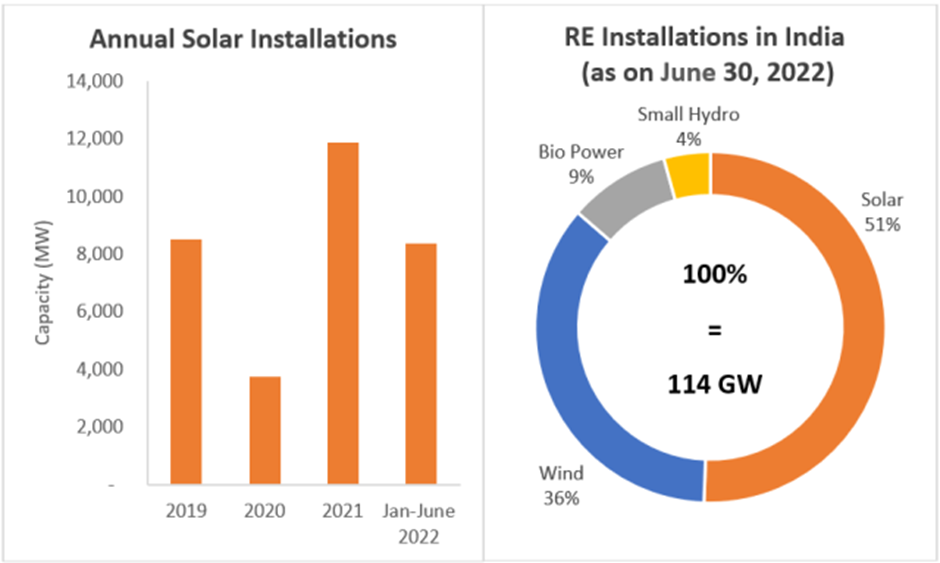

India deployed 8,359MW of solar PV in the first half of the year, marking a significant increase of 71% compared to the same period last year, according to figures from the Central Electricity Authority (CEA) and analyst firm JMK Research.

The country is also expected to deploy 20GW in the whole of 2022, made up of ~16.5 GW of large-scale PV and 3.5 GW of rooftop solar. This would be another huge jump up from the 12GW deployed in 2021.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The solar hotbed state of Rajasthan has installed the most capacity by far this year with 4.5GW, almost three times that of its closest rival Gujarat (1.5GW), followed by the southern state of Tamil Nadu with 680MW.

The country’s cumulative renewable energy installations up to June 2022 have now reached 114GW, with solar taking up 51% of that capacity, according to figures from the Ministry of New and Renewable Energy (MNRE). The remainder of deployment is made up by wind energy (36%), bio-power (9%) and small hydro (4%).

Back in 2015, Prime Minister Narendra Modi had originally set a target of 100GW of solar by 2022, a five-fold increase from the previous government’s target of just 20GW.

However, while India’s utility-scale PV additions have nearly kept up with objectives, being on track to reach 97% of its 60GW target by December, rooftop solar is expected to fall a huge 25GW short its 40GW target. Since the boom in Indian solar kicked off by the 100GW target, the rooftop sector has always lagged behind the large-scale sector, which was driven by a plethora of mega-scale solar park contracts.

However, last month India’s government reportedly said it would stop the electronic reverse auctions it had used to proliferate renewables projects across the country, due to concerns that it had led to unhealthy competition. Right from the early days of the auctions, certain industry members had expressed their concerns over the regular achievement of record low prices in these auctions.

As many commentators have said over the years, JMK repeated that it was “imperative” to concentrate efforts and put more focus on the rooftop sector otherwise the overall PV targets would be missed. Noting supply chain risks, it also said that enhancing domestic PV manufacturing facilities was “critical”. Chinese suppliers still accounted for the vast majority of modules used in India in FY2022.

Last week, Indian newspaper The Economic Times reported sources saying that India had dropped its 2030 target of 500GW of non-fossil fuel based installed capacity, which had included a 300GW target for solar PV. The country has instead reportedly opted for a more flexible target of 50% power from non-fossil fuel sources, allowing it to consider new coal-fired power plants.