from 25% to 50% under Section 301.

Moreover, it lifted the bifacial module exemption under Section 201, and Biden hasreiterated that 6 June 2024 is the day the tariff waiver on solar imports from Southeast Asia will end.

However, this is not the last we have heard about the antidumping and countervailing duty (AD/CVD) tariffs, as the Department of Commerce opened an investigation into solar cell imports from Cambodia, Vietnam, Thailand and Malaysia last week.

The investigation is based on a petition raised by the American Alliance for Solar Manufacturing Trade Committee in April. The group comprises a number of solar manufacturers with US bases, including cadmium telluride (CdTe) thin-film module producer First Solar and major silicon-based manufacturers Qcells and Meyer Burger, which have called for an investigation into manufacturing practices in the four named countries.

States to carry the weight

Regardless of the status of the federal government, individual states could continue to be responsible for delivering growth in the renewables sector.

During Trump’s first presidential term between 2016 and 2020, state-level renewable portfolio standards and voluntary renewable energy targets supported annual average solar and wind capacity expansions of more than 13%.

The Wood Mackenzie report mentions that: “While a second Trump administration would almost certainly reduce federal support for decarbonisation, individual states will take up the baton.”

PV Tech’s publisher Solar Media will host the Renewable Energy Revenues Summit on 21-23 May 2024 in London. The event will explore PPA design, the role of effective policy, evolving strategies for large energy buyers and more. For more information, go to the website.