1 year on:

The Inflation Reduction Act passed into law a year ago today. Touted as the most significant climate change legislation in US – possibly in world – history, it unlocked a potential US$369 billion for renewable energy deployments, transmission and manufacturing, including tax credits.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Whilst 2024 has been earmarked to be the year when its effects begin to be fully felt in the solar PV industry, project deployments and, in particular, manufacturing announcements have already significantly increased. There are portions of the IRA that need unpacking, examining and clarifying – most notably at time of writing the domestic content adders – but its impact will likely be hard to overstate in the long run.

This article will bring together some opinions and thoughts on the anniversary of the IRA from different parts of the US solar industry, as well as charting a timeline of the course that took the IRA from opposition in the Senate to the present.

The IRA is built on two central tax incentives: the production and investment tax credits (PTC/ITC). The ITC allows taxpayers and companies to claim back portions of the cost of developing renewable energy projects, whilst the PTC allows producers of renewable power to claim credits based on the amount of clean electricity they produce. The act extended these credits through at least 2033.

What made it possible?

Speaking at a media briefing led by the UK-based Energy and Climate Intelligence Unit (ECIU) yesterday afternoon (15 August) to mark the IRA’s anniversary, Mark Williams, senior fellow at the Centre for American Progress, drew attention to the politics necessitated to pass the IRA almost one year ago. According to Williams the success of the legislation lay in its domestic nature. Focussing on domestic benefits such as jobs, increasing manufacturing and energy security, the IRA was able to succeed in Congress.

“The IRA needed to be about domestic jobs, domestic manufacturing, it needed to be about supporting the American worker. Without that it wouldn’t have passed, it would be ephemeral, it would have been like every other climate bill we passed throughout the decades,” said Williams.

“Additionally, we would never have met any Climate Commitment without getting our own house in order. So without getting ourselves to a point of climate investments, climate regulation, without the IRA, we would never have been a legitimate voice, again, in international climate discussions, climate debates, climate negotiations, and multilateral trade functions where climate is on the table, we would have been an illegitimate voice.

“The IRA has brought us to that place where we can actually come to these tables with something behind us that says we’re actually doing our part.”

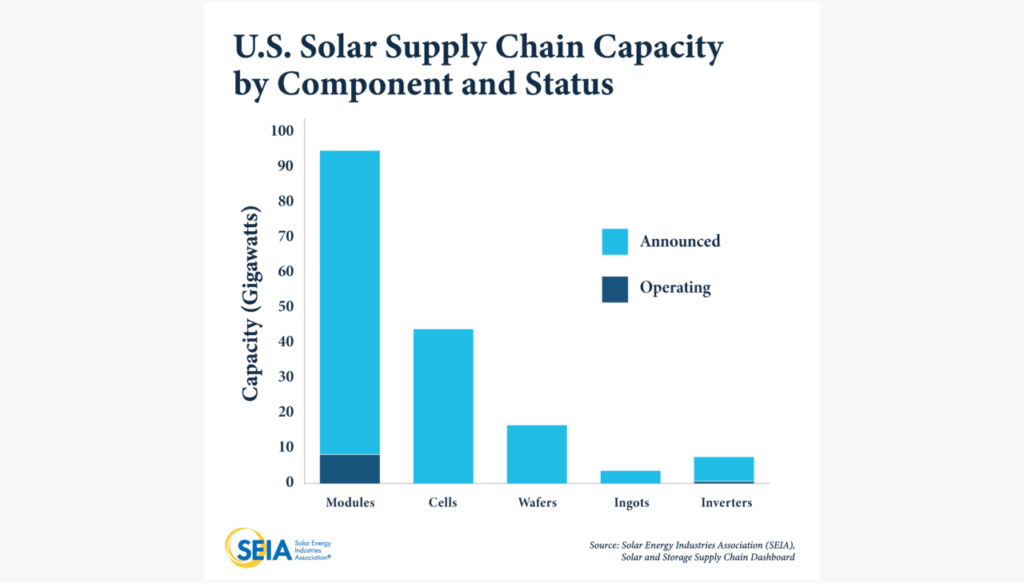

Reflecting on a year in post-IRA America, the Solar Energy Industries Association (SEIA) concluded that solar and storage companies had added US$100 billion to the US economy since the act passed, and that the momentum wasn’t going to lessen in the coming years: it forecasts that IRA incentives will onshore 155GW of solar manufacturing capacity to the US. This breaks down into existing announcements for 85.1GW of solar modules, 43.2GW of cells, 19.6GW of ingots and wafers and 6.8GW of inverters.

