SPONSORED: On May 31, 2018, the Chinese government announced subsidy reductions for photovoltaic power generation, widely known as the “531 Policy”. The move led to the sudden contraction of the country’s PV market and has had a great impact on the local PV industry. According to IHS, as a result of the policy change, China’s photovoltaic installation capacity is expected to decline from 52GW to 40GW in 2018. With that, local photovoltaic enterprises have turned to overseas markets to mitigate the impact.

As China tries to regulate its photovoltaic industry through resolute policies, flourishing overseas markets offer a way for Chinese enterprises to get out of the predicament. Yet it’s not at all easy to enter and take market share in those countries. In markets with a high access threshold like Japan, what kind of products and which businesses can win out?

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

High-requirement market with great opportunities

As the Japanese market has requirements for high-quality photovoltaic products, industry recognition from the Japanese market promotes your business in other countries as one of the top PV manufacturers.

Generally speaking, the Japanese market is one with both opportunities and challenges. After the nuclear leakage of the Fukushima Daiichi nuclear plant, the country has stopped nuclear power generation. Since then, it has encouraged the development of renewable energy. One of the encouraging policies implemented by the government on July 2012 stipulates that those solar power utilities certified by the Ministry of Economy, Trade and Industry (METI) can get the electricity generated by them purchased at a fixed price, i.e. 42 Yen/kWh (US$0.37/kWh) for twenty years.

For the Chinese PV companies facing significant pressure from the anti-dumping and anti-subsidy policies of the US and EU, as well as from subsidy reduction in the domestic Chinese market, Japan became an attractive target market with broad prospects.

However, 90% of the PV market in Japan has been occupied by local photovoltaic enterprises including Mitsubishi, Panasonic, Sharp, Toshiba, etc., and it would be a great challenge for Chinese enterprises to capture the market opportunities. Among those who have entered the market, who will gain market share and take the lead?

Products with good quality and high conversion efficiency are desirable in the Japanese market regardless of the business environment and policy change

Quality matters

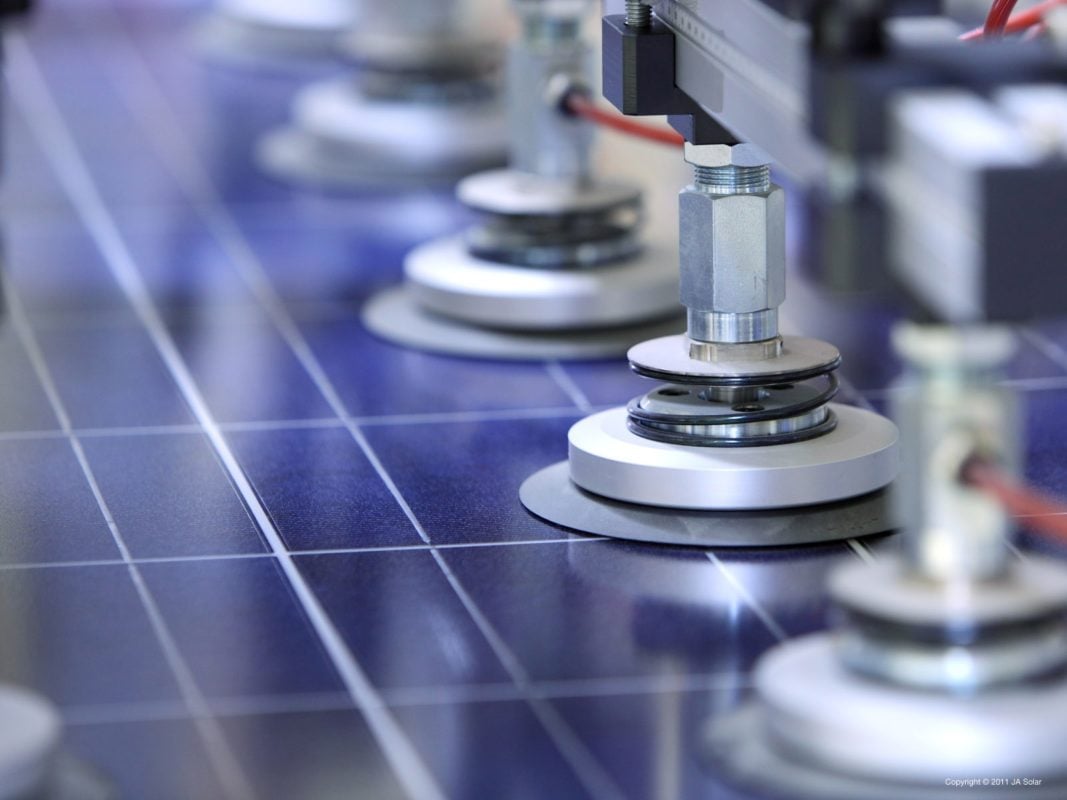

In 2014, JA Solar’s shipment of solar products to Japan reached 1GW, which marked the company out as the top manufacturer in the country’s photovoltaic market for the first time. JA Solar has been in the market-leading position since then. JA Solar’s cumulative shipment to Japan to date is over 3.3GW. Its products are sold in all of 47 administrative districts in Japan, and are widely used in residential, commercial and industrial rooftop PV systems as well as large-scale ground-mounted power plants.

So, what helps JA Solar to stand out in the high-standard market?

JA Solar began its business operations in Japan through cooperating with influential local residential photovoltaic system installers (such as West Energy Solution) on power plant design, construction, sales, and maintenance. Through the solid business relationships with system installers and partners, JA Solar rapidly expanded its share of market by optimizing their market coverage and client base. In addition, its solar products are well recognized in Japan and have won a number of awards, which is critical to the company’s success in Japan.

China’s photovoltaic industry has been at the forefront in product quality, conversion efficiency and technological innovation. China accounts for over 80% of the solar production capacity globally. The PV manufacturers in China are in a solid competitive position in terms of low-cost manufacturing, primarily driven by large-scale production of the manufacturing industry.

As a world-leading manufacturer of high-performance solar power products, JA Solar stands out amongst its peers in China as a result of its superior product quality, excellent service and competitive pricing.

Products with good quality and high conversion efficiency are desirable in the Japanese market regardless of the business environment and policy change. In 2012, JA Solar was granted the PERC patent in China, after which the company marketed mono PERC cell PERCIUM and poly PERC cell RIECIUM to Japan, taking the lead in the high-efficiency product category. JA Solar’s module conversion efficiency is 1% higher than those of its peers. Importantly, the company provides both mono and poly products to meet customer demand. In 2017, JA Solar started the mass production of its bifacial PERC double glass modules and PERC half-cell modules, which was critical in lowering LCOE and increasing system power output. In 2018, JA Solar received its intellectual property on the patented bifacial PERC technology in Japan.

Shi Jun, sales director of JA Solar’s Japanese market, said: “JA Solar is committed to providing high-efficiency products and exceptional services to our clients. In the first half of 2018, JA Solar’s shipment to Japan reached 280MW, an increase of 2.5% compared with the same period last year. Our target for 2018 is to maintain 10% market share in Japan, and we are confident to achieve it with JA Solar’s superior brand, products and services.”