Several listed companies in China’s PV industry disclosed their Q3 2025 reports in recent days. In terms of performance, companies in the polysilicon and wafer segments have shown signs of recovery and emerged as the first to return to profitability. Meanwhile, while cell and module manufacturers have managed to narrow their losses, they still remain unprofitable.

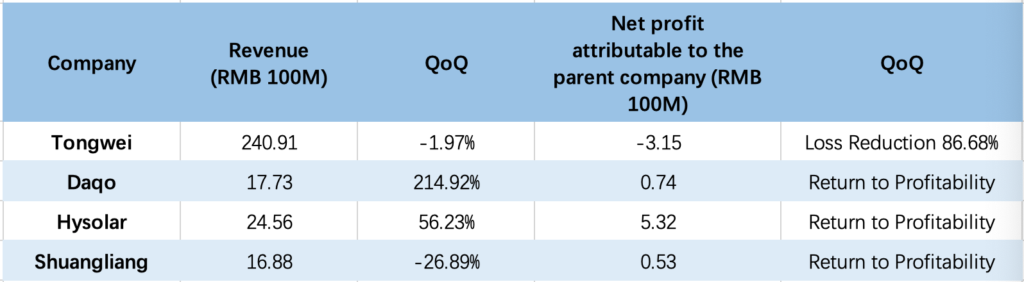

Specifically, Tongwei, GCL-Tech and Daqo, all with polysilicon as their core business, have all achieved improved profitability in Q3. Among them, Daqo reported Q3 operating revenue of RMB1.773 billion (US$**), a year-on-year increase of 24.75%; it also recorded net profit attributable to shareholders of RMB73.479 million, ending the consecutive losses dating back to Q2 2024.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Regarding the performance changes, Daqo explained in its report that from January to September 2025, affected by the supply-demand mismatch, polysilicon prices decreased compared to the same period last year. Reduced production led to lower sales volume, resulting in a decline in operating revenue. The company also noted that the polysilicon market recovered, with both volume and prices rising, leading to an increase in revenue and consequently an increase in net profit attributable to shareholders.

Tongwei, meanwhile, significantly reduced its losses in Q3. The company reported a net loss of RMB315 million in Q3, compared to a net loss of RMB2.363 billion in Q2, representing a quarter-on-quarter reduction in losses of 86%.

GCL-Tech announced that its PV materials business returned to profitability in Q3 2025, recording a profit of approximately RMB960 million, in contrast to a loss of RMB1.81 billion in Q3 2024. Furthermore, the average tax-inclusive selling price of the company’s granular silicon stood at RMB42.12/kg—significant increases compared to RMB35.71/kg in Q1 and RMB32.93/kg in Q2.

The improved Q3 performance of several major polysilicon manufacturers reflects both the market recovery and the initial progress of the PV industry’s collective efforts to curb the “vicious competition”.

According to statistics from the Silicon Branch of the China Nonferrous Metals Industry Association, the domestic polysilicon industry recorded a cumulative inventory reduction of approximately 12,000 tons (including imports and exports) in the first three quarters of 2025. Self-disciplined production cuts on the supply side are still underway.

Supported by tighter supply, polysilicon market prices strengthened. A review of polysilicon price trends (based on data from the Silicon Branch of the China Nonferrous Metals Industry Association) shows that polysilicon prices hit their lowest at the end of June 2025. Specifically, the average prices of n-type recycled polysilicon and granular silicon stood at RMB34,400/ton and RMB33,500/ton respectively. However, as the PV industry’s anti-vicious competition initiatives continued to advance, polysilicon prices rose to RMB45,000/ton to RMB 50,000/ton in mid-to-late July 2025, representing a significant increase of 25% to 35%.

By the end of September, the average prices of n-type recycled material and granular silicon stood at RMB53,200/ton and RMB50,500/ton, respectively, representing increases of 55% and 51% compared to the average prices at the end of June 2025.

