Donald Trump’s return to the White House portends disruption to US trade policy, with likely consequences for PV supply chains. Mike Hall of Anza looks at what the data shows and where the market could be headed under Trump 2.0.

With the new administration under president-elect Donald Trump taking office, further changes to US trade policy may be on the horizon. So far, the US has implemented key trade measures within the solar supply chain to protect domestic manufacturers, reduce reliance on imports and address unfair labour practices. These policies – including tariffs, duties, compliance rules and incentives – have significantly reshaped the module pricing and procurement landscape. As a result, solar developers reliant on imported products have faced volatile costs, shifting supply chains and ongoing uncertainty.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

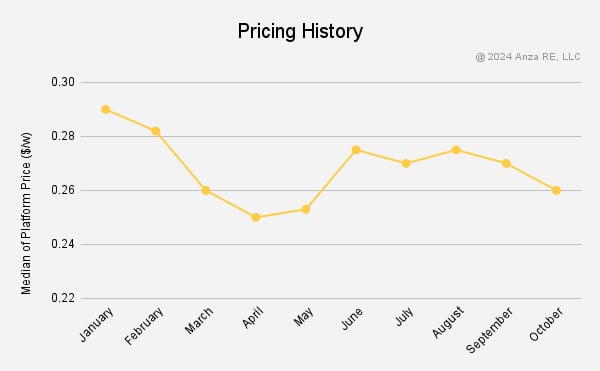

Data on recent market trends reveals how the solar industry has reacted to these new trade policies, offering insights into what may lie ahead. According to data from Anza, which captures 95% of the US module market, prices increased from April to August 2024. During this period, the median US module price rose from 25 cents to 27.5 cents per watt—a 10% increase from April’s low to the high in June. Although prices eased slightly after August, overall prices remained up by 4% from April to October.

These shifts reflect the impact of current trade measures and economic pressures on the solar supply chain. As new policies potentially take shape under the Trump administration, these initial reactions may signal what to expect in the market going forward, shaping future strategies for solar developers and manufacturers.

How AD/CVD duties are reshaping the market

The US government has taken decisive steps to protect domestic solar manufacturers from unfair competition, imposing antidumping (AD) and countervailing duties (CVD) on solar panel imports from countries such as China, Vietnam, Thailand, Malaysia and Cambodia. These measures aim to

counteract foreign practices that artificially depress production costs, allowing companies to undercut US manufacturers. By levelling the playing field, the US hopes to strengthen its solar manufacturing base, though these actions have had a profound ripple effect on module pricing and supply chains.

Before AD/CVD duties were introduced, per-watt pricing generally trended downward. Anza’s Q2 Module Pricing Insights Report showed a clear price floor had been reached between February and May 2024, at roughly 25 cents per watt, for the first time in the last two years, along with early signs of a bounce back in pricing. The shift was primarily due to the AD/CVD petition, specifically on Southeast Asian (SEA) module imports. Additional data through to the end of August confirmed that pricing floor, showing a notable rise in solar module prices from the lows in April 2024 to nearly 28 cents per watt, as the effects of the AD/CVD petition began to take hold.

In early October 2024, the US Department of Commerce issued preliminary CVD tariffs, with rates ranging widely from below 1% to nearly 300%, depending on the company. While the final AD rates remain undetermined, these CVD tariffs have already driven up costs for Southeast Asian module suppliers, especially as companies adjust their supply chains and incur new capital expenses. This AD/CVD petition and resulting tariffs have driven a notable increase in module prices, with the US median module price rising approximately 15% from April to August 2024, reaching nearly 28 cents per watt.

Not all foreign suppliers, however, have been equally affected; some outside the scope of the current investigation have quickly adapted, maintaining stable pricing compared to pre-AD/CVD levels. This divergence has introduced new pricing dynamics, where rising costs impact some suppliers more than others. Since August, prices have softened, with the median falling back to around 26 cents per watt by October. These mixed impacts reflect a shifting landscape where US trade measures have heightened costs for some suppliers, added complexity to supply chains and created a more nuanced market outlook for the future.

The impact of Sections 201 and 301

Sections 201 and 301 empower the US to impose tariffs as a defence against import surges that threaten domestic industries and to counteract unfair trade practices by foreign nations, such as trade agreement violations or discrimination against US goods. When applied to foreign solar products, these tariffs can significantly raise costs for US solar developers, making it more expensive to import affordable foreign modules that many have come to rely on.

The recent removal of the bifacial panel exemption under Section 201 in May 2024 introduced a 14% tariff on these previously exempt products, leading to a noticeable increase in module prices. By June, the median price of modules without Section 201 tariffs peaked at 29 cents per watt, slightly above the 27 cent peak for those affected by the tariff.

Interestingly, even modules exempt from Section 201 and the AD/CVD investigations have seen price hikes, likely due to competitive pressures. With most other modules facing a 14% tariff and the AD/CVD pricing impacts, tariff-free suppliers have been able to raise prices while still appearing attractive to buyers.

