Slowing solar PV and energy storage installations in Europe risks “competitiveness and security at a pivotal moment”, according to the head of SolarPower Europe.

Speaking at an online event to launch the industry group’s latest Solar Market Outlook report, Walburga Hemetsberger, CEO of SolarPower Europe, said that allowing the continent’s solar and energy storage installations to slow down was “self-destructive”.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

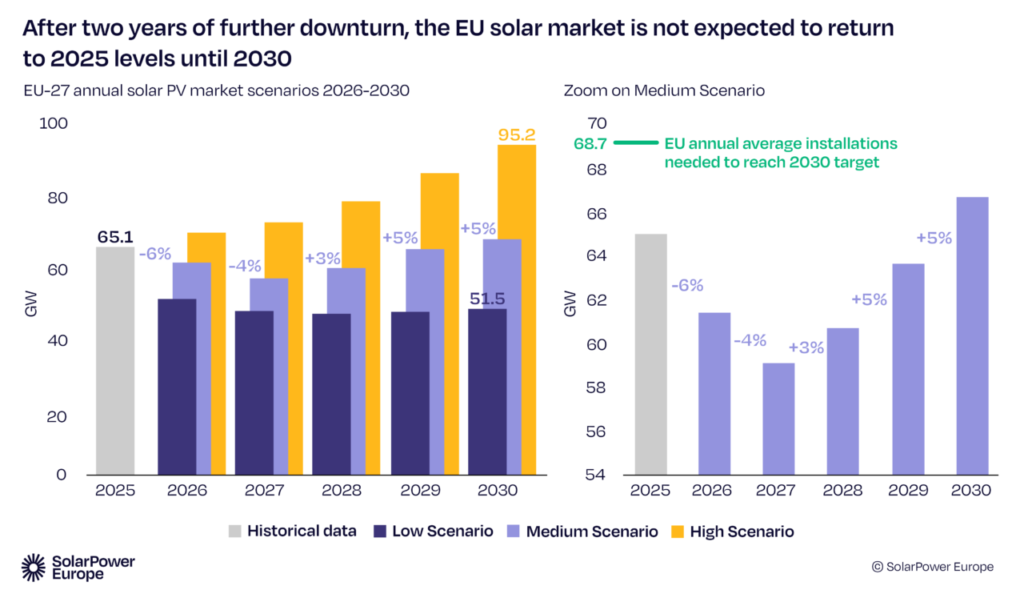

The new report shows that 2025 will be the first time in a decade that Europe adds less new solar energy capacity than the previous year. SolarPower Europe forecasts 65.1GW of new solar capacity this year, compared with 65.6GW in 2024.

This decline follows a decade that has seen annual EU solar additions increase by over five times, and solar has more than doubled its share of the EU’s electricity mix over the last five years. Wind and solar generation are now cumulatively ahead of fossil fuels in the EU’s energy mix, and despite the downturn, SolarPower Europe said that the solar sector will reach the EU’s 2025 capacity target of 320GWac (400GWdc).

But the 2030 deployment targets are unlikely to be met, according to Micheal Schmela, executive advisor and director of market intelligence at SolarPower Europe.

“As the famous Bob Dylan song goes, the times, they are a-changing,” Schmela said. “And not changing for the better.”

Solar installations are expected to continue to decline for another two years before single-digit increases return in 2027. 2025 deployment levels will not be reached again until 2030, according to SolarPower Europe’s medium forecast scenario.