Beyond silicon materials, some companies in the wafer segment also began to turn a profit, with Hysolar (603185.SH) and Shuangliang Eco-Energy(600481.SH) both returning to profitability. Among them, Hysolar achieved a single-quarter core business revenue of RMB2.456 billion in Q3 2025, a year-on-year increase of 85.5%. For the first three quarters, it achieved a net profit of RMB235 million, making it the first company in the wafer segment to achieve quarterly profitability. Shuangliang Eco-Energy, meanwhile, reported revenue of RMB1.688 billion in Q3 2025, a year-on-year decrease of 49.86%, but still recorded a net profit attributable to shareholders of RMB53.18 million yuan, reversing the loss it incurred in Q3 2024 (the same period last year).

The four major module giants remain in the red, but losses narrowed

While upstream polysilicon and wafer companies saw improved financial performance in Q3 2025, downstream PV module manufacturers—hampered by rising costs and softening end-market demand—have yet to return to profitability.

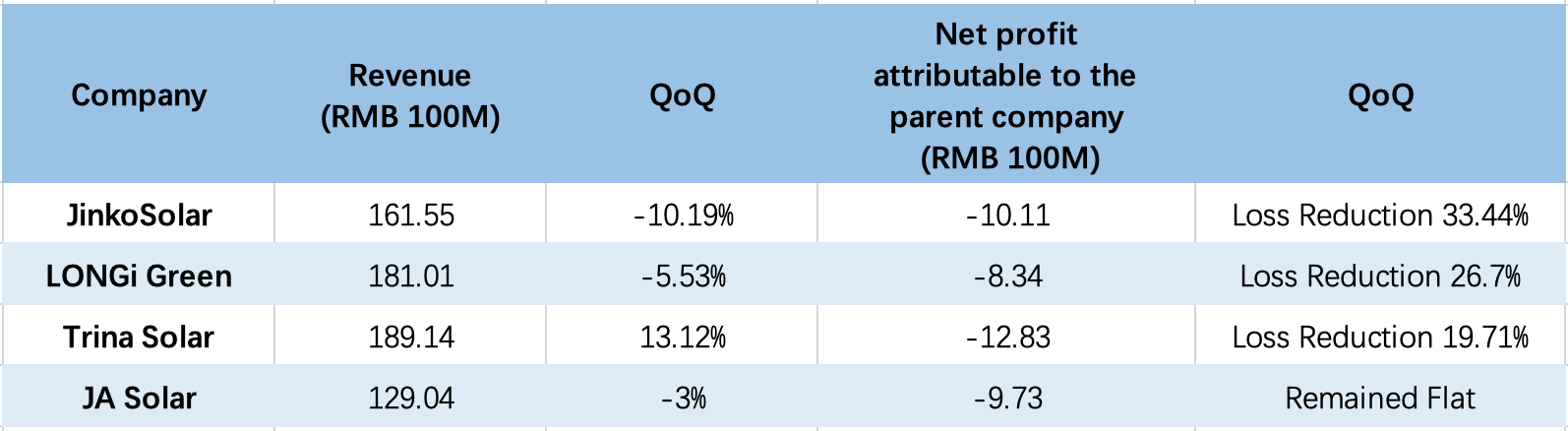

Overall, in Q3 2025, the four first-tier PV companies – Jinko Solar, LONGi Green, Trina Sola and JA Solar – all remained unprofitable. When ranked by single-quarter net loss amount from largest to smallest, the order is: Trina Solar with a net loss of RMB1.283 billion, Jinko Solar with RMB1.011 billion, JA Solar with RMB 973 million and LONGi Green Energy with RMB834 million.

According to their financial reports, the net losses of the aforementioned four PV module manufacturers all exceeded RMB3 billion in the first three quarters of 2025. When ranked by first-three-quarter net loss from largest to smallest, the order is: Trina Solar with a net loss of RMB4.201 billion, Jinko Solar with RMB 3.920 billion, JA Solar with RMB 3.553 billion and LONGi Green with RMB3.403 billion.

These companies attributed their losses to the low-price competition in the PV industry. Their financial reports all noted that, hampered by imbalances in the industrial chain’s supply and demand as well as persistently low market prices for PV products, the profitability of their PV module businesses has declined.

Based on the reports, while the four companies remained in the red in Q3 2025, each recorded a year-on-year and quarter-on-quarter reduction in losses.

