India’s PV manufacturing industry is setting its sights on becoming a global hub for solar components. As the first headwinds emerge in its home and overseas markets, Shantanu Roy explores how the sector can sustain itself.

India’s solar sector has witnessed unprecedented growth over the past decade. From a modest base of less than 3GW in 2014 [1], the country’s installed solar capacity has surged to around 130GW as of 30 October 2025 [2], making it the third-ranked country globally in terms of installed solar capacity as well as the third-largest solar power producer in the world [3]. This remarkable progress reflects India’s determination to lead the global clean energy transition through technology, innovation and large-scale deployment in pursuit of its long-term renewable energy ambitions.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

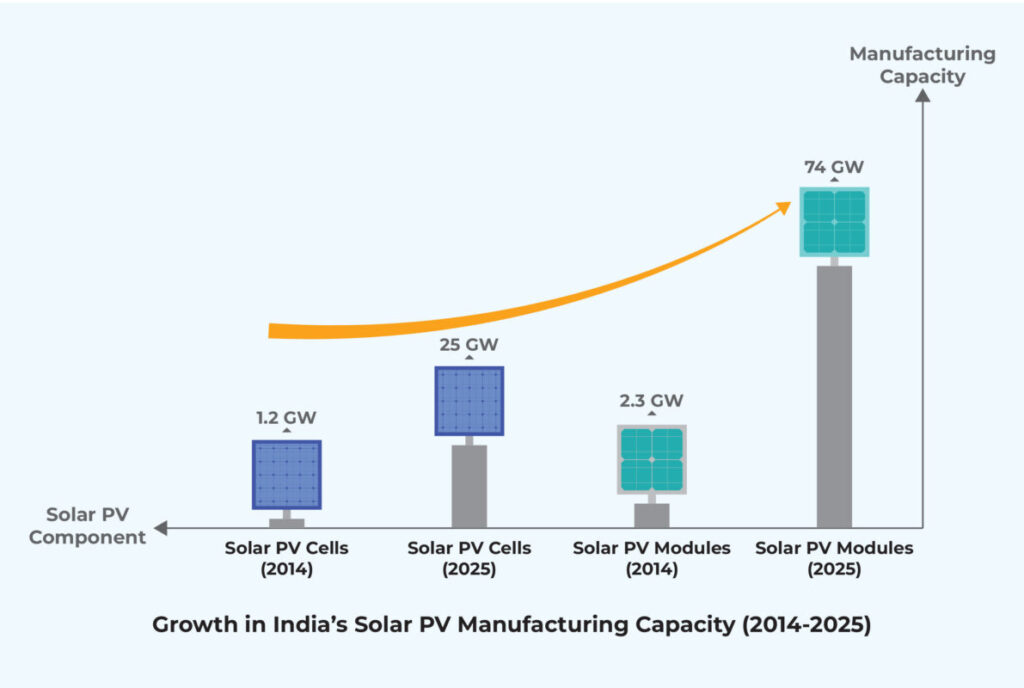

Parallel to this rapid rise in solar deployment, India is now taking bold strides in building an integrated domestic manufacturing ecosystem. According to India’s Ministry of New and Renewable Energy (MNRE), the country’s solar module production capacity nearly doubled within a single financial year, increasing from 38GW in March 2024 to 74GW in March 2025, while solar cell production capacity rose from 9GW to 25GW. The country also inaugurated its first ingot and wafer manufacturing facility, with a capacity of 2GW, marking the beginning of upstream value chain localisation [3].

The Government of India’s commitment to install 500GW of non-fossil fuel capacity by 2030, including around 300GW from solar energy, has made a robust domestic manufacturing ecosystem indispensable. India’s annual installed solar capacity additions already exceed 24GW [1], and the sector must almost double that pace to meet its 2030 target. To sustain such growth, the country requires a stable, competitive and resilient domestic supply of solar modules and cells.

Overall, India’s module manufacturing capacity has expanded more than thirtyfold since 2014, when it stood at just 2.3GW [3]. This rapid industrial expansion signals a structural transformation. What was once an import-dependent industry has evolved into a major manufacturing base with the potential to meet domestic demand and serve global markets. India’s solar manufacturing take-off is, therefore, more than an industrial milestone; it represents the country’s growing ambition, technological maturity, economic self-reliance, creation of high-value green employment and a decisive step towards shaping the global clean energy value chain.

The evolution of India’s manufacturing ecosystem

India’s solar manufacturing journey began to take shape in 2010 with the launch of the Jawaharlal Nehru National Solar Mission (JNNSM), an initiative by the Indian government that sought to create both a domestic market for solar power and an indigenous manufacturing base. The early years (2010-2016) witnessed impressive deployment growth but limited industrial development. Developers imported inexpensive modules from China and Southeast Asia that were considerably cheaper than local products, while Indian manufacturers struggled with small-scale operations and limited access to finance. Manufacturing remained fragmented, dominated by medium-sized firms operating well below capacity, even as demand accelerated through government tenders.

The second phase (2017-2020) marked a shift in policy and industry sentiment. In response to rising import dependence, the government introduced a safeguard duty in July 2018 [4] on imported cells and modules to protect local producers. These tariffs provided temporary relief but did not fully resolve deeper cost and technology challenges. Still, they revived investor confidence and encouraged early efforts toward integration and efficiency. During this period, the government began aligning manufacturing-linked tenders and promoting vertically integrated facilities. Large Indian conglomerates that had previously focused on project development started entering manufacturing, laying the foundation for large-scale industrial consolidation.

The third and decisive phase began in 2020 under the Atmanirbhar Bharat (‘SelfReliant India’) initiative, which elevated solar manufacturing from a commercial activity to a strategic national priority. The approach combined trade protection with targeted incentives and emphasised backward integration from modules to cells, wafers and eventually polysilicon. This phase also saw the emergence of end-toend facilities and supporting industries for glass, backsheets and encapsulants, strengthening the domestic value chain.

Alongside industrial growth, a dedicated research and testing ecosystem has taken shape. Institutions such as the National Institute of Solar Energy, the National Centre for Photovoltaic Research and Education and other national research facilities are working closely with manufacturers to validate technologies, improve efficiency and ensure quality compliance. These linkages are gradually embedding scientific capability and innovation into what was once an assembly-driven sector. Together, these developments mark a clear transition from fragmented assembly to integrated industrial manufacturing. The evolution of the past 15 years has transformed manufacturing from a policy aspiration into an operational reality, positioning India as a credible producer in the global photovoltaic value chain.

Policy drivers and institutional support

India’s solar manufacturing expansion has been underpinned by a carefully coordinated mix of policy instruments, financial incentives and institutional reforms that signal a long-term commitment to domestic value creation. At the centre of this transformation stands the Production Linked Incentive (PLI) scheme, specifically the ‘National Programme on High Efficiency Solar PV Modules’, launched in 2021 and expanded in 2022 with an enhanced budget of INR24,000 crore (US$2.7 billion) [5]. The scheme rewards efficiency, scale and technological advancement by offering incentives to selected solar PV module manufacturers for five years after commissioning on the manufacture and sale of high-efficiency solar PV modules. Unlike earlier support programmes that offered blanket subsidies, the PLI scheme directly links fiscal support to productivity, ensuring competitiveness and accountability.

The scheme has successfully drawn large-scale industrial participation, attracting conglomerates such as Reliance’s New Energy, Adani Solar, Tata Power Solar, Vikram Solar and ReNew. Together, they have committed more than 40GW of new integrated manufacturing capacity [6], [7]. This has brought economies of scale, spurred vertical integration and encouraged the localisation of supply chain components, such as glass, backsheets and junction boxes. More importantly, the PLI scheme has established a new policy template that treats solar manufacturing as a strategic industrial sector rather than merely a supplier to the power market.

Complementing the PLI scheme is the Basic Customs Duty (BCD), introduced in April 2022 at 40% for modules and 25% for cells. The BCD is a tariff levied mainly on imports from countries such as China, which had dominated India’s module supply for over a decade. It was designed to discourage dependence on low-cost imports from these markets and to stimulate investment in domestic production. While the duty initially increased project costs for developers, it played a crucial role in reducing import dependence and providing investors with long-term visibility. The duty structure effectively created a price buffer that made local manufacturing financially viable. Together, the PLI scheme and BCD have redefined the risk-reward balance for manufacturers by ensuring both market protection and performance-based incentives.

Equally important is the Approved List of Models and Manufacturers (ALMM), which reinforces quality assurance and traceability across India’s grid-connected solar projects. By certifying module performance and origin, the ALMM ensures that government-supported projects use reliable, verified products. When the list was temporarily suspended in 2024 to ease short-term supply constraints, developers rushed to import modules, underscoring the effectiveness of the mechanism in steering demand towards domestic sources. Its reintroduction has reaffirmed the government’s intent to sustain manufacturing growth while balancing deployment needs.

The Renewable Energy Research and Technology Development programme [8] complements India’s manufacturing-focused policies by supporting innovation across solar, wind, hybrid, storage, hydrogen and other renewable technologies. The programme provides up to 100% financial support to government R&D institutions and 50% to 70% to industry for research, design and technology demonstration projects aimed at cost reduction and performance improvement [9]. By linking industry and research, the programme promotes indigenous technology development and enhances India’s long-term competitiveness in renewable energy.

Other complementary measures reinforce this ecosystem. The Domestic Content Requirement policy for public sector projects creates an assured baseline of demand for Indian-made modules and cells, supporting utilisation in emerging facilities. The Viability Gap Funding mechanism offsets cost differentials between imported and domestic modules, helping government agencies procure locally made products without inflating tariffs [10], [11].

The recent reduction in Goods and Services Tax rates on solar components is also expected to support the manufacturing sector by easing working capital pressures and lowering production costs. This measure will improve the cost competitiveness of domestic manufacturers and complement existing policy initiatives aimed at strengthening India’s solar manufacturing ecosystem.

These instruments, collectively, constitute a coherent and multi-layered industrial policy. They blend protection, promotion and performance, balancing the need for early-stage support with incentives for efficiency and innovation. Institutional coordination among MNRE, Solar Energy Corporation of India and other government agencies has been equally critical in maintaining momentum and ensuring policy predictability.

The outcome is a policy architecture that not only nurtures domestic manufacturing but also aligns with India’s long-term energy and industrial strategy. The shift from fragmented support schemes to a unified, incentive-linked framework reflects a maturing approach that integrates industrial competitiveness, supply chain resilience and national energy security within a single policy vision.

Industrial integration and the rise of national champions

India’s solar manufacturing landscape is entering a new phase of industrial maturity, led by large vertically integrated firms that are consolidating capacity across the entire photovoltaic value chain. They are driving this transformation from small-scale module assembly to comprehensive manufacturing ecosystems that span ingots, wafers, cells and modules.

Reliance is developing the Dhirubhai Ambani Green Energy Giga Complex in Gujarat, western India, spread over 5,000 acres and representing an investment of approximately INR 60,000 crore (USD 6.7 billion) in clean energy manufacturing infrastructure. The company has announced a 10GW solar PV module manufacturing facility, which will expand to include integrated production of polysilicon, ingots, wafers, cells and balance-of-system components such as glass and encapsulants. Reliance recently commissioned the first line of this facility to produce high-efficiency heterojunction (HJT) modules, marking the beginning of full-scale operations.

Adani Solar, part of the Adani Group, operates one of India’s most advanced integrated manufacturing campuses in Gujarat. In April 2024, Adani began commercial production of wafers and ingots with an initial capacity of 2GW, alongside plans to expand total manufacturing capacity to 10GW in the coming years. The company has already shipped over 15GW of solar modules (domestic 10GW and international 5GW), underlining its emergence as a global-scale producer.

Tata Power has also joined this wave, announcing plans to establish a 10GW wafer and ingot manufacturing facility, building on its existing 4.9GW of integrated cell and module capacity. The new facility, once commissioned, will strengthen the upstream solar manufacturing base