Made In America?

Following the announcement of a new 3GW cell and module production facility in New Mexico, Maxeon CEO Bill Mulligan said: “The IRA created a favorable policy environment that made it possible for Maxeon to locate our next large capacity expansion in Albuquerque. This policy environment, together with strong and growing customer demand, are catalysts that will enable Maxeon to re-shore solar cell and panel manufacturing, create thousands of good jobs, and enhance domestic energy security.”

Announcements from Hanwha QCells of an ingot-module integrated facility in Georgia, alongside an encapsulant plant, and ones from Enel Green Power and Maxeon have all spurred manufacturing on. However, the below graph from the SEIA shows that the plans are very much for the future, and currently supply is still majority imported.

Analysts have said that the US will struggle to meet its demand in the coming years with domestic supply alone and it remains to be seen how quickly capacity will come online, especially with the end of Joe Biden’s antidumping tariff waiver due to impose heavy duties on lots of Southeast Asian products from next year.

In a comment to PV Tech Premium for this article, the vice president of global policy at US cadmium telluride thin film manufacturer First Solar, Samantha Sloan, said: “Since its passage, the Inflation Reduction Act has been a catalyst for growth in solar manufacturing, and we are pleased that so many solar manufacturers intend to join us in investing in the United States.”

First Solar recently announced the Louisiana location of its fifth domestic factory, a 3.5GW facility that will produce its CadTel thin film modules.

Sloan continued: “As a proud American company, we remain focused on creating enduring value for the country by investing in achieving 14GW of domestic nameplate manufacturing capacity in 2026, supporting over 4,000 direct and thousands more indirect jobs, expanding our industry-leading domestic value chain, and doubling down on innovation. This is essential to allow the US to enter the next decade in a position of strength, powering its energy transition with technology made in America, for America.”

Worldwide attention

It certainly has put the wind in the sails of American industry, and the IRA has left Europe and others scrambling to keep up. The European Commission directly referenced the IRA in its announcement of the Green Deal Industrial Plan, and Ursula von der Leyen said that “It is no secret that certain elements of the design of the Inflation Reduction Act raised a number of concerns in terms of some of the targeted incentives for companies.”

A telling fact might be that both Maxeon and REC Group abandoned plans for European factories, and Maxeon has since announced a new US facility and expansions to its Mexico plant to supply the US market.

Canada’s 2023 budget also introduced IRA-style investment tax credits and Australia’s Clean Energy Council has called for its government to invest in a similar manner to avoid being left behind. The IRA has been a shot in the arm to governments and renewables industries the world over, both as an example and a daunting bar to try and reach.

CEO of perovskite-focused PV startup Caelux Scott Graybeal outlined his thoughts at the anniversary of the IRA: “IRA tax incentives play a crucial role in addressing the persistent supply issue in the US, reducing our dependence on imports, particularly from China. While importing from China was once an effective, even encouraged, strategy when our trade relations were more harmonious, recent geopolitical tensions and forced labour practices are prompting governments and companies to cultivate supply elsewhere.

Looking forward

Graybeal continued: “However, successful implementation and impact will vary based on state and local government actions, as well as the private sector’s willingness to accelerate investments and lead the charge on innovation.”

“Because it is critical to ensure that the benefits of IRA are deeply rooted in communities, more stakeholders should be brought to the table from the outset to help guide strategy development and implementation.”

Regarding deployments in commercial and industrial and smaller sites, solar financier Sunstone Credit offered its thoughts on the IRA’s impact: “The IRA has provided commercial and industrial property owners with the regulatory stability and economic incentives to make the incorporation of solar into their long-term property ownership and investment plans a no brainer.

If you own commercial or industrial property across any asset class, the new incentives available under the IRA make going solar a fantastic way to reduce tax liability and generate additional net operating income.”

There are still creases to be ironed out. In terms of onshoring and changing the face of US solar, chief among them might be cost-effectiveness and the competitive edge China’s manufacturers have after years of tailwinds. PV Tech’s Finlay Colville suggested in a feature that the IRA should prioritise cell manufacturing if it’s going to meaningfully change the makeup of US solar PV and avoid just importing a fleet of overseas module assembly plants that don’t really contribute to long-term energy security.

