At the end of October, Corning announced that it had started producing ingots and wafers at its Michigan, US, plant during the third quarter of 2025 as it began ramping up production to one million wafers per day in Q4 2025.

The construction of the ingot and wafer plant was also achieved in a very short span of time, with the original announcement made in October 2024. Though construction is most likely to have started before that, it still remains a fast construction timeline for such a facility on US soil.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

“Getting our ingot and wafer plant online so quickly was made possible through close collaboration with state and local government, regulators, our utility provider, and a skilled workforce already attuned to the needs of our industry,” said Phil Rausch, Corning Division Vice President, Commercial Director, Solar, to PV Tech Premium.

“Thanks to this accelerated buildout, Corning now operates the largest ingot and wafer facility in the US, enabling a fully domestic solar supply chain for the first time in a decade. With a collocated polysilicon source on our Michigan campus, our logistics are measured in minutes, not months, making us resilient to trade disruptions. The domestic content bonus further amplifies our impact.”

Moreover, this marked a celebrated milestone for the US solar manufacturing industry, as it meant that for the first time in nearly a decade, ingots and wafers were produced on US soil. However, this would not be enough to supply the entire value chain, considering the volume of module capacity now operational in the US, and several gigawatts of solar cells are expected to come online in the coming months.

“According to our estimates, Corning’s annual wafer capacity is approximately 2.5GW. Total cell capacity in the US is estimated to be 3GW, which is expected to increase significantly over the coming years. The gap is even more pronounced when compared to the estimated 35GW of modules being produced domestically. So, while Corning’s announcement is a significant milestone for the solar industry in the US, it is far from sufficient to meet the short-term to medium-term needs of the US market,” said Joe Henessy, analyst at PV Tech Market Research.

Outside of Corning, the only c-Si solar manufacturer with an ingot/wafer manufacturing facility currently under construction is Qcells, with its 3.3GW vertically integrated plant in Cartersville, Georgia. The manufacturing plant is forecast to be operational in early 2026, yet the wafers produced at the facility will be for internal use only.

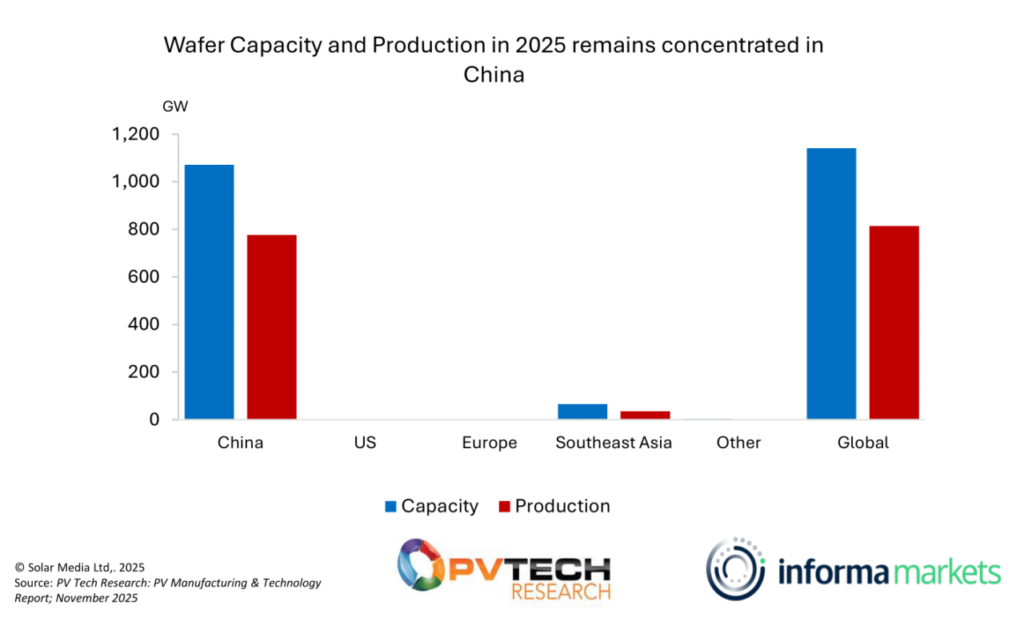

Out of the entire supply chain – from polysilicon to modules – the ingot/wafer stage is the most heavily concentrated in China, with 95% of global production made in China in 2025, as per PV Tech’s Market Research data (see chart below). There are only a few wafer manufacturing facilities that are up and running outside of China, with the majority of those located in Southeast Asia and owned by Chinese companies.

This limited amount of non-China-based (or owned) wafer capacity leaves Corning in an advantageous position to supply US-made and Foreign Entity of Concern (FEOC)-compliant wafers, while competition from outside remains scarce, but we’ve already seen a first move from a company to supply FEOC-compliant wafers from outside of the US. Last month, OCI Holdings acquired from Elite Solar Power a 65% majority stake in a 2.7GW wafer plant in Vietnam.

According to industry experts PV Tech Premium spoke with, it wouldn’t be far-fetched to see Corning further expanding its capacity to meet domestic demand as the entire market is theirs at this point. More so, considering that Corning has already secured purchases of more than 80% of its polysilicon and wafer production for the next five years.

FEOC and Section 232 policy advantages

Currently, Corning is ramping up its production to reach one million wafers per day in Q4 2025. Calculations from PV Tech’s Market Research put this at more than 2GW of annual production capacity. However, the company aims to continue ramping up its production and make improvements in the coming quarters, as mentioned last month in an earnings call.

Edward Schlessinger, executive VP and CFO at Corning, said that the facility would see “incremental improvements as we add capacity and as we sell more”.

Furthermore, any possible capacity expansion from Corning would be supported by the current policy landscape in place in the US. With both US-made polysilicon – from its subsidiary Hemlock Semiconductor – and wafers, there are no Uyghur Forced Labor Prevention Act (UFLPA) nor foreign entity of concern (FEOC) risks for buyers.

On top of that, there is an industry consensus that a decision on Section 232 is imminent, one that could lead to tariffs not only on polysilicon but also on wafers.

“Having a domestic source of wafers will be the least risky way to supply the US market,” said Henessy, adding that the combination of US-made capacity and Section 232 will put the levels of utilisation at the wafer plant higher than seen on other wafer manufacturing facilities.

Moreover, using Corning wafers will also allow other domestic manufacturers of solar cells to get a higher value of domestic content bonus, as mentioned by an industry expert to PV Tech Premium.

Unless there is a major turnaround in US policy, Corning is well-positioned to supply the US market with its wafers as the company plans for its US-based production to drive US$2.5 billion in revenue by 2028.

“We deliver secure, transparent, U.S.-based solutions that strengthen the nation’s solar supply chain and reinforce our leadership at a time when resiliency and compliance matter more than ever,” concluded Rausch.