US think tank Edison Energy has published its latest report into the global renewables market, which demonstrates that the average price of power purchase agreements (PPAs) across Europe and the US has fallen from the first to the second quarter of this year.

While the report’s authors noted that concerns remain over the regions’ solar supply chains, and the cost of products necessary for renewable power generation, they are generally positive about the implications of falling power prices, and how PPAs could become more attractive to potential power producers and buyers in the long-term.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

“Project developers are beginning to receive more clarity on how to qualify for tax credits, enabling them to revise their assumptions on the cost to meet these requirements,” wrote the report’s authors, discussing the US PPA market. “This has given renewable buyers more confidence in PPA prices going forward.”

Falling prices and faltering confidence in the US

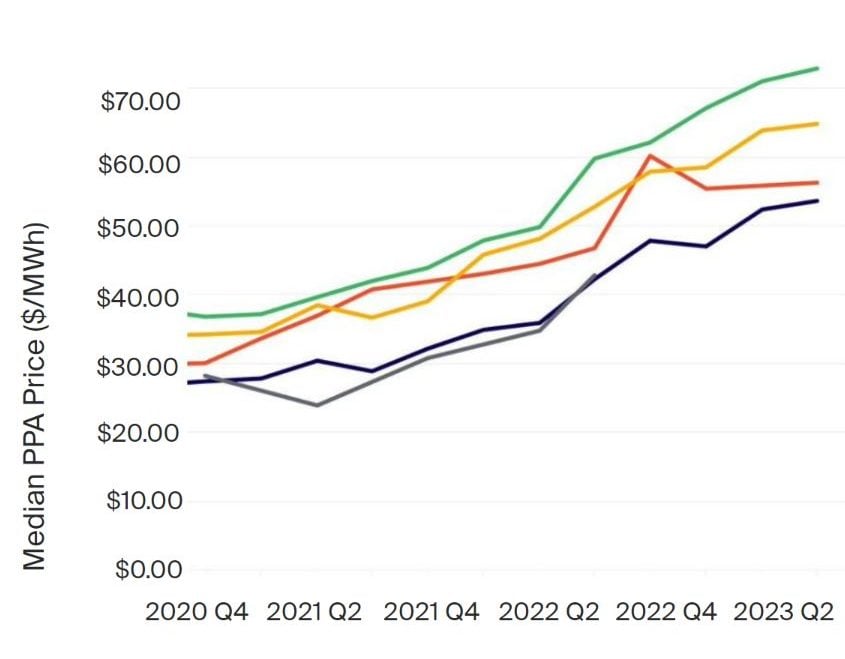

The report shows that US median PPA prices fell by 3% in the second quarter of 2023, the equivalent to a drop of US$2 to US$59. Edison attributes this to a 30% increase in the size of the project portfolio owned by the Electric Reliability Council of Texas (ERCOT), which operates 90% of the Texan electricity grid, and has a significant impact on US power infrastructure as a whole.

ERCOT also saw the lowest median PPA price in the second quarter of this year, across the US utilities covered in the report, with an average price of US$53.75/MWh. PJM, the utility representing several eastern states including Indiana and Kentucky, reported the highest average PPA price of US$72.46/MWh, and the low prices of solar power in Texas could have encouraged power producers and ERCOT to be more proactive in the market, adding to the utility’s portfolio.

Despite the fact that both solar and wind PPA prices increased over the last three years, for all five major US utilities profiled by the report, the report drew positives from the slowdown in the rate at which these prices increased. The Edison researchers note that the latest round of prices “demonstrates some moderation in the market, particularly following the drastic increases between Q4 2022 and Q1 2023.”

“Some Reducing Emissions from Deforestation and Forest Degradation projects, which were criticised by The Guardian earlier this year, are trading at record-low levels,” wrote the Edison researchers in the report, acknowledging faltering faith in some renewable power projects in the US. “Despite these setbacks, developers remain optimistic due to expected growth in demand as 2025 and 2030 climate commitments inch closer.”

