Earlier this week Duke Energy Progress (DEP) unveiled its 2020 Integrated Resource Plan, detailing the potential resource portfolios for both DEP and Duke Energy Carolinas (DEC) over the course of the next 15 years.

Following on from a raft of other IRPs published in recent months, the Duke plan provides a snapshot into how the utility’s operational power portfolio is expected to change in the coming years, driven by evolutions in both demand for electricity and how, precisely, the utility intends to cater for it.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

DEP’s position makes for an interesting study in how the power system stands to change over the next decade or so. Despite the utility’s efforts in demand side reduction programmes, between 2020 and 2035 power demand from customers is still expected to increase by more than 7,000GWh each year. This is combined with the loss of around 4,000GWh each year from legacy generators due to be phased out in that time.

Altogether, Duke forecasts there to be a need for some 6,200MW of new electricity resources in that time. And, given the utility’s stated aim of becoming net zero by 2050, it’s almost certain that that power will have to originate from clean resources.

Duke’s IRP establishes a number of clear models for this – six, in fact – which take into account various inputs from technology adoption to public policy. The most important factor within the plan is the possible introduction of carbon policies that would drive the adoption of renewables and other technologies. “These portfolios will ultimately be shaped by the pace of carbon reduction targeted by future policies and the rate of maturation of new, clean technologies,” the document reads.

Further inputs include the most economic and earliest practicable retirement of Duke’s coal fleet, the acceleration of renewables, the integration of battery and pumped-hydro energy storage, expanded demand response and energy efficiency schemes and the deployment of new zero-emitting load following resources such as small modular reactors.

Another critical input into the modelling is cost, with Duke incorporating a “least-cost” portfolio into its plan, alongside other scenarios that reflect differing future resource portfolios or rates of penetration of renewables and other technologies.

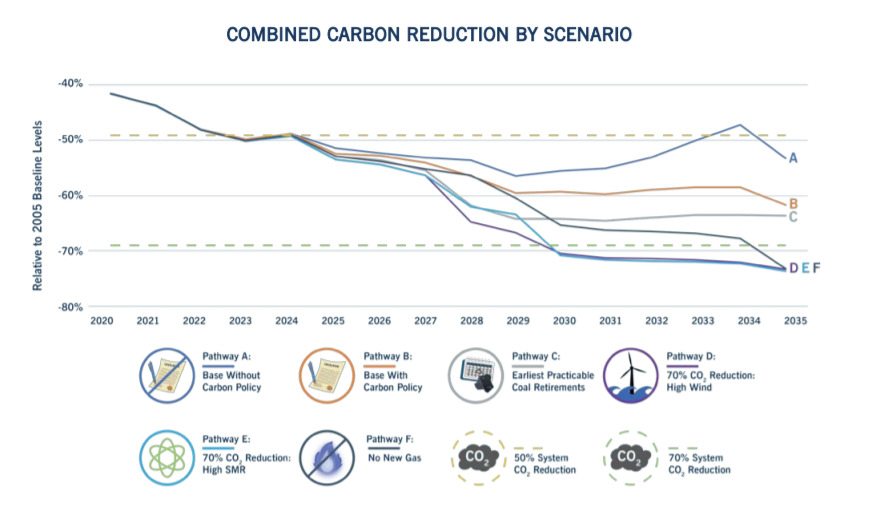

All portfolios are, however, united in their vision for Duke to have slashed carbon emissions by at least 50% by 2030, and to have achieved net zero status by 2050.

The solar impact

Duke’s commitment to solar PV is already strong. The combined activities of DEP and DEC sees the entities purchase or own around 4,000MW of solar generation from around 1,000 separate facilities located throughout both North and South Carolina.

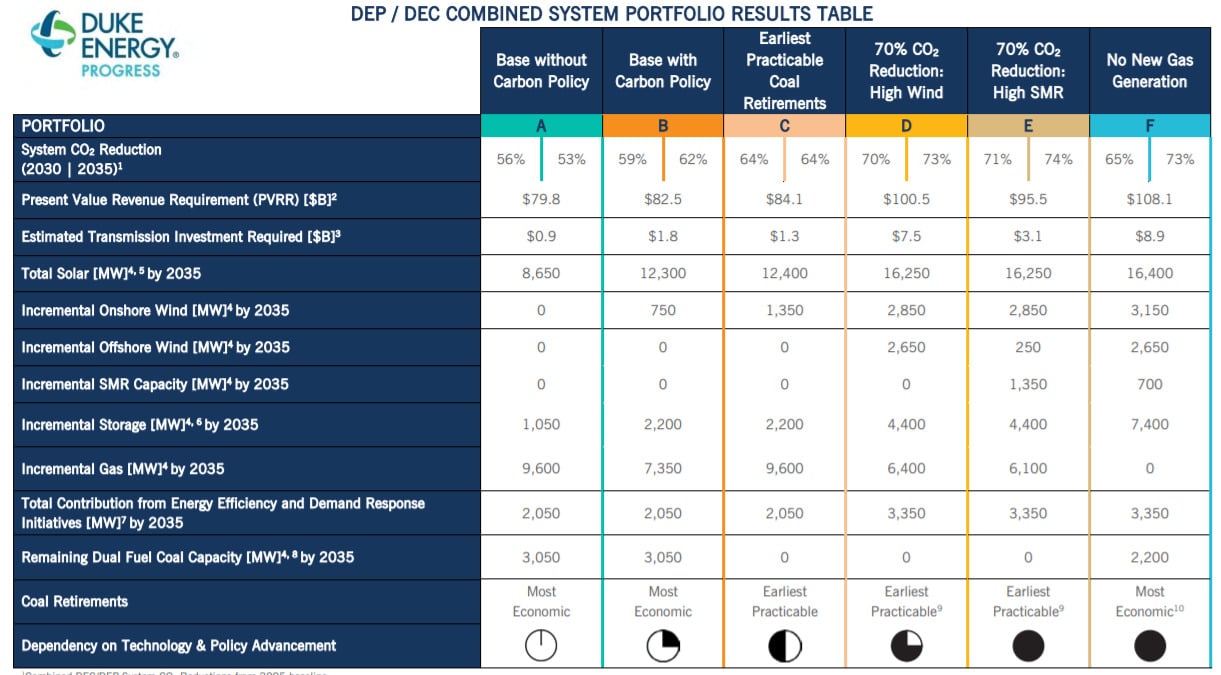

However the IRP shows that this will at least double over the course of the next 15 years, with the utility’s base scenario – which includes no carbon policy drivers – including a projected total solar capacity of 8,650MW by 2035.

When such carbon policy is introduced, the models escalate rapidly. Duke’s base case with a carbon policy suggest the utility will amass a total solar capacity of 12,300MW by 2035, while the three most ambitious models in terms of solar proliferation suggest Duke could own a solar portfolio in excess of 16GW by that date.

The impacts of such solar adoption – coupled with the introduction of onshore and offshore wind at various paces as well as the phase out of Duke’s coal and gas fleet – ricochet throughout the utility’s IRP. Duke’s storage fleet is forecasted to reach anywhere from 1GW to 7.4GW depending on the renewables adoption rate, while the transmission investment required varies from US$900 million in a least-cost, least-renewable scenario to nearly ten-times that (US$8.9 billion) under the utility’s most ambitious model.

Separate tables for both Duke Energy Progress and Duke Energy Carolinas can be seen in the report, here.

While there remains some uncertainty over the extent of the role solar, storage and indeed other clean or renewable technologies will play in US utilities’ transition away from renewables, a consensus has formed within IRPs published to date that utilities from coast to coast will be a phenomenal driver of deployment over the next decade, regardless of the impact policy or cost may have on a utility’s actions.

But in spite of the sizeable commitments to renewables and Duke’s intent to derive a significant share of its power from solar and other clean sources, such is the desire for a renewable power system in the US that the utility’s plans have been criticised for not going far enough.

As Duke’s chart shows, in all but one of its scenarios there will be additional gas-fired power generators in Duke’s portfolio by 2035. While this is obviously not as polluting as Duke’s last remaining coal-fired projects, the inclusion of gas as a pivotal cog in its plans has meant the utility’s plan is debatable in its climate ambition.

Environmental non-profit Environmental Working Group, headquartered in Washington D.C., slammed Duke for giving “short shrift” to wind power while betting on an introduction of small modular nuclear reactors that remain uncertain in their development.

“If investors and regulators were hoping Duke would put forth a serious plan to reduce emissions and combat climate, this IRP wasn’t for them,” Grant Smith, senior energy policy advisor at EWG, said in a statement. “Even the most ambitious scenario would only modestly invest in offshore wind, despite the enormous potential in the Carolinas, make paltry advances in solar, spend billions on more nuclear reactors and jack up customers’ bills by nearly US$60 a month.”

While Duke may argue that consumer bills must be considered in every action it takes, it’s clear that the expectation on utilities to embrace solar and other renewables has already grown. Given these plans are supposed to set a path out till 2035, by which time the cost of deploying solar and storage will have no doubt contracted further still, means that any ambition must be greater still.

PV Tech Power, PV Tech’s print publication for the international downstream solar market, is exploring the role of utility IRPs in its next edition – Volume 24 – published in two weeks’ time. To subscribe to the journal and receive your digital copy, entirely free of charge, when it is released, click here.