Regarding the Q3 2025 results, Trina Solar’s management stated during a post-earnings call that the company is actively addressing current challenges. Trina Solar’s chairman and CEO, Gao Jifan, noted that the revenue decline and losses are primarily driven by cyclical fluctuations in the industry. The company plans to enhance its competitiveness by optimising its product portfolio, controlling costs and accelerating its international expansion. Specific measures include: increasing the production and sales share of n-type modules, with a target of raising this share to over 50% by the end of 2025; scaling back high-cost production capacity and shutting down some older production lines; and strengthening its energy storage and smart energy businesses to diversify its revenue streams.

During the 2025 semi-annual results briefing in September, Zhong Baoshen, chairman of LONGi, said that the company is expected to reach breakeven in Q4 2025 and expressed strong confidence in this target. The company plans to increase the revenue contribution of its back contact (BC) products and scenario-specific products; if the revenue share of these two product categories rises, the company’s operating performance is expected to improve. This forms the core of its current overall strategy.

It is worth noting that the module sector has already shown a market pattern where “the big get bigger”. According to analysis by the industry institution InfoLink Consulting, in H1 2025, the total shipments of the global top ten module suppliers were approximately 247.9GW. The shipments of just the top four first-tier companies (Jinko Solar, LONGi Green, Trina Solar and JA Solar) accounted for nearly 60% of the total shipments.

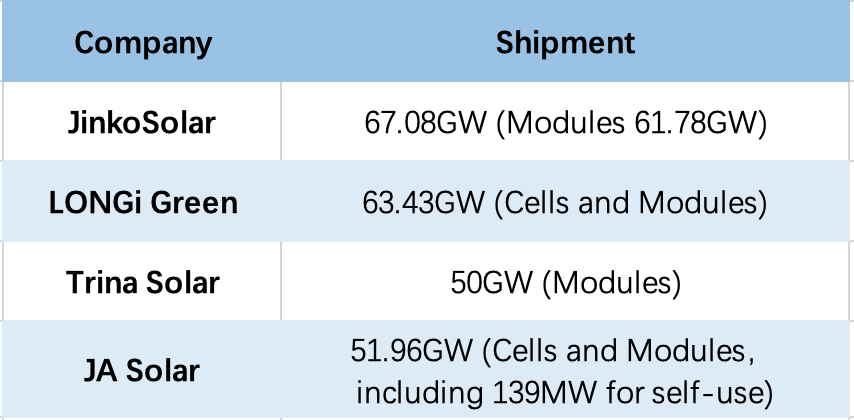

According to the companies’ announcements, the specific PV product shipment figures for the aforementioned firms are as follows:

For January-September 2025, Jinko Solar recorded total PV product shipments of 67.08GW, with module shipments accounting for 61.78GW of this total. The company noted that the average module delivery price rose quarter-on-quarter, driving improvements in its profitability and operating cash flow compared to the prior quarter.

During the same period, LONGi Green recorded external sales of 38.15GW for wafers and 63.43GW for cells and modules. Of these totals, cumulative BC module sales from January to September reached 14.48GW. Additionally, production and sales of its HPBC 2.0 products saw rapid quarter-on-quarter growth, underscoring the company’s distinct competitive edge through product differentiation.

Trina Solar’s module shipments in the first three quarters totalled approximately 50GW. During its earnings call, the company said that its module business narrowed losses in Q3 2025. This was driven by two key factors: first, its sales strategy shifted to focus more on overseas markets, with overseas shipments accounting for roughly 60% of total module shipments; second, product prices increased moderately thanks to joint efforts across the upstream and downstream of the industry chain, which in turn pushed up the overall average selling price (ASP) of its module business quarter-on-quarter. The company’s loss reduction aligns with the broader industry trend.

Notably, Trina Solar has set a clear energy storage shipment target of 8GWh for 2025 and plans to roughly double this volume in 2026. The company currently has signed overseas energy storage orders totalling over 10GWh, with deliveries expected to take place primarily between 2025 and 2026.

JA Solar’s cell and module shipments in the first three quarters totalled 51.96GW, including 139MW for self-use. The company’s Q3 2025 cell and module shipments reached 18.2GW, remaining roughly flat quarter-on-quarter. Overseas shipments accounted for 49.78% of this total, maintaining a relatively high proportion.