Major China-based polysilicon producer Daqo New Energy Corp reported record production and revenue in the fourth quarter of 2020, resulting in record annual figures, driven by higher production levels and ASPs as polysilicon supply constraints worsened.

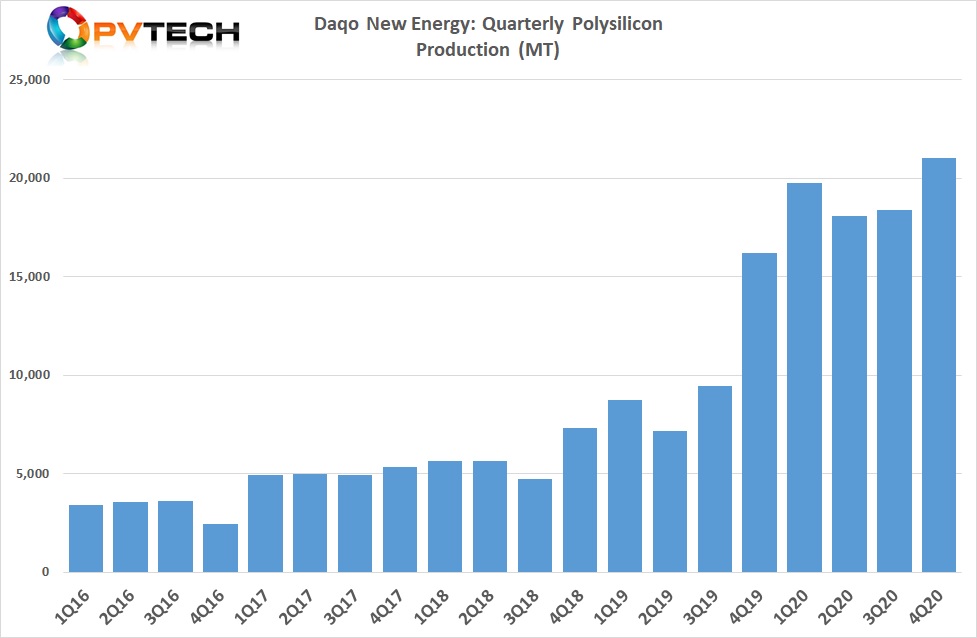

As expected, Daqo maximised its polysilicon production capacity in the fourth quarter of 2020 just beating the high-range guidance figures, due to capacity constraints.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Polysilicon production volume was 21,008MT in Q4 2020, compared to 18,406MT in the previous quarter and the highest in the year.

Longgen Zhang, CEO of Daqo New Energy, commented, “During the quarter we produced 21,008 MT of polysilicon, a record-high in our company’s history. Our production cost was reduced by 2.7% in RMB terms, primarily due to our efforts in additional energy savings, offset by a higher than expected rise in the cost of silicon raw material in the fourth quarter.”

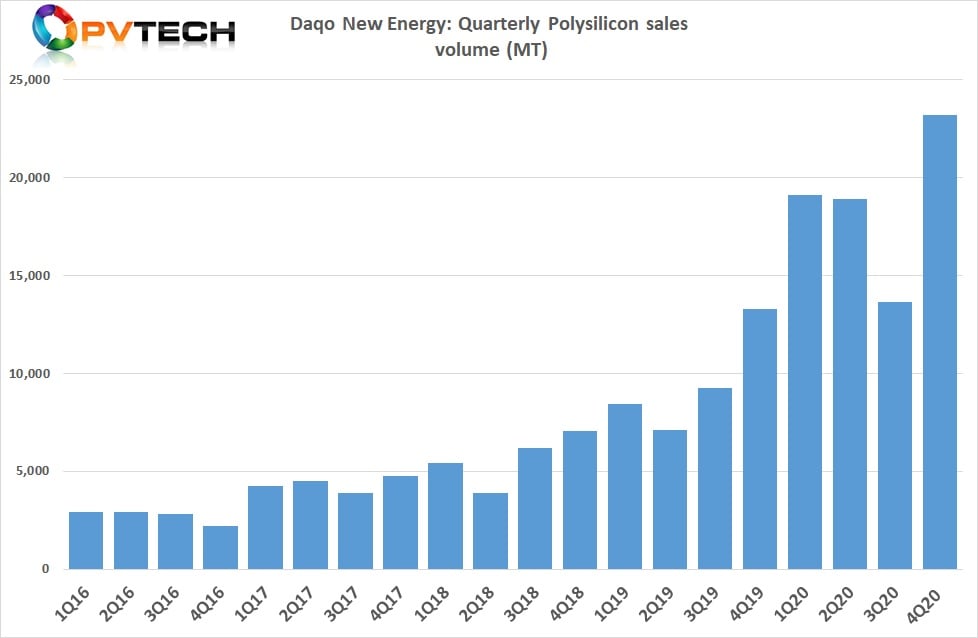

Daqo reported polysilicon sales volume of 23,186MT in the reporting quarter, up from 13,643MT in the previous quarter, a new record for the company.

