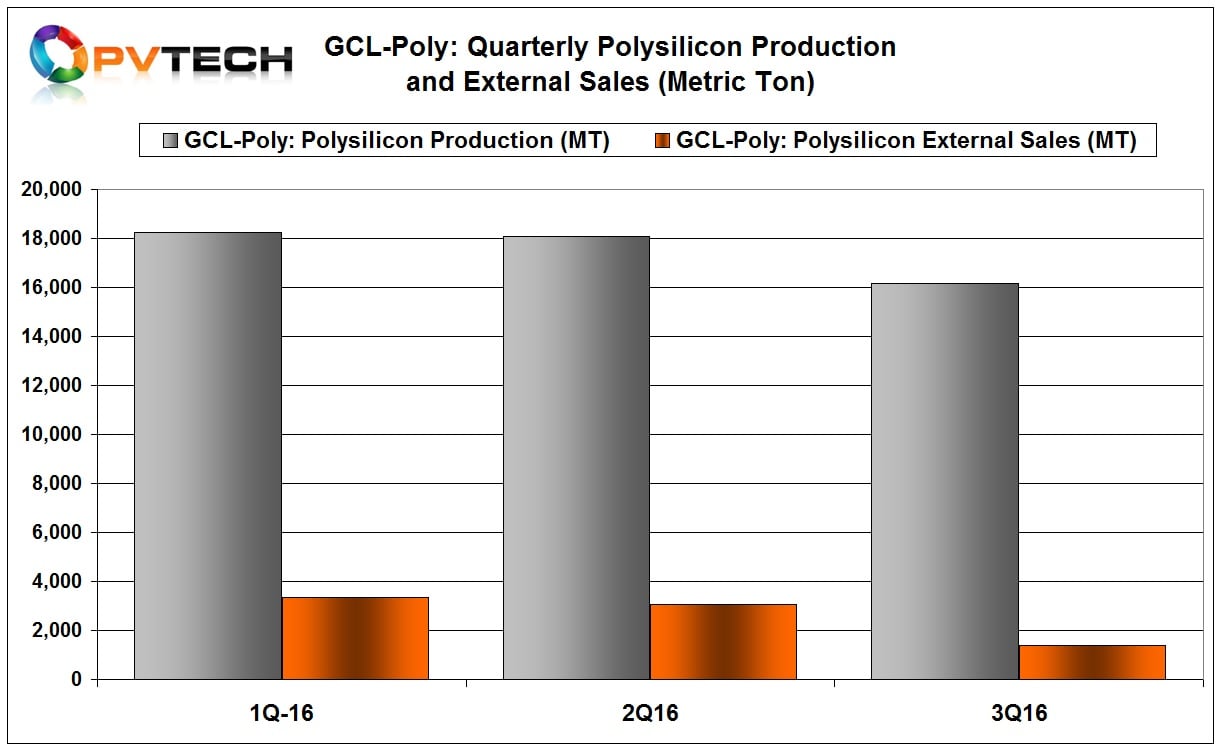

Leading polysilicon and wafer producer GCL-Poly reported a 15% cut in production of polysilicon in the third quarter of 2016, compared to the prior year period, due to weak China end-market demand.

GCL-Poly said in reporting its third quarter business performance report that it produced 16,160MT of polysilicon, representing a decrease of approximately 15% compared with 19,003MT over the same period of last year and down around 10.6% (18,078MT) from the previous quarter.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

External polysilicon sales in the quarter were approximately 1,398MT, representing a 70.0% decrease compared with 4,653MT over the same period of last year. External polysilicon sales fell 54%, quarter-on-quarter.

Polysilicon production volume for the first three quarters of 2016 was approximately 52,488MT, representing a decrease of approximately 5.9% compared with 55,771MT over the same period of last year.

External polysilicon sales were approximately 7,787 MT of polysilicon for the first three quarters of 2016, representing a decrease of approximately 33.2% compared with 11,658 MT over the same period of last year.

Overall polysilicon production capacity remains at 70,000MT on an annual basis.

