As module suppliers adapt to the slowdown of Chinese module demand in 2018 and 2019, global EPCs and developers are likely to see new Asian-produced panels being offered for both rooftop and ground-mount installations.

This issue was discussed in a recent PV-Tech blog last week, and forms a key theme of the topics and agenda during the forthcoming PV ModuleTech 2018 event, on 23-24 October 2018, in Penang, Malaysia.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

This article reveals who the GW-plus module suppliers are to the global end-market, once we remove module supply to the domestic Chinese market, and identifies some of the chasing pack that are hoping to increase global brand awareness going into 2019.

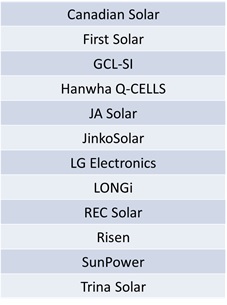

Twelve module suppliers account for two-thirds of non-China global demand

While there remain hundreds of companies producing modules today, from regional single-production-line start-ups, to the multi-GW capacities of the Silicon Module Super League players, once we remove China market supply channels and all the low-volume suppliers (typically into a small subset of non-China markets), we are left with 12 major global suppliers. This list (shown alphabetically) is displayed below.

In fact, collectively these companies are likely to account for about two-thirds of global PV module installation capacity (excluding China) during 2018, with much of the supply being to utility-scale projects where company and technology are two critical issues that undergo various forms of risk-mitigation, auditing and bankability.

The list of 12 companies can be grouped and discussed here, to illustrate the different profiles and strategies for non-Chinese global module supply.

While having different technology offerings, First Solar and SunPower have relatively similar downstream-driven operations, with SunPower’s rooftop activities being the main differentiator.

Canadian Solar, JA Solar, JinkoSolar and Trina Solar can also be put together, with Canadian Solar having a more arms-length projects business that is not tied to using the company’s branded modules.

Risen shares similarities to the above China-HQ companies, but without its own non-Chinese manufacturing operations. Risen has downstream tactics similar to Canadian Solar.

LONGi and GCL-SI form the next group-of-two, being legacy upstream China-based poly/wafer suppliers, but now having multi-GW cell/module capacity with ambitious non-China module supply aspirations.

LG Electronics and Hanwha Q-CELLS form the Korean-run subset here, with both companies having been focused strongly in the past few years on being leading suppliers to rooftop and ground-mount segments in the US. Not surprisingly, both companies have also revealed module assembly capacity expansion plans in the US, hoping to benefit from the 2.5GW of tariff-free cell imports.

This leaves REC Solar somewhat in a grouping of its own, having a different place in the PV industry, compared to the above companies. While REC Solar has dabbled on and off with projects business operations over the past decade, it retains a somewhat European-run company, despite Asian ownership.

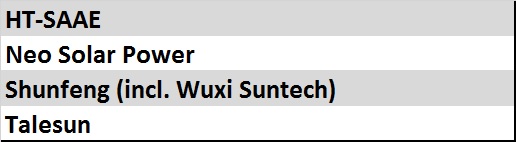

The chasing pack

There are over 100 module suppliers that would love to be included in the above list. Indeed, many of these companies were seen stepping up trade exhibition visibility in Europe and the US during the past couple of months, hoping to connect more with developers and EPCs outside China.

The strongest challengers to the above top-12 are listed now:

Talesun has the potential to be included within the Jinko/JA/Trina grouping above, due to multi-GW status (very close to SMSL inclusion) and non-China cell/module plant operations.

Neo Solar Power remains the surprise package for 2019 possibly, with the collective resources of UREC being potentially available, and at a time when NSP has been repositioning itself with project financing and site acquisition globally.

Note that we have purposely excluded companies (mostly in Southeast Asia) that have been used purely as OEM contract module suppliers.

PV ModuleTech 2018 to explain more about the top-12 market leaders

While strong growth outside China set to be the driver for end-market growth going forward, knowing more about the financial and technical strengths of the above-mentioned module suppliers will be critical to project developers and EPCs, when designing and building out new solar sites.

Even from a list of 12 or 17 however, there is plenty to learn and understand. While the above text offers a basic segmentation, there are many differences between how the companies operate outside China (or Korea), and in the product portfolios offered from each company.

The goal of PV ModuleTech this year is to provide a platform to help in this respect, and many of the module suppliers discussed here (such as First Solar and SunPower) will be explaining how their module offerings are both bankable and performance-leading, backed up with field performance data linked to manufacturing excellence.

To participate in the PV ModuleTech 2018 event in Penang on 23-24 October 2018, please click here for further information.