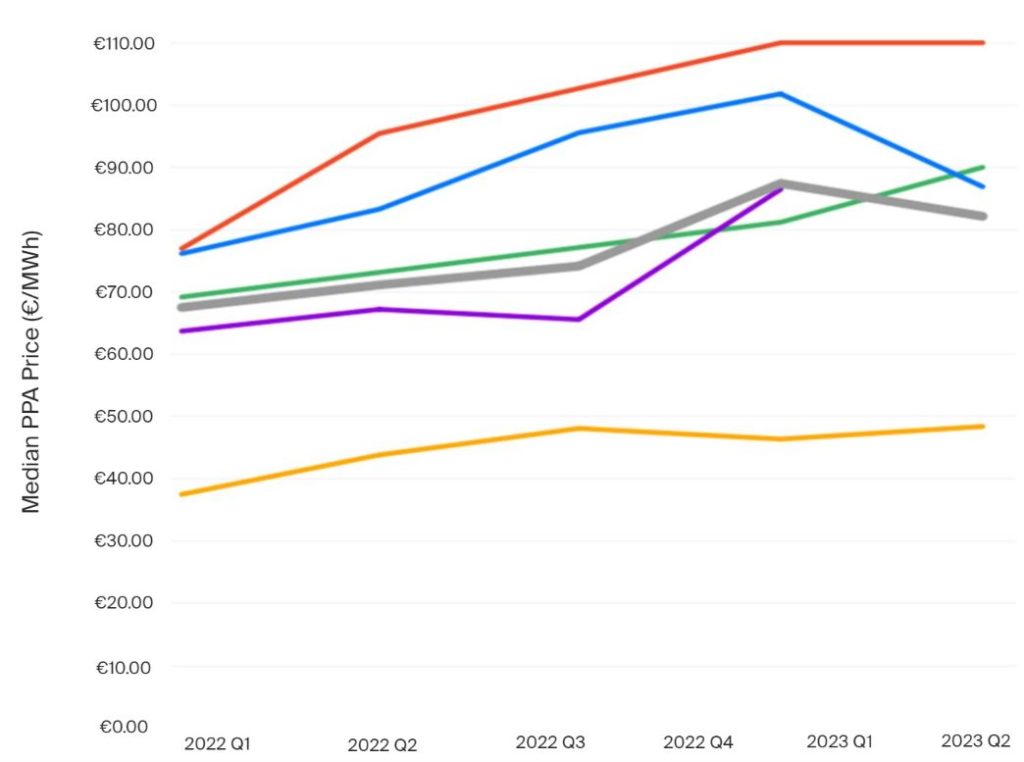

High variance and high demand in Europe

The Edison report shows that European PPA prices fluctuated much more than those in the US, although the trend generally saw prices fall from the last quarter. The EU PPA price index fell from around €88/MWh (US$97.15/MWh) in the first quarter of the year to around €82/MWh in the second quarter, indicative of the fact that the average PPA price in Europe is falling, but not yet in line with those in the US.

Poland saw the highest average PPA price, of €110/MWh, a figure which remained consistent from the first quarter of 2023, and was the only country to record the same price in both quarters of the year.

Spain’s price of around €49/MWh was the lowest among the countries profiled, and perhaps the most striking change occurred in the Netherlands, which saw the average price of its PPAs jump from €81/MWh to €90/MWh, above the EU PPA price index for the first time since the third quarter of 2022. While the implications of this fluctuation is unclear, the Edison researchers expect this trend to continue, with more PPA activity forecast in the coming years.

“Corporate interest has continued to grow after a year of political and price uncertainty, and current pricing and risk are more palatable to buyers now than they were in the second half of 2022,” wrote the researchers in the report. “As PPAs continue to make up an increasing share of the decarbonisation effort, buyers are also getting closer to major corporate sustainability milestones in 2025 and 2030, which will further drive PPA activity.”

The report’s authors also note a shortfall in solar project applications across Europe, with many governments not granting tenders for all the solar capacity that they are offering. In 2022, Germany granted tenders for 2.9GW of solar power, compared to 4.8GW offered, while Italy offered 1.7GW out of the 3.4GW of renewable capacity that the government made available.

“However we are expecting this trend to reverse in the medium to long term,” wrote the report’s authors. “In response to a pressing need to ramp up government auctions and meet renewable energy targets, the EU and other forums are actively planning for Contract for Difference reform to make auctions more attractive.”