Major polysilicon and wafer producer GCL-Poly Energy Holdings reduced losses in its Materials business segment in 2019 by continuing to reduce polysilicon production while boosting solar wafer capacity by 5GW.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Polysilicon

GCL-Poly cut polysilicon production from approximately 61,785MT in 2018 to around 57,394MT in 2019, a decrease of 7.1% from the previous year, continuing a downward trend from a record peak production of 74,818MT in 2017.

The annual production capacity of polysilicon at GCL-Poly’s main base in Xuzhou, China remained unchanged at 70,000MT for the sixth consecutive year. This is despite plans announced in 2017 to expand capacity to 115,000MT before 2020.

The company noted in its latest annual report that average selling prices (ASPs) (excluding tax) of polysilicon in 2019 stood at US$8.7/kg compared to US$11.73/kg in 2018, a new record low for the company.

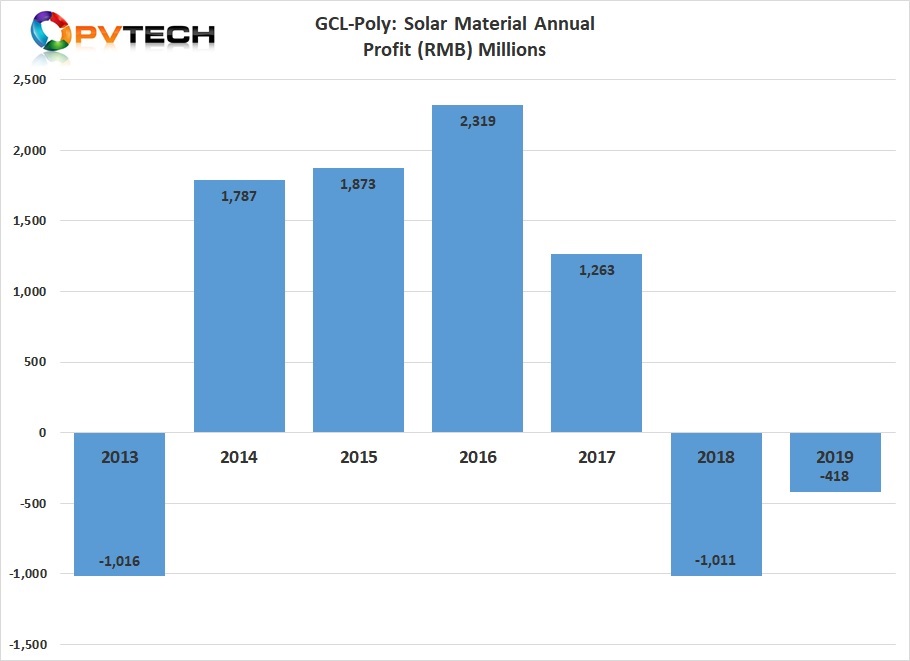

Those record low ASPs led GCL-Poly to make product impairment charges on its Solar Material business of approximately RMB 2,074 million (US$292.4 million) and RMB 479 million (US$67.9 million on property, plant and equipment.

Western rival Wacker Chemie had previously announced an impairment charge on its polysilicon production facility assets, due to major ASP declines to the tune of €750 million, although this was increased to €760 million in its preliminary full-year results. Other companies are shutting down polysilicon facilities in 2020.

GCL-Poly said that the new Xinjiang polysilicon base started to operate at full capacity in 2019 to provide 48,000T in output. However, GCL-Poly had said in October 2018 that the annual nameplate capacity would be increased to 60,000MT, up from the revised plans mid-year to increase the capacity from 40,000MT to 50,000MT.

The Xinjiang polysilicon plants goal was to become the leading low-cost, high-quality polysilicon production base for the modified Siemens process.

In 2019, the company completed the disposal of a 31.5% equity interests in the Xinjiang facility, receiving RMB 4.4 billion (US$ 624.2 million) as a one-off gain from equity disposal and a net cash inflow of RMB 1.33 billion (US$ 188.7 million), improving GCL-Poly’s profitability and liquidity. The company also received an RMB 2.5 billion (US$354.6 million) syndicate loan from local state investment funds for the Xinjiang project.

However, the equity sale meant that Xinjiang GCL ceased to be a subsidiary of GCL-Poly, with profits and loss as well as assets and liabilities of Xinjiang no longer consolidated into the consolidated financial statements of the GCL-Poly. Yet, one of the controlling shareholders in a new investment company is a subsidiary of GCL-Poly that was said to maintain a controlling share.

Polysilicon sales to outside customers totalled 38,789MT, up from 20,041MT in 2018, a 93.5% increase.

Wafer

A major push for GCL-Poly was to migrate ingot/wafer production away from the rapidly declining demand for multicrystalline wafers and begin the production ramp of its mono-cast wafer technology, which had been in R&D for several years.

The company had stated in its previous 2018 annual financial report that it expected the monthly production capacity of its mono-cast wafer technology in 2019 would reach no less than 500MW, accounting for around 26GW of total wafer production.