Wafer update

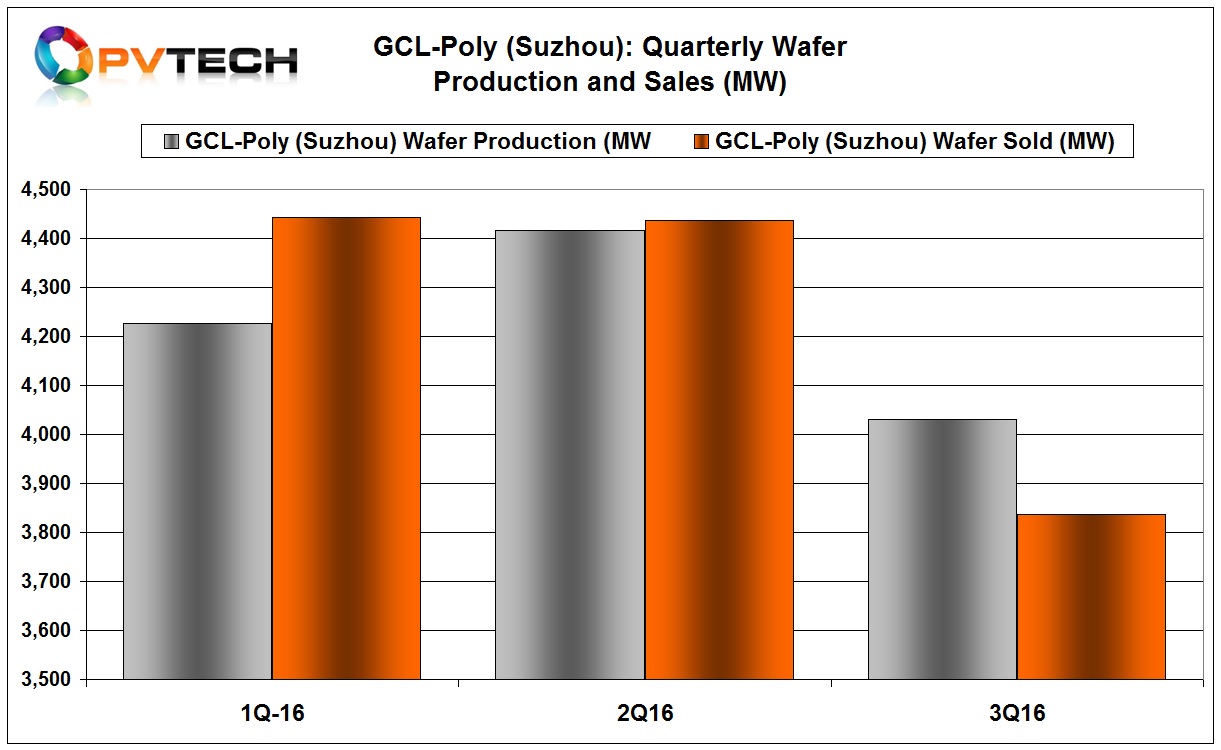

GCL-Poly reported solar wafer production of approximately 4,031MW in the third quarter, representing an increase of approximately 5.4% compared with 3,826MW over the same period of last year. However, production was down around 8.6%, quarter-on-quarter.

Overall multicrystalline silicon wafer production at the end of the third quarter of 2016 was ramped to 17.5GW and monocrystalline silicon wafer production to 1GW, bring total wafer production to 18.5GW.

Wafer sales approximately 3,837 MW, representing a drop of approximately 4.6% compared with 4,022 MT over the same period of last year and down around 13.5%, quarter-on-quarter.

The company sold approximately 12,717MW of wafers for the first three quarters of 2016, representing an increase of approximately 14.7% compared with 11,083MW over the same period of last year.

Pricing update

GCL-Poly reported polysilicon average selling price for the first three quarters of 2016 was US$15.4/kg). The average selling price of wafers was US$0.175/W.

The company said that at the end of the third quarter of 2016 a rebound of both the demand as well as the price of polysilicon and wafers had occurred.