Why would a Chinese inverter and storage manufacturer look to list on the Hong Kong Stock Exchange (HKEX)?

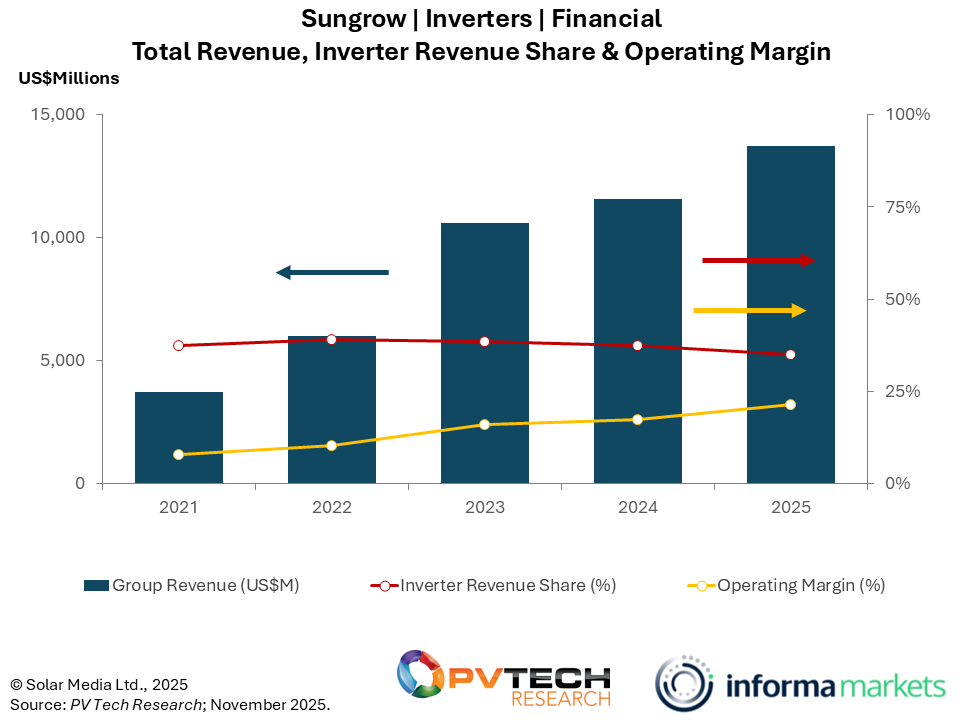

Last month, Sungrow announced plans to issue 338 million shares and raise US$126.7 million through an IPO on the HKEX, to support the research and development of new solar PV and energy storage products and new manufacturing bases in other countries. But why has a company that enjoyed revenue of US$11.6 billion as recently as 2024 sought to expand its financing work, and why has it looked to foreign investors to raise these funds?

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The most obvious answer to the latter is to sidestep some of the global supply chain issues that have become commonplace in the renewable energy sector, particularly between the US and China. In its IPO prospectus, Sungrow listed its main business risks as “operational risks, compliance and regulatory requirements,” including “uncertainties associated with tariffs” and “uncertainties associated with geopolitical tensions”.

However, as Cormac Gilligan, as associate director at S&P Global Commodity Insights, tells PV Tech Premium, there could be a technological element as well, as the increasing technical complexity of the renewable energy space has increased capital demands for those keen to invest in the latest technologies.

Sungrow’s plans to invest more into the solar and storage space, despite its background in inverter production, comes at a time where, according to Gilligan, working with a single technology type is increasingly financially unviable.

“The days of being a singular technology provider are limited,” explains Gilligan. “Solar module companies have expanded over the last few years into having battery energy storage capabilities; it is very difficult to be a single technology provider now, given the prevalence of the amount of activity in solar-plus-storage [with] co-location and hybrid power plants being active in the market.”

