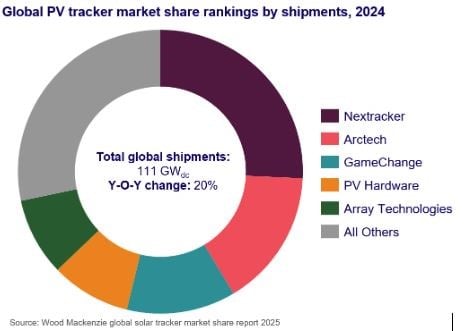

The global solar tracker market expanded by 20% in 2024 to a record size, according to energy research firm Wood Mackenzie.

Global tracker shipments reached 111GW last year, according to Woodmac’s new “Global solar PV tracker market share” report, up from 92GW in 2023 as per the previous iteration of the study.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

US-based tracker manufacturer Nextracker had the largest market share of any single company, capturing 26% of the market with 28.5GW of shipments. Nextracker’s shipments grew 39% year-on-year (YoY) and its 2024 revenues increased by 29.5%, its largest yearly jump since 2018-19. Woodmac said the company expanded its market share in “each major region” of the global tracker market.

However, the other top performers from last year have been surpassed by Arctech Solar, the largest Chinese tracker company.

Last year’s second, third and fourth-largest producers, US-based Array Technologies, GameChange Solar and PV Hardware, all ceded global market share to Arctech Solar this year.

Woodmac said this was due to growing demand for trackers in India and Saudi Arabia, where Arctech held a “top-two position” in both markets.

The Indian and Saudi markets represented a combined 28GW of tracker capacity in 2024, more than the entirety of Europe, Woodmac said.

Indian PV deployments have increased dramatically since the start of 2024, driven in large part by favourable policy and relaxed laws on imported products. JMK Research said the country installed a “record” 24.5GW of new PV capacity in 2024, more than double the capacity added in 2023.

Slowed demand in China and US

The growth in overall global solar PV capacity is still far ahead of tracker installations. 597GW of new solar PV capacity was added across the world in 2024, a 33% uptick compared with 2023. As well as rooftop PV capacity, which will not feature trackers, the disparity between the growth rates for tracker shipments and total PV additions may partly come down to decreased tracker demand in China.

Woodmac said China’s “domestic tracker demand continued to decline for the second straight year.” The 2023 market report said that Chinese demand for trackers fell as developers sought the lower installation costs offered by fixed-tilt systems. China accounted for over half of the total global PV installations last year.

While still topping the global leaderboard, the US tracker market declined by 9% in 2024. However, the relationship between trackers and total PV installations in the US is far closer than the world at large; 33GW of tracker shipments entered the US market last year and 50GW of overall PV capacity was installed.

US producers dominated the US market – Nextracker, GameChange Solar and Array Technologies accounted for almost 90% of the US market, Woodmac said.

By contrast, Europe is defined by variety and competition, the report said. “Over nine” tracker vendors have between 5% and 15% of the market, Woodmac said. However, much of the continent’s growth was concentrated in emerging markets.