Between US$7 and US$9 billion in transferable tax credit transactions were made last year in the US, according to a report from Crux, an ecosystem for entities to transact and manage transferable tax credits.

The domestic clean energy infrastructure market is expected to grow even further in 2024 as transactions last year only started after the US Department of Treasury released the guidance on transferability in June, which already grew to a third of the traditional tax equity market, estimated at US$23 billion in 2023.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Tax credits for clean energy were made transferable by the Inflation Reduction Act. The move was aimed at making it easier for companies without specialist tax credit or tax equity experience to invest in clean energy.

Interest in clean energy tax credits in the first full year since the passing of the Inflation Reduction Act, is expected to continue throughout the decade and could reach US$83 billion by 2031, according to Swiss banking entity Credit Suisse, while JPMorgan expects transferable credits to be the likely main driver of tax attribute investment.

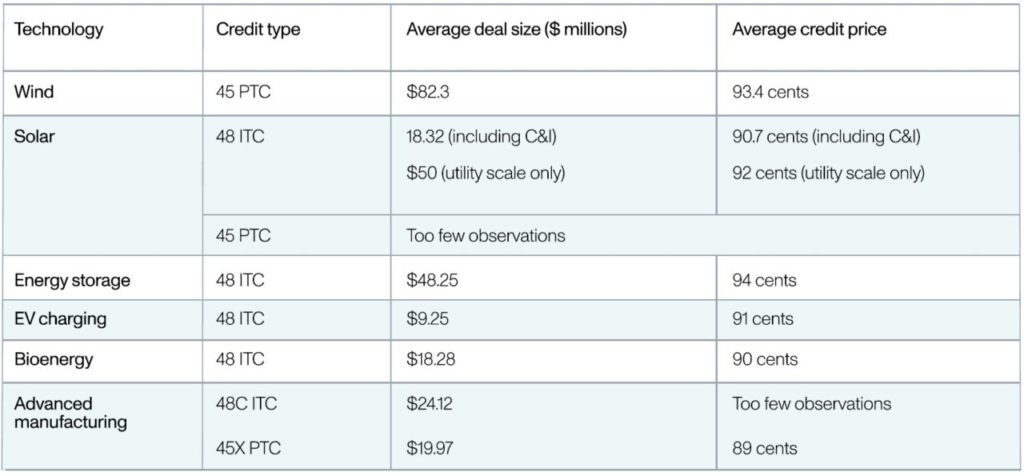

Crux’s report, Transferable Tax Credit Market Intelligence Report, covered US$3.5 billion of tax credit transactions – which represents between 30% to 50% of the market – and highlighted the average investment tax credit (ITC) deal was US$20 million and priced at US$0.92, while average production tax credit (PTC) deal was US$60 million and priced at US$0.94.

As shown in the chart below, solar average deal size reached US$18.3 million, including the commercial and industrial solar market, while it averaged US$50 million with only utility-scale solar.

Overall, ITC deals were the most frequently sold credits in 2023, accounting for more than half of all deals in Crux’s dataset, and tended to be smaller, while larger deals were favoured in PTC. However, some large deals for hybrid solar and storage involved a mix of ITCs and PTCs.

Among these types of hybrid solar-plus-storage deals was renewables asset manager Arevon Energy’s 157MW solar PV and 150MW/600MWh of energy storage project in California, which secured a mix of debt transfer and tax credit transfer with JP Morgan.

Back in October, financing firm Evergrow claimed to have completed the first tax credit transfer deal for a solar project in the US state of Connecticut. The ITC deal covered a behind-the-meter PV project with a 1MW capacity.

A majority of transactions (80%) analysed had a face value of US$50 million or less, showcasing a level playing field for smaller projects – as deals under US$50 million usually have limited access to traditional tax equity – and new technologies that qualify for tax credits for the first time, including advanced manufacturing and standalone energy storage among others.

In terms of advanced manufacturing production tax credit deals, thin-film module manufacturer First Solar recently secured up to US$700 million in tax credit transfer agreement on Section 45X, which is the first one of its kind in the solar manufacturing industry, according to the company.

This deal was made only a few days after the US Department of Treasury and The Internal Revenue Service (IRS) released a proposed guidance for the Section 45X credits on advanced manufacturing production credit.