India’s residential rooftop solar capacity is set to increase 60% by the end of the fiscal year 2023, according to a new report by the Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Research.

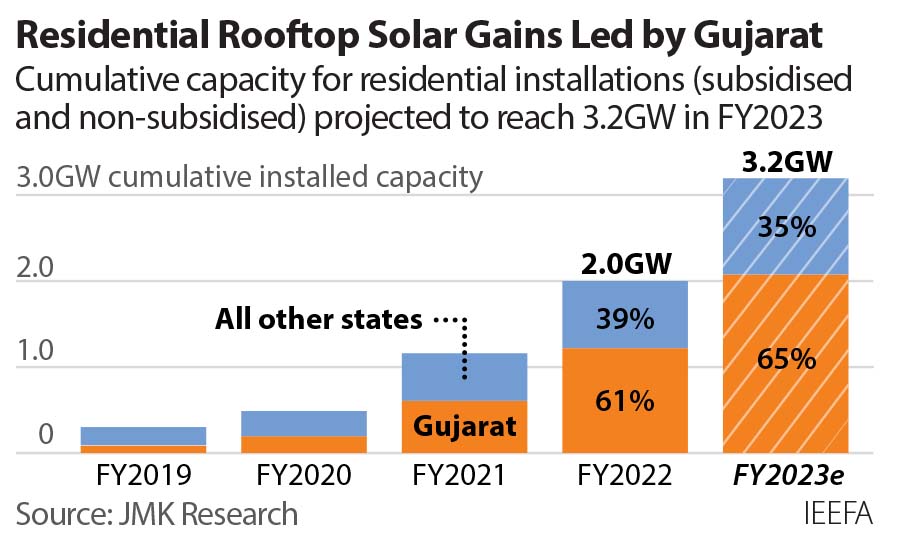

A rising need for cost savings and increased awareness post COVID-19 among customers could rapidly accelerate the installation of residential rooftop solar, rising from a cumulative 2GW of installed capacity at the end of March 2022 to 3.2GW a year later.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

However, the country will likely miss out on its 2022 target to install 100GW of solar capacity due to poor performances from the rooftop segment, which had only 11.8GW installed as of end of March 2022, of which 17% from the residential sub-segment.

This sudden growth comes despite the fact that the country has been the “world’s least” expensive residential solar power market for a decade, said Jyoti Gulia, founder of JMK Research.

In 2020, the average cost of a residential rooftop solar system in India was US$658/kW, a 73% decline from 2013. While leading residential markets such as Japan, the UK, Switzerland and the US had costs 3.3x to 6.4x India in 2020.

Vibhuti Garg, South Asia director at IEEFA, said: “India has more than 300 million households and is endowed with abundant sunshine almost throughout the year, with an annual average of 300 sunny days. This shows that the potential for rooftop solar installations in residential spaces is huge in India.”

The state of Gujarat could be an indication of what to replicate in order to improve uptake of residential rooftop. In the last 18 months, 1.1GW of solar capacity has been installed in Gujarat alone and it is set to represent 65% of the 3.2GW of total residential rooftop installed capacity in FY2023.

Gujarat Surya’s scheme – a major government rooftop solar incentive programme in the region that was introduced in August 2019 and allows consumers to claim state subsidies – showcased how proactive support from state agencies led to an increase in rooftop solar adoption.

After Gujarat, the states of Haryana and Maharashtra are the two other Indian states with the most favourable residential rooftop solar installations, mirroring their dominance in utility-scale deployment.

Moreover, in July, the Indian government introduced a newer and simplified rooftop solar subsidy scheme that could have the potential to catalyse the growth of the residential solar segment in the country.

“The new Central Financial Assistance (CFA) scheme will allow residential consumers to buy rooftop solar systems from any registered supplier of their choice. This broadens consumers’ options for quality products and services,” said Prabhakar Sharma, senior research associate at JMK Research.

Meanwhile, a recent World Bank loan for US$165 million to support the Indian residential solar segment could make distributed generation systems more affordable for end consumers.

However, the report found that some policy hurdles still remain, such as delays in net metering approvals and lack of proper communication regarding the benefits of rooftop solar installations. Moreover, India’s state distribution companies (Discoms) have reportedly delayed subsidy payments to the installers in some cases.

Akhil Thayillam, senior research associate at JMK Research, said: “In the case of residential rooftop solar systems, Discoms, in general, need to be restricted to carrying out two activities: inspecting solar plants and selling the net meters.”