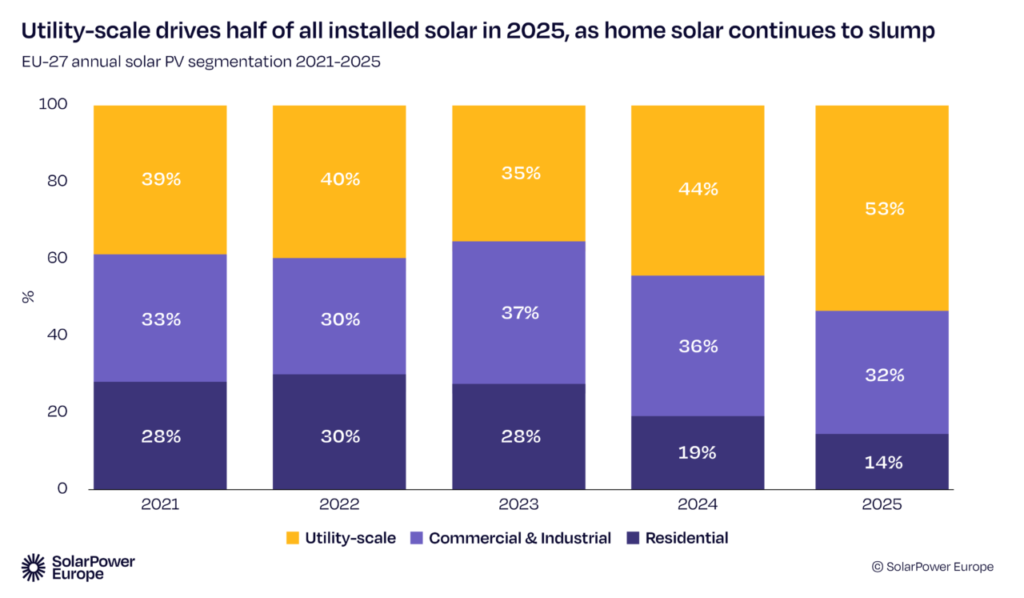

The decline until 2027 is sharpest in the utility-scale sector, despite utility-scale projects having supported a growing share of Europe’s solar market since 2023, as residential and rooftop installations have fallen.

Five EU member state markets installed less solar capacity in 2025 than 2024, and the sector’s heavyweights, Germany and Spain, saw only slim new capacity growth. Italy, Poland, Greece, Portugal and the Netherlands all saw slower growth this year than last.

Residential slump, grid constraints and energy storage

Schmela explained that the downturn in the EU’s market is driven by declining installations in the rooftop and residential sector. This has been well documented over recent months, as incentives for rooftop solar have been withdrawn across a number of EU states and the high energy prices that drove many people to install solar have subsided.

A total of 19 European markets saw residential installations contract in 2025, the report said, pushing the sector’s share of Europe’s solar industry down to 14%, half the level in 2023 at the height of the energy crisis.

On the upside, Schmela said that so-called “plug-in”, or balcony, solar systems have seen a significant increase. “One in every two” solar installations in Germany this year have been balcony systems, he said, which indicates sustained interest in solar even as the economics for residential systems change.

Grid congestion and infrastructure is also slowing installations, SolarPower Europe said. “Congestion, negative-price periods and curtailment continue to affect project bankability, while storage deployment, smart-meter rollout and aggregator access remain insufficient to support higher solar integration,” the report reads.

Moreover, the forecast contraction in the utility-scale sector is due to changing technology and bankability concerns. “Standalone solar especially faces increasing challenges on profitability,” the report said, as projects look to co-locate with battery energy storage systems.

In addition, the current policy landscape is not explicitly supportive enough of energy storage to support greater solar penetration on the current grid infrastructure, said Dries Acke, deputy CEO of SolarPower Europe.

Geopolitics and energy security

SolarPower Europe outlined five policy recommendations to prevent the “self-destructive” decay of the continent’s solar capacity additions.

First was to “Redefine” energy security to frame renewables as the centre of the policy. “Our reliance on imported fossil fuels is a vulnerability,” Acke said. The report argues that Europe must “treat the energy transition as a security imperative and evolve into an ‘electro-continent’, which relies on domestically produced clean energy,” and follows a new proposal from the European Commission to strengthen the continent’s grid infrastructure this week.

Acke said this was necessary because the geopolitical situation has changed in recent times, and Europe has seen the “weaponisation” of trade. Centring Europe’s energy security policies on renewable energy would create a policy imperative for expanding installations, the report argues.

It also called for an energy flexibility strategy that explicitly embraces energy storage. Acke said that while grid upgrades are essential, Europe “risks increasing network charges” if grid upgrades are not paired with energy storage capacity to allow greater flexibility and renewables integration.

Acke also outlined calls for boosting the residential solar market. “[Residential solar] is the cornerstone of public acceptance of the energy transition,” he said, as it allows the public to “hedge against” potential energy crises and price rises. The removal of net metering incentives for rooftop solar in countries like Italy, Germany and the Netherlands has not been replaced by schemes that effectively encourage self-consumption and energy storage, the report said, which has “left citizens in limbo and uncertainty”.

Solar manufacturing supply

SplarPower Europe reiterated calls for a “sustainable, resilient and European” solar supply chain. “Diversification is essential,” Acke said, and pointed to efforts in India and Turkey to lessen the concentration of solar supply in China.

He called for a dedicated solar manufacturing “fund, booster, bank, call it what you like,” pointing to similar policies dedicated to green hydrogen and energy storage technologies. He also reiterated industry calls for a “made in Europe” provision in the Net Zero Industry Act (NZIA), to be first introduced in public procurement auctions.

Europe has a strong solar inverter manufacturing base, around 96GW, but is lacking in the silicon solar module supply chain. Certain companies are trying to build out capacity, notably French producer Holosolis which plans to produce tunnel oxide passivated contact (TOPCon) modules at a factory in France, using technology licenses from Chinese solar manufacturing giant Trinasolar.