“During the months of November and December 2020, we saw significant pick-up in polysilicon demand from our customers to meet their increasing production needs to serve the growing solar end-market,” added Zhang.

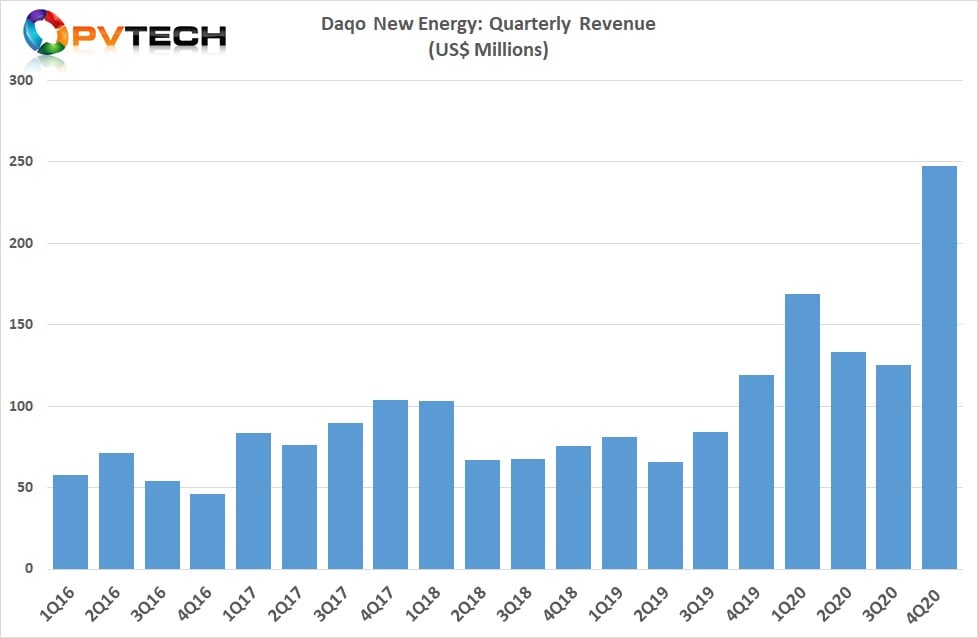

The company reported polysilicon ASPs of US$10.79/kg in the reporting period, compared to US$9.13/kg in Q3, US$7.04/kg in Q2 and US$8.79/kg in Q1 2020, increasing 22.8% in the year.

As a result, revenue in the fourth quarter of 2020 reached a record US$247.7 million, compared to US$125.5 million in the prior quarter, which was impacted by facility maintenance and reduced production.

Gross profit was US$109.5 million in Q4 2020, compared to US$45.3 million in the previous quarter. Gross margin was 44.2% in the reporting period, compared to 36% in the third quarter of 2020.

With strong market demand driving ASPs up and maximising production, Daqo reported record annual polysilicon production volume of 77,288MT in 2020, compared to 41,556MT in 2019.

Polysilicon sales volume reached a record 74,812MT in 2020, compared to 38,110MT in 2019.