Diversifying technology

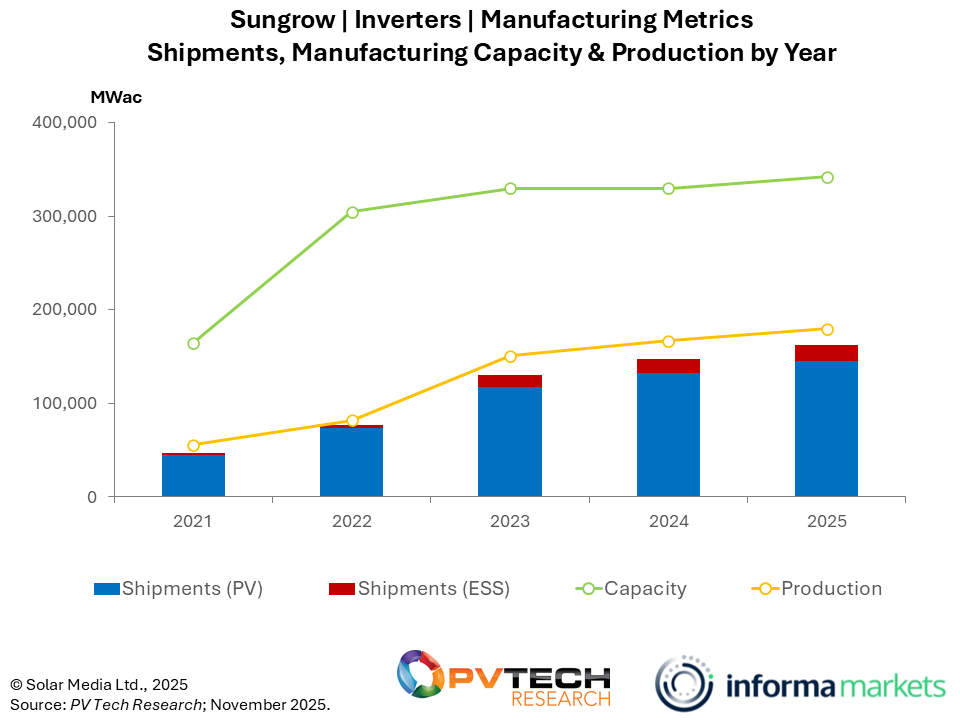

This shift away from relying on a single technology type is borne out in Sungrow’s own financial results. This is not to say that the company has turned away from the inverter sector as a whole—the company’s inverter sales are forecast to more than double from 2022 to the end of 2025, according to PV Tech Market Research—but other technologies are a growing part of Sungrow’s revenue generation strategy.

“The company’s energy storage system (ESS) sales have surged, now making up over 30% of overall revenue, a rise from 13% in 2021,” Mollie McCorkindale, a senior analyst at PV Tech Market Research team, tells us. This is shown in the graph below, where Sungrow’s inverter revenues have accounted for a smaller percentage of total revenue over time, despite overall revenue growth.

Figures from PV Tech Research show that the contribution of inverter sales to Sungrow’s total revenue has fallen marginally from 39% in 2022 to a low of 37% in 2024, and McCorkindale says this is forecast to fall further to 35% by the end of this year. This contrasts sharply to the company’s storage products, where revenue contribution has almost tripled from 12% in 2022 to 33% in 2025.

Indeed, investing in manufacturing capacity of a single technology, at least in the solar and storage sectors, could be unadvisable for companies due to the ongoing manufacturing downturn in the global solar sector.

In Europe, for instance, figures from sun.store demonstrate that inverter prices recovered for the first time in months following overproduction from specialists in both sectors, and McCorkindale argues that “an oversupply situation in the market” made sales challenging for many companies.

“Many manufacturers of inverters have expanded into the energy storage market in one way or another,” explains McCorkindale. “They could be either producing battery cells, assembling ESS, creating power conversion systems (PCS), or diversifying their inverter manufacturing to include energy storage inverters.

“This cross-integration allows companies to achieve greater financial stability in response to fluctuations in demand for either inverters or energy storage systems.”

However, McCorkindale notes that inverter manufacturers, such as Sungrow, are still looking to expand inverter manufacturing capacity, anticipating an increase in demand and an end to the downturn that has affected the industry in recent years. The graph below shows how Sungrow’s total manufacturing capacity has increased in the past few years, despite a slowdown in total capacity additions, while annual inverter production has increased steadily.

“Most inverter manufacturers are currently expanding their manufacturing capacity,” says McCorkindale. “This does not indicate a lack of existing capacity, but rather a response to the anticipated growing demand in the market. As a result, these companies feel the need to expand in order to remain competitive with larger manufacturers like Sungrow and Huawei, which possess significantly greater production capabilities than other inverter manufacturers.”

