Even if president-elect Trump follows through with his threats to dismantle the Clean Power Plan, renewable energy will still be on the rise regardless, according to a new report by the US Energy Information Administration.

The report, entitled Annual Energy Outlook 2017, contains long-term projects up to 2050 that indicate that clean energy and natural gas will continue to grow, even in the scenario where the CPP is omitted. The administration warns that the outlook is not a prediction, however, but a series of potential options the nation could follow dependent on certain circumstances.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

“Even if the CPP is not implemented, low natural gas prices and the tax credits result in natural gas and renewables as the primary sources of new generation capacity,” the EIA report reads.

The emissions regulation, penned by the EPA under the Obama administration, is currently stayed while subject to judicial review by the Supreme Court as part of a legal battle that asserts the EPA is guilty of overreach.

Even without the contentious proceedings, the CPP is endangered by threats by Trump to dismantle it, and other federal spending on any regulations pertaining to climate change.

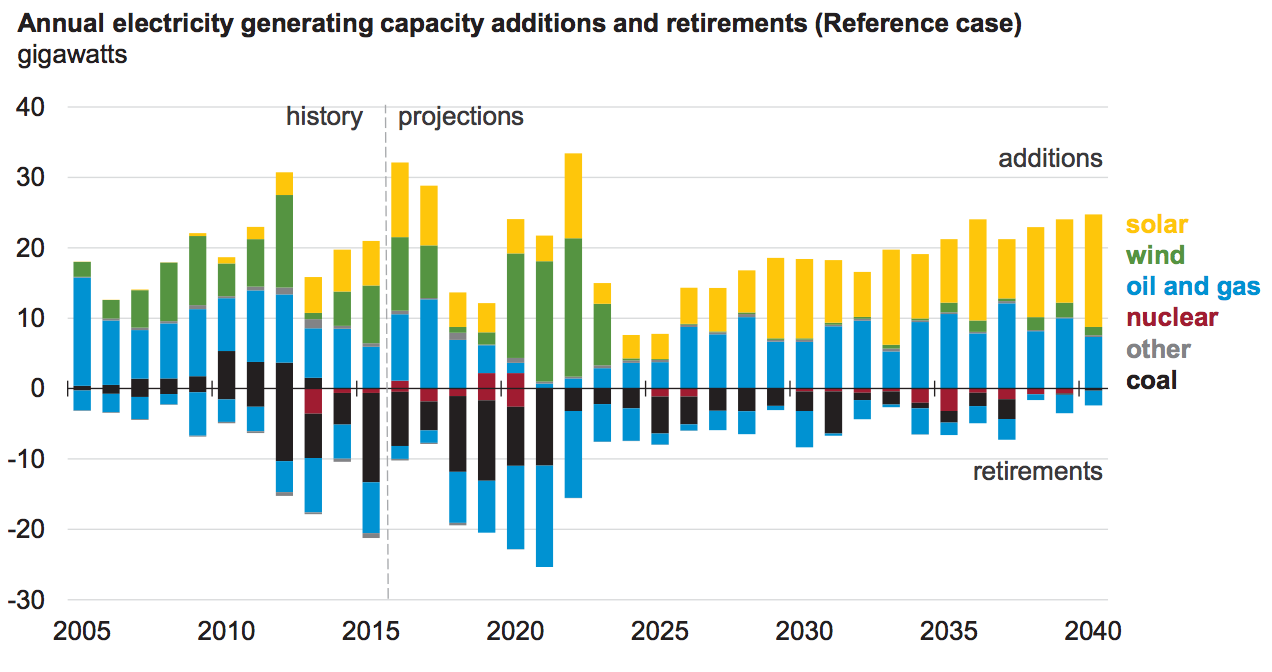

The EIA contends however that the primary driver of new alternative electricity capacity will be an ongoing series of coal-fired plant retirements. Report forecasts detail that without the CPP, coal generation will still remain steady through the 2020, and whilst at a slower rate than with the emission regulations in place, renewables and natural gas will continue to expand.

