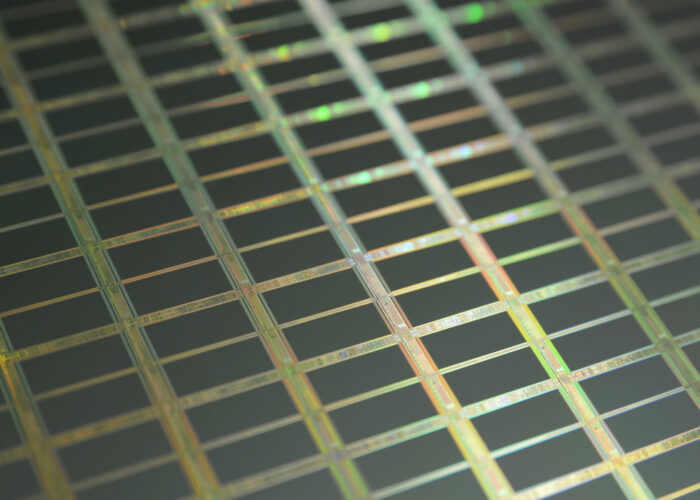

Japan added 1,394MW in clean energy capacity between 1 April 2012 and 31 January 2013, of which solar PV accounted for 1,329MW.

Data compiled by the Agency for Natural Resources and Energy, part of Japan’s Ministry of Trade and Industry, showed a 300MW increase in generation since last April for residential PV. Other PV installations saw a rise of 2MW to 306MW by January.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

The additions follow the introduction of an incentive programme begun in July to increase clean energy after the 2011 Fukushima nuclear disaster.

The ministry approved non-residential solar projects totalling 5,749MW, and residential solar worth 958MW.

Analysts are forecasting great things for the Japanese market this year, especially in the first half according to NPD Solarbuzz. A new Bloomberg New Energy Finance (BNEF) report forecast Japan’s solar industry to hit between 6.1GW and 9.4GW of installed capacity this year.

BNEF recorded Japan achieving a US$8.2 billion surge in investment. Small-scale solar investment in Japan reached US$6.7 billion in Q1 2013, more than double a year earlier.