Skilled labour is another concern which the IRA has tried to incentivise but there’s no guarantee of fixing. One report from the SEIA forecast that there would be 120,000 solar jobs in the US by 2033, but a survey of the US industry from May this year found that the US industry was concerned skill shortages and supply chain constraints, which the IRA is by no means guaranteed to fix.

This is to say nothing of the US’ interconnection shortfalls, for which the IRA includes US$2 billion. However, the progress of the PV industry could be hampered by interconnection queues and curtailments that arise when there isn’t enough grid space or reliability to support expansion.

Part of this article was taken from coverage on our sister site, Current±. Read their full piece here.

Timeline of the Inflation Reduction Act

July 2022: The provisionally-named Build Back Better Act is debated over in the chambers and back corridors of the US Senate, a political football kicked around between Democrats and Republicans and ultimately passed to the feet of Senator Joe Manchin, a Democrat with reservations about his party’s commitments to clean energy. The Act promises to commit billions to clean energy deployment, extend the Investment Tax Credit (ITC) and open the door for a US solar PV manufacturing base. Concerns abound about the stability of the US grid and the price tag attached to the Act that the government will have to pay.

At the end of the month, Manchin reaches a deal with his party and the newly-named Inflation Reduction Act (IRA) is submitted to the Senate, and passed on Sunday 7th August.

16th August 2022: The IRA is signed into law by President Joe Biden, introducing US$369 billion in energy security, clean energy and climate change programmes over a decade – the biggest climate investment package in US history.

Prior to the announcement, industry analysts including BloombergNEF called it the “best chance the US has to build a domestic PV manufacturing industry”. The Solar Energy Industries Association publishes a white paper in the following days predicting that the US could be sitting on 50GW worth of domestic solar manufacturing by the end of the decade if the IRA’s incentives are deployed correctly.

19th-22nd September 2022 – The RE+ trade event in Anaheim, California sees the IRA take centre stage. Amidst the excitement and optimism, questions are being asked about when the effects will begin to take hold and whether it will loosen the module supply constraints in the US. There are also questions over the specifics of the bill – how does it plan to address the labour shortage in the US solar sector? What about the barrier that the country’s dated interconnection system poses? What will the IRA look like in practice regarding domestic content requirements and other adders?

Unpacking the IRA becomes the biggest source of legal challenges for the US industry.

30th November 2022 – The IRS releases its guidance for the IRA wage and apprenticeship requirements, due to be applied to projects that begin on or after 30th January. Projects that begin between the guidance announcement and the 30th January can be eligible for the IRA bonuses without having to satisfy the wage and apprenticeship rules.

11th January 2023 – After 2022 ended with 22GW worth of PV cell and module manufacturing plans announced since the passage of the IRA, Hanwha Qcells said it was dropping a cool US$2.5 billion on a vertically integrated ingot, wafer, cell and module production chain in the state of Georgia. Around the same time, PV Tech published analysis that said that the US should prioritise solar cell production if it wants to build a genuine domestic solar supply chain.

14th February 2023 – The Treasury releases guidance on IRA tax credits for deploying renewables at low income and coal-based communities with US$10 billion in funding.

26th April 2023 – Opposition to the IRA returns, this time in the form of the ‘Limit, Save, Grow Act’, proposing to roll back many of the measures that the IRA introduced to support renewable energy and other sectors of the economy. It comes as the White House is embroiled in a row over the country’s debt ceiling and the people proposing the new bill are looking to decrease spending, as well as bolster fossil fuels and uphold student debts. Climate and energy groups criticise the move, citing the US$150 billion in clean energy investments that have been announced to date since the IRA came into law.

16th May 2023 – With the IRA still in place, the IRS releases guidance for the domestic content tax adder requirements. In addition to a 100% domestic content requirement for steel, solar PV projects are required to show that 40% of their total cost is covered by US-made products if they are to receive the extra 10% tax credit. The IRS says that this threshold will rise to 55% in 2026. Questions hover around the guidance and what constitutes ‘domestic product’.

14th June – The treasury releases the ‘direct pay’ and ‘transferability’ guidance, widening the net of recipients for IRA tax credits to include state and local governments, non-profits, tribal bodies and other smaller entities by introducing more flexibility to the credits awarded.