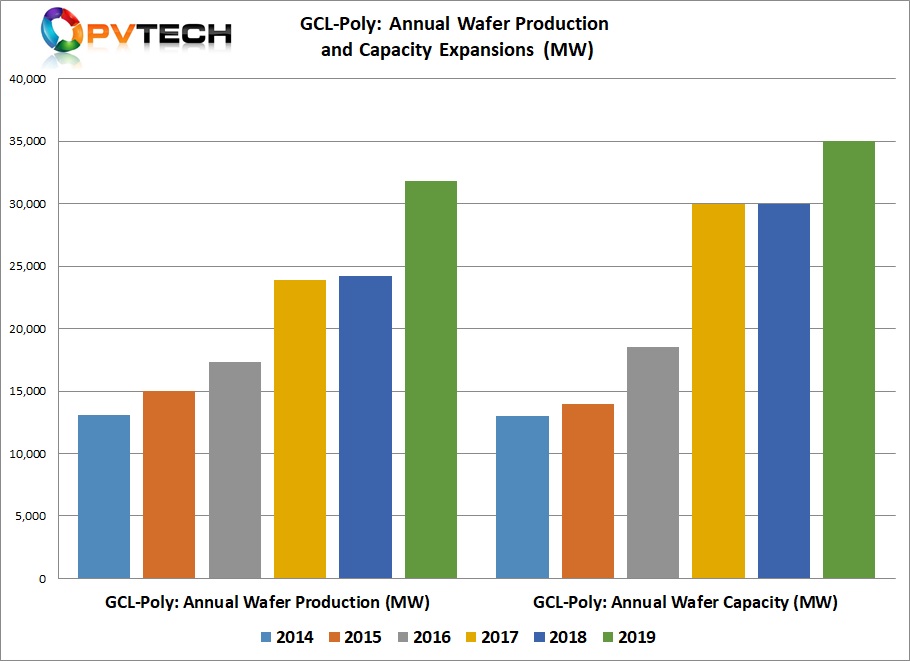

GCL-Poly said that annual wafer production capacity stood at 35GW at the end of 2019, up from 30GW at the end of 2019. Wafers produced in 2019 stood at approximately 31,852MW, an increase of 31.7% from 24,189MW in 2018. The company did not breakout production of multi versus mono-cast wafers in its 2019 annual financial report.

Wafer sales in 2019 reached 31,969MW, a 29.1% increase from the previous year. However, the ASP (excluding tax) declined from US$0.087/W in 2018 to US$0.061/W in 2019.

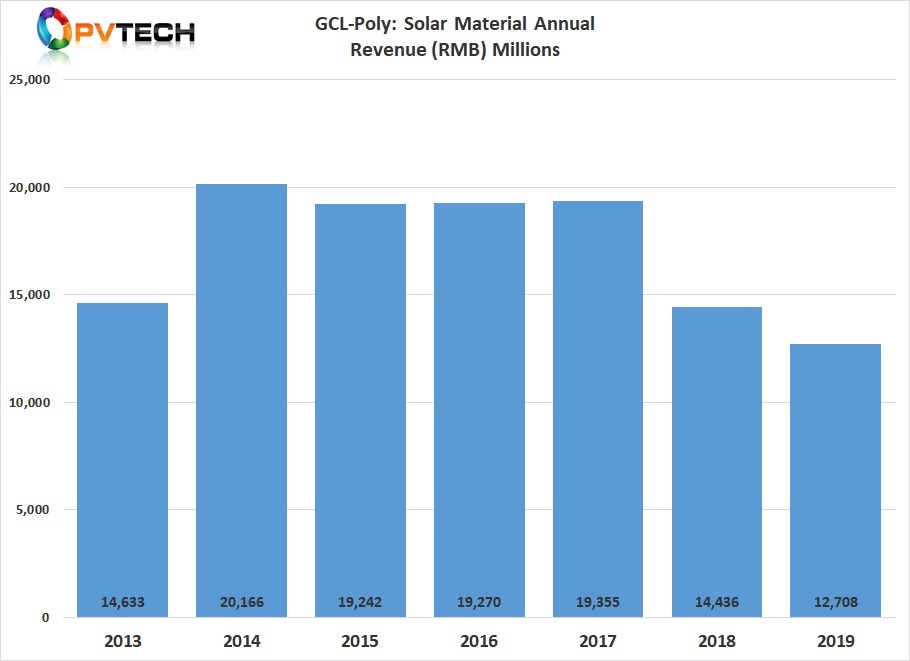

Revenue decline and cash burn

Revenue from external customers in the Solar Materials business amounted to approximately RMB 12,708 million (US$1.79 billion) in 2019, representing a decrease of 11.9% from RMB 14,436 million in 2018.

The Solar Materials business' gross loss in 2019 was RMB 417.8 million (US$59.0 million), a significant reduction from the previous year. GCL-Poly Group, reported just a US$15.6 million gross profit in 2019, compared to a circa US$64 million loss in 2018.

Despite asset sales and restructuring, GCL-Poly Group had cash and cash equivalents of approximately RMB 1,548 million (US$218.2 million) at the end of 2019, compared to RMB 4,121 million (US$581 million) at the end of 2018.

The Group’s total borrowings in 2019 totalled RMB 56,466 million, out of which approximately RMB 29,766 million (US$4.2 billion) would be due in the coming twelve months.