Australia generated 5,271GWh of utility-scale solar PV and wind power in November 2025, a 28% increase from the same period last year.

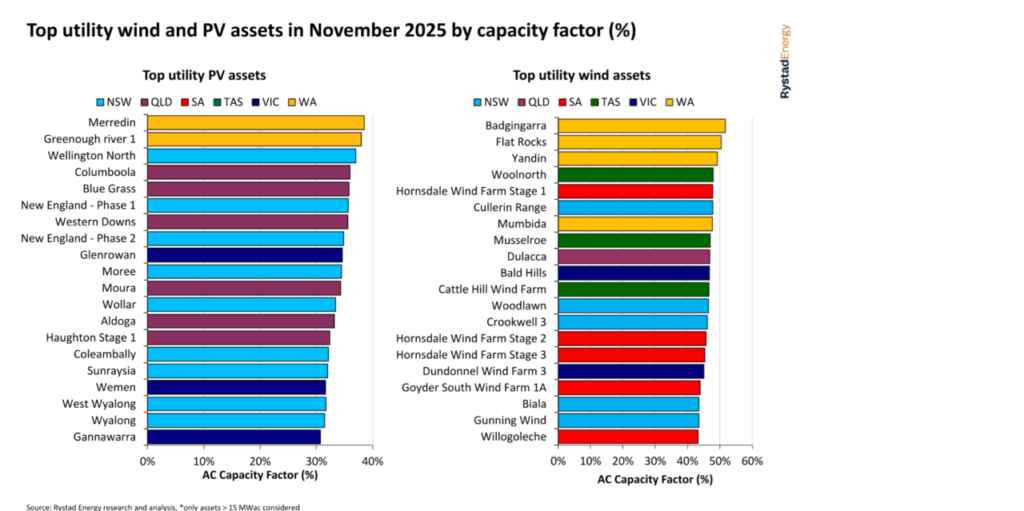

This is according to figures from analyst Rystad Energy, which published data on Australia’s electricity generation this week. The top three solar projects by capacity factor—SUN Energy’s 132MW Merredin project, Synergy and Potentia Energy’s 10MW Greenough River facility and Lightsource bp’s 300MW Wellington North project—are located in Western Australia and New South Wales, demonstrating the geographic diversity among Australia’s top-performing solar projects.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

This compares to the wind sector, where the top three projects by capacity factor are located in Western Australia, as reflected in the graph below.

Rystad noted that New South Wales also led the country in utility-scale PV generation, with 891GWh, compared to 715GWh of wind generation. New South Wales is home to a 300MW solar farm owned by Octopus Australia, the largest PV project to begin construction this year, and the Blind Creek solar-plus-storage project, which began construction earlier this year and is the largest such project to commence this year.

Other noteworthy events highlighted by Rystad include 9.03TWh of renewable energy generation in Australia’s National Energy Market (NEM) during November, the second-highest monthly total on record. This follows a strong performance in October, during which all NEM PV projects, across both the utility-scale and distributed sectors, generated 4,715 GWh of electricity, representing a 9.88% year-on-year increase from the 4,291 GWh recorded in October 2024.

Rystad said 2025 was also shaping up to be a record-breaking year for the NEM overall. The consultancy said it had tracked over 9GW of new solar and wind capacity additions between January and November 2025, and predicted 10GW of new NEM capacity would be energised by the end of the year. Should it meet this forecast, it will be the first time the market has added over 10GW of capacity in a single year.

However, Rystad also noted that November was a record for negative hours in South Australia (346 hours, accounting for 48% of the month), Victoria (320 hours for 44%) and New South Wales (214 hours for 30%).

Power prices pushed into the negatives is a common occurrence for regions that are deploying significant renewable energy capacity, and is often tackled with the integration of more battery energy storage systems (BESS); Australia added close to 3GW of new BESS in the year to the third quarter of 2025, and will need to continue this pace of installation to limit the impacts of negative hours going forward.