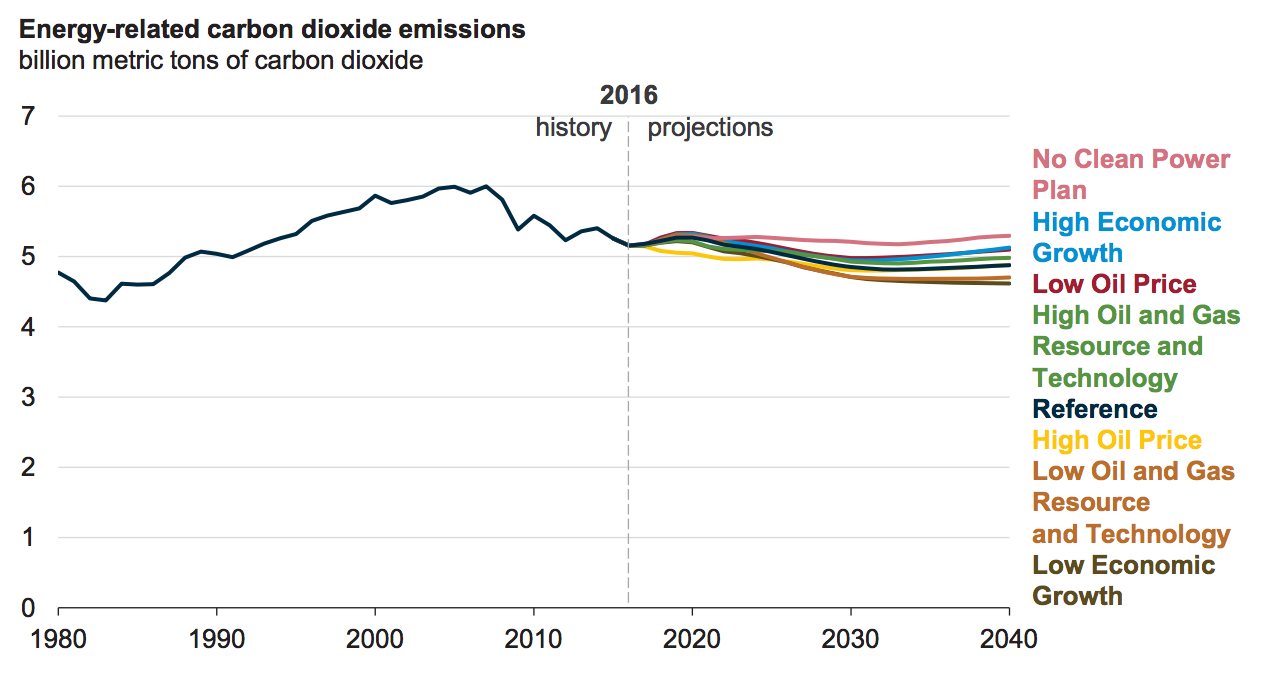

Furthermore, if Trump scraps the CPP has he has been so called on to do by a 24-state coalition spearheaded by West Virginia AG Patrick Morrisey, energy-related carbon emissions would increase.

However, in the case without the CPP, the declining cost of natural gas is still encouraging utilities to shift away from coal. Utilities retired 1.48GW of coal-generating capacity in 2015, according to the EIA, representing about 5% of US coal-generating capacity.

Another 6.5GW of coal-fired generation were retired in the first half of 2016.

The EIA expects almost 70GW of new wind and solar capacity to be added by 2021, with utility-scale solar being the main driver for renewable capacity additions; spurred on by declining costs and the ITC. After 2030, natural gas is forecast to catch up, with new capacity to be split between the two energy sources.

Whilst EIA predictions for both renewables and emissions fared better under the scenario with the CPP, many feel that the decline of fossil fuels is more economic driven than regulatory. In fact, outgoing EPA administrator Gina McCarthy said critics give the CPP “too much credit” during a speech in November.

“The CPP was designed to follow the clean energy transition that was already underway, the one that the energy market depends on and the one that the energy market will continue to demand,” she said. McCarthy also noted that 24 states already had lower emissions in 2015 than required by 2022 under the plan.

Despite confirmation from the EIA that the renewable energy outlook remains positive in the absence of the Plan, contention over its fate continues with 15 states planning to litigate if Trump does scrap the regulation.