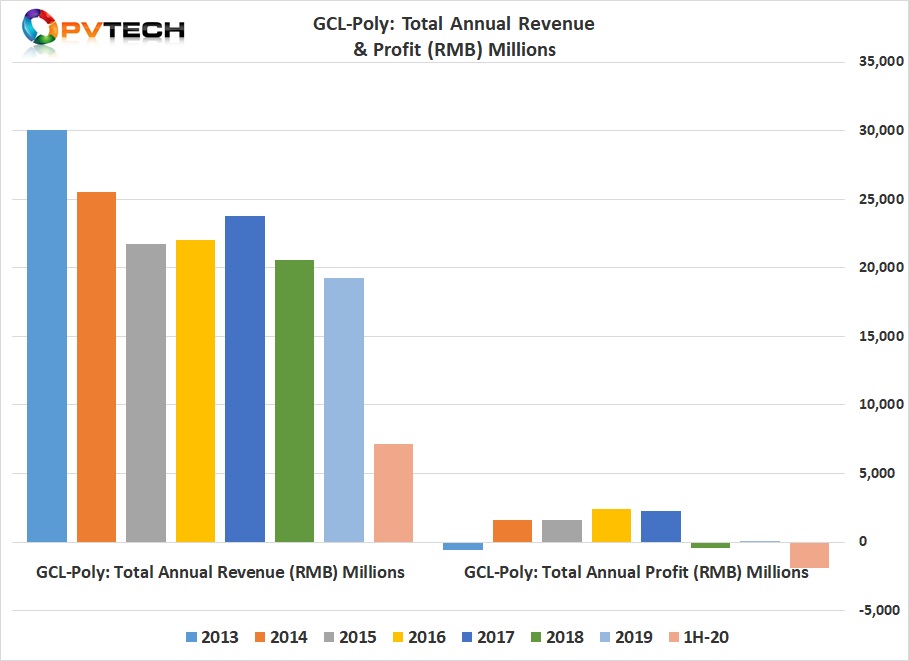

GCL-Poly had recently warned investors that it expected to make a net loss of at least RMB 1.5 billion (US$217 million) for the first half of 2020 as market demand, due to COVID-19 and other issues impacted profitability.

The total loss for the first half of 2020 was RMB 1,924 million (US$281.8 million), with its Solar Material business unit (polysilicon and wafers) making losses of RMB 2,023 million (US$296.2 million).

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Key to the significant losses was GCL-Poly’s polysilicon business, due to a 51.1% decline in actual silicon rod production as the company disposed of a 31.5% equity interest in Xinjiang GCL polysilicon plant with a nameplate capacity of around 50,000(MT) in 2019.

Subsequently, the Xinjiang plant reportedly suffered a major incident while under annual maintenance that could keep the plant offline for as much as nine months, which remains highly speculative but has limited high-purity polysilicon supply and caused polysilicon prices to double since the end of the first half of 2020.

In the reporting period, GCL-Poly said that its annual production capacity of silicon rods at the Group’s Xuzhou base switched to producing 30,000MT of granular silicon (FBR technology) in the next few years, which resulted in silicon rod capacity declining to only 36,000MT, compared with previous annual nameplate capacity of 70,000MT.

As a result, GCL-Poly’s silicon rod production in the first half of 2020 was only 17,881MT, compared with 36,592MT produced in the prior year period. The company noted that the production volume of granular silicon reached 2,442MT in the reporting period after the switch of material.

GCL-Poly noted that its Xuzhou facility currently has a production capacity of 6,000 tonnes of granular silicon, which is expected to increase to over 10,000 tonnes within the year.

GCL-Poly sold 17,489MT of silicon rod polysilicon in the first half of 2020, compared to 20,731MT in the prior year period, a 15.6% decrease. Silicon rod polysilicon ASPs were US$7.56/kg in the first half of 2020, compared to US$9.01/kg in the prior year period.

The company reported that its annual wafer production capacity increased from 35GW to 40GW, primarily to new cutting machines for thinner wafers. However, in the reporting period, GCL-Poly produced 14,328 MW of wafers in aggregate (including 7,288MW of OEM wafers), representing a decrease of approximately 2.3% from 14,658MW (including 4,006 MW of OEM wafers) in the prior year period, a decrease of 33.9% (excluding OEM wafers).

Wafer ASPs were equivalent to US$0.050/W, compared to US$0.062/W in the first half of 2019.

GCL-Poly also noted that since the end of the second quarter of 2020, polysilicon prices had increased significantly, primarily driven mainly by the growth in orders backed by emerging global demand for installed capacity.

By the end of 2020, GCL-Poly is expected to own dedicated monocrystalline wafer capacity of at least 10GW. Current wafer capacity is split between multicrystalline and cast mono.

Clearly, GCL-Poly is undertaking major changes to its production setups for both polysilicon and wafer operations as the market rapidly shifts to p-type and n-type monocrystalline needs.