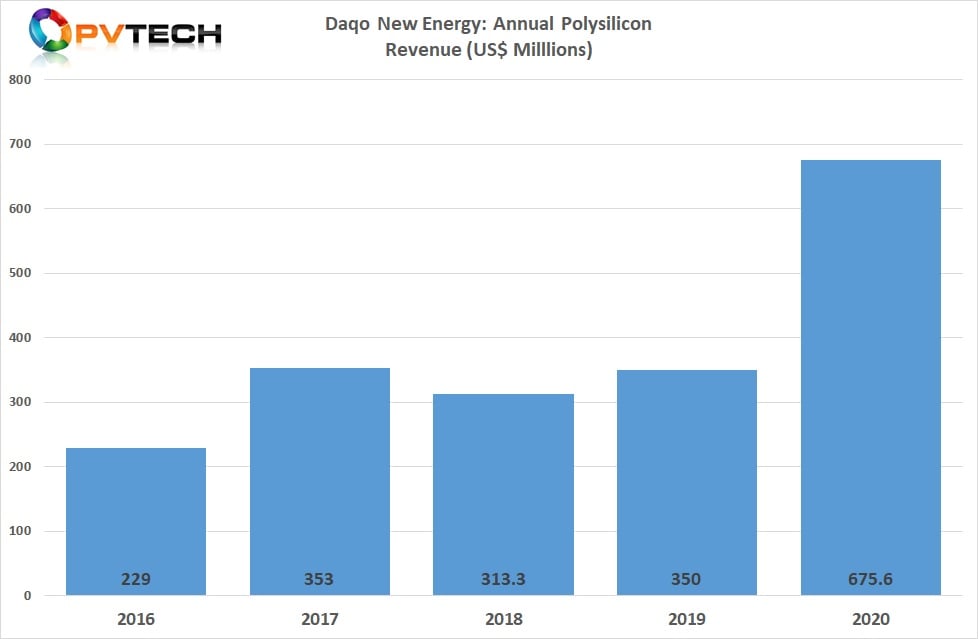

Full-year revenue was US$675.6 million in 2020, another new record, compared to the previous US$353 million revenue record set in 2017. Polysilicon ASPs are basically back to mid-2017 levels.

Guidance

Daqo said that it expected to produce approximately 19,500MT to 20,500MT of polysilicon and sell approximately 20,000MT to 21,000MT of polysilicon to external customers during the first quarter of 2021.

In the full-year 2021, Daqo said it expects to produce approximately 80,000 to 81,000MT of polysilicon, compared to 77,288MT in 2020. The slight increase will be due to debottlenecking activities.

“Since the beginning of 2021, we continue to see rising polysilicon market prices, and most recently market poly ASP has reached a range of $15/kg to $16/kg. As our mono-wafer customers continue their capacity expansion plans supported by robust downstream market demand, we believe that the supply of polysilicon will continue to be very tight throughout the year given very limited additional polysilicon supply this year,” noted Zhang.

The company also noted that its Phase 4B polysilicon project with an annual capacity of 35,000MT was expected to start construction in mid-March 2020 and was expected to be completed by the end of 2021 and ramp-up to full capacity by the end of Q1 2022. This is dependent on its production subsidiary having a successful IPO, due soon.

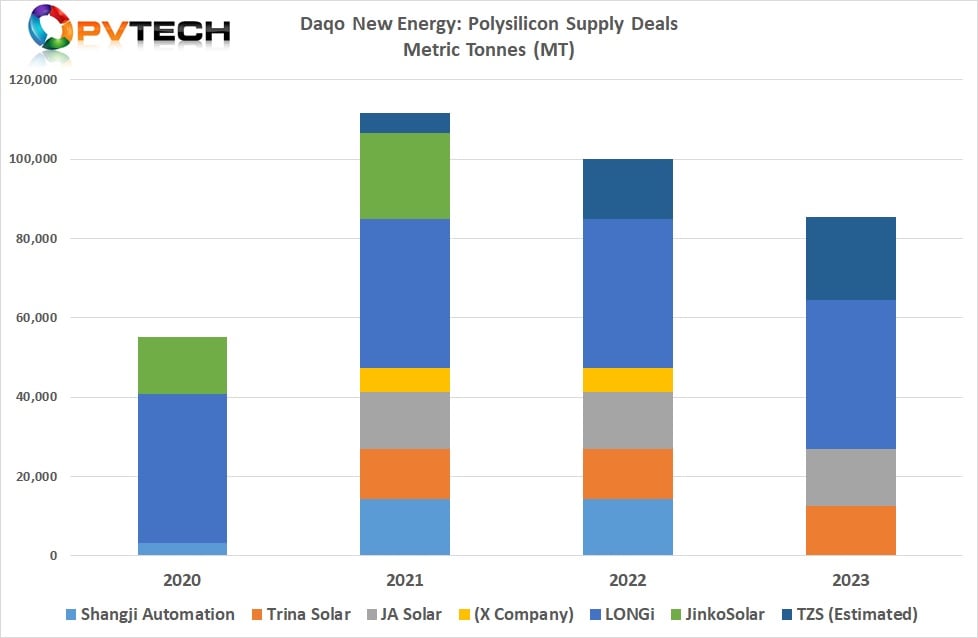

Daqo has signed a number of key supply contracts that limited extra supply through 2021.

Metric Tonnes (MT)