Increasing the total available market

Gilligan argues that shifting away from investment in a single technology type, and working with a range of products across the clean energy space, is a key reason for companies across the renewable energy industry looking to raise more funds at present.

“Companies are moving horizontally, across the clean tech value chain; so what that means, in my terms, is that those that are historically active in solar and wind now may be moving into green hydrogen, as an example, or battery energy storage,” he explains.

“For an inverter company, that can mean simply doing energy storage inverters, or it can mean doing other parts of the supply chain; it could be buying cells and assembling battery packs, it could be doing inverter integration, even creating things like an AC block where you integrate the battery modules and the power conversion.”

“It’s not as siloed as it once was in the past,” he continues, and suggests that the increasing prevalence of hybrid renewable power projects demonstrates investor appetite for more multi-faceted clean power production. Earlier this year, experts from LevelTen Energy argued that “everyone is talking about” the co-location of batteries with renewable power generation projects in Europe as a way to provide stability amid grid vulnerabilities and make projects more bankable.

“In my view, it’s becoming more interconnected,” says Gilligan. “What we’re seeing in the utility-scale is a growing number of hybrid power plants, any mix of solar, wind and energy storage—and maybe even green hydrogen—and any number of these solutions could be hypothetically at one site, or two of them or three of them. The expertise and the interactivity between the different teams is growing.”

Gillian also argues that combining a number of technologies that are growing at different rates is important for the success of the renewable energy transition. Figures from SolarPower Europe forecast the world’s solar capacity to grow by 10% by the end of 2025, a significant slowdown from the 33% year-on-year growth seen in 2024 and the 87% year-on-year growth seen in 2023. Simultaneously, batteries are being installed faster than ever, with a growth rate of 54% in the first half of this year, and can continue to provide growth for renewable power generation projects that are, according to Gilligan, approaching their “mid-life challenges”.

“It’s really important to have scale on whatever vertical you operate in at the moment, not just being big for the sake of being big but because it gives you economies of scale,” he explains. “The other one that’s really important, especially in these faster-growing areas, is time-to-market, in terms of innovating a product. Speed and scale are two keys to survival in this era of the solar and wind market maybe going through its mid-life challenges.”

Ultimately, he says, companies are looking to “increase their total available market” and invest in the production and sale of as broad a range of technology types as possible as a hedging mechanism to protect themselves from changes in the value of a single technology type.

Global supply chain challenges

The importance of de-risking investments is particularly pressing considering the global supply chain uncertainties at present; as Gilligan says, “the markets are a little bit more challenging, in the sense that there are tariffs and duties,” which are affecting companies’ decision-making.

Sungrow, for its part, singled out the US and the high reciprocal tariffs it has threatened against Chinese imports in its Hong Kong IPO prospectus.

Further concerns for Chinese cleantech manufacturers are the new ‘Foreign Entity of Concern’ (FEOC) rules for solar projects in the US seeking tax credits, which limit the proportion of Chinese-made hardware permitted, including inverters. Sungrow has a significant market presence in the US, with figures from Wood Mackenzie showing that, in 2024, Sungrow was the leading seller of inverters in the US.

While the relocation of resources from mainland China to Hong Kong would not necessarily tackle these issues, this could be the launching point for further Sungrow investment in overseas manufacturing.

The company says it has 119GW of inverter manufacturing capacity currently in operation in mainland China, and overseas capacity of 50GW. Gilligan says investments in overseas work can take the form of building new factories, or simply hiring from local workers in markets where a company wants to make inroads.

“In some cases, there either can be local manufacturing or building out teams,” he explains. “Maybe companies will not build out the manufacturing aspect, but they may want to localise teams for Europe, India, the US and all the major markets. Sales, service support and things such as that [are important] and ‘local for local’ is what you sometimes hear.

“Companies are having to upskill team members, and make them dual [experts] in the sense that they’re not only active in solar, but they also have to be [active] in solar-plus-storage, and to build up your capabilities in the space to ride the wave of the bigger opportunity.”

The increasing technical complexity of many of these clean energy projects, and the demand for increasingly international teams of workers with as wide a range of skills as possible, is driving the demand for greater financing in the renewables space, according to Gilligan.

“The increasing level of sophistication broadly in the clean tech world is requiring greater amounts of funding.”