Battery manufacturer Freyr Battery has agreed to acquire a 5GW module manufacturing facility in the US state of Texas from leading Chinese module manufacturer Trina Solar.

On the same day as Donald Trump won the US presidential race, promising sweeping measures to protect domestic manufacturing, Norway-headquartered startup Freyr, which is listed on the New York Stock Exchange (NYSE), said it wanted to create a vertically integrated solar manufacturing footprint in the US.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Alongside the module factory acquired from Trina, the company is also planning to build a 5GW cell production plant and has already begun selecting a site for the facility.

In its deal with Trina, Freyr will pay a total consideration of US$340 million, including US$100 million in cash and 9.9% of its outstanding common stock. If “certain conditions” are met, the company will also transfer 11.5% of its outstanding common stock to Trina, although Freyr did not specify what these conditions would be; if these conditions are not met, Freyr will instead pay a US$80 million convertible loan note.

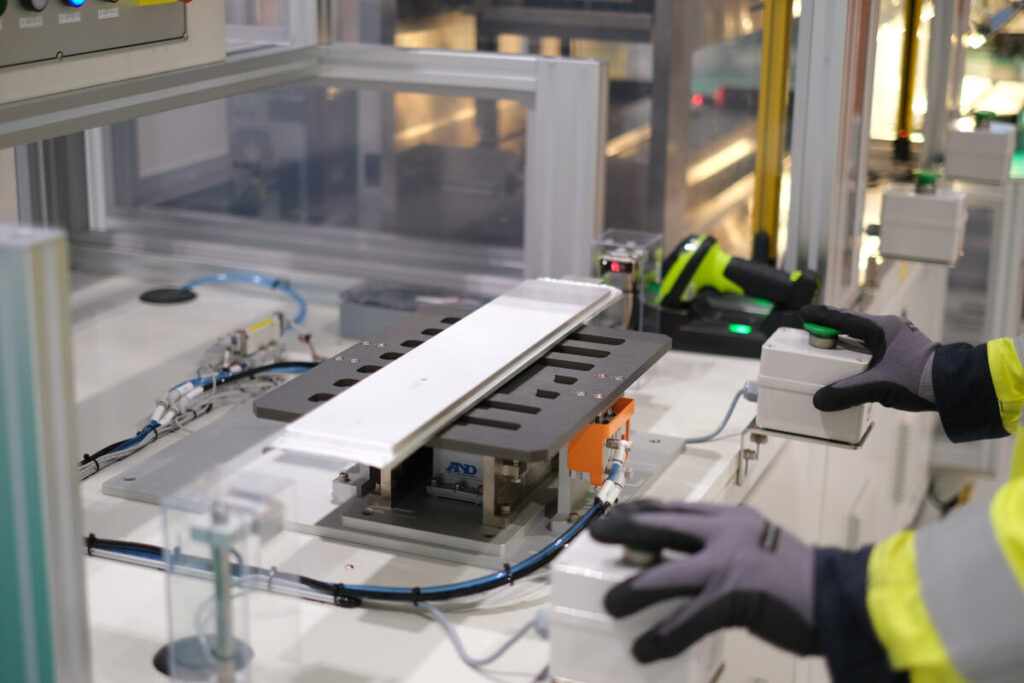

In return, Freyr will acquire Trina’s module plant in Wilmer, Texas, which was announced last September and started commercial operations just six days ago. The company plans to scale up production to its full capacity of 5GW next year, and noted that it has “firm offtake contracts” in place with US customers for the modules. Trina noted that the companies will form a “multi-stage strategic cooperation plan” for the long-term, and that modules produced at the facility will still use the Trina Solar brand.

Part of this plan includes changes to the Freyr board. Co-founder Tom Einar Jensen will step down from the Freyr board to become the CEO of Freyr Europe, while current Freyr chairman of the board Daniel Barcelo will become the company’s CEO. Trina has also appointed head of overseas finance Mingxing Lin to the board of Freyr as its chief strategy officer, while renewable energy executive Dave Gustafson will take over as Freyr’s chief operating officer.

Moving to the US

“We are pleased to announce this transformative transaction, which will immediately position the company as one of the leading solar manufacturing companies in the US,” said Barcelo. “Domestic manufacturing capacity for solar and batteries is essential for energy transition and job creation. The US was once the global leader in solar, and it can be again.”

The move will further bolster Freyr’s presence in the US, where the company is already building a battery manufacturing plant in the state of Georgia as well as moving ahead with the PV cell production plans. The company said site selection was underway for the 5GW solar cell plant and construction would begin in the second quarter of 2025. Commercial production of cells is slated for the second half of 2026.

Freyr started its work in Norway, producing chargeable unit cells at a customer qualification plant (CQP) in Norway earlier this year, which use the company’s proprietary semi-solid state lithium iron phosphate (LFP) technology, licensed from 24M. However, Freyr has since made cuts at its European facility, including slashing jobs in November 2023, and again in August 2024, and withdrew funding from its flagship Giga Arctic project in Mo I Rana, Norway.

Last year, then-CEO Birger Steen, who resigned from his position in June after ten months on the job, told our colleagues at Energy-Storage.news that “all our scaling will happen in the US”, with tax benefits offered to companies building renewable power manufacturing capacity under the Inflation Reduction Act (IRA) cutting production costs by as much as 35%.

While the company received NOK200 million (US$18.4 million) from the Norwegian government, Steen noted that Freyr had asked the state to match the level of support offered under the IRA, which amounted to around NOK9.5 billion, making clear the different levels of support for new renewable energy manufacturing in the US and Europe.

The company noted that its acquisition of the Trina facility would involve the creation of a US-owned and operated company, which could benefit from the financial incentives offered under the IRA. Outgoing president Biden’s landmark policy has sparked a fourfold increase in US PV manufacturing, but this week’s re-election of Donald Trump has cast doubts over the future of federal support for clean energy initiatives. Trump has instead promised steep import tariffs as an alternative means of stimulating US manufacturing.

This article has been updated with further background on Freyr’s European operations and shift of focus to the US.