This dynamic has added complexity to the pricing environment, where even tariff-free options are trending upward. However, since August, price spreads between tariff-affected and tariff-free modules have gradually shrunk, with median prices settling at around 25.5 cents per watt for both by October 2024.

What to know about UFLPA

The Uyghur Forced Labor Prevention Act (UFLPA) targets forced labour concerns by blocking imports of solar modules and components that use polysilicon from China’s Xinjiang region, where forced labour has been widely reported. This law adds a layer of complexity for US solar developers and importers, as compliance demands more stringent supply chain documentation, raising the risk of delays and disruptions. These challenges have driven up prices across the board, impacting the competitiveness of imported modules and increasing project costs industry wide.

While these measures push suppliers to move away from Chinese polysilicon, contributing to price increases, they also represent a positive shift toward global ethical standards. Despite the volatility in the solar market, the combined effects of import duties, trade restrictions and the higher costs of US manufactured products will likely exert moderate upward price pressure in the US solar market, shaping a more sustainable and accountable industry overall.

Broader implications of trade measures on solar module pricing

In response to tariffs, many solar developers and procurement teams have started diversifying their supply chains, looking to alternative suppliers or domestic manufacturers. While this shift may ultimately help stabilise supply, it often comes with increased costs, as production relocates to regions lacking the efficiency or scale of some foreign manufacturers.

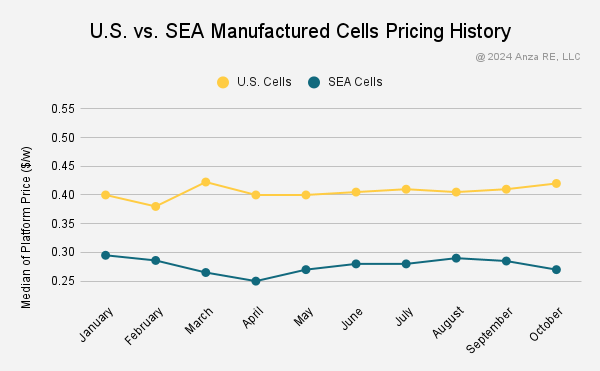

However, an upside to these trade measures is the opportunity they create for US manufacturers. By shielding domestic solar companies from unfair competition, these policies lay the groundwork for a more resilient US solar industry less reliant on imports. Recent adjustments to the domestic content calculation method, effective May 2024, further support this goal by simplifying qualification for a 10% bonus on the Production Tax Credit (PTC) or Investment Tax Credit (ITC) when using US-made components. This change has spurred a wave of investment in US manufacturing capacity as companies race to meet demand for domestic solar components. In turn, increased competition among US manufacturers has led to a 7.5% price reduction between March and August 2024, demonstrating the potential for cost savings as domestic production scales up.

While US manufacturers are experiencing growth, they remain in the early stages of competing globally, where a significant cost gap exists compared to Southeast Asian production. Most US-made solar products will now be consumed domestically, with demand driven mainly by IRA-based incentives. In the long term, the goal is to make US production more competitive, though in the short term, this still translates to higher costs for buyers.

Despite these cost pressures, the global oversupply of solar modules is expected to protect the US market from significant price spikes, helping keep equipment costs manageable. Additionally, substantial drops in storage prices may encourage further deployment of solar solutions, as renewables remain more cost effective and faster to deploy than fossil fuels.

The US has a strong appetite for new power generation, and renewable energy’s cost advantages reinforce this trend. However, the continued uncertainty around trade measures with a new administration – whether they’ll be renewed, expanded or adjusted – introduces volatility in module pricing. Development and procurement teams will likely face ongoing challenges in forecasting long-term costs, adding uncertainty to project budgets and timelines.

Embrace the change or get left behind

As the solar industry evolves under the influence of US trade measures, development and procurement teams face growing complexity and uncertainty. The shifting dynamics of trade policies, tariffs, and the broader market require a more strategic, data-driven approach to stay ahead of these changes.

For solar decision-makers, having access to comprehensive market insights is crucial—not only to assess price but also to track more difficult-to-measure factors like performance and risk. By staying informed on market trends and leveraging real-time pricing data, developers and procurement teams can better navigate volatility, manage risks and make more informed investment and purchasing decisions especially as the market remains uncertain with a new administration and ongoing policy changes.

Mike Hall is CEO of Anza. He previously served as CEO of Borrego Solar, a company he co-founded in 2002. In 2020, Mike and his brother Aaron developed the initial Anza business strategy after observing Borrego’s IPP customers’ challenges in managing a rapidly changing module supply environment. Prior to establishing Borrego Mike worked as a process engineer for Applied Materials in Santa Clara. He holds an M.S. in chemical engineering from Stanford University and a B.S. in chemical engineering from the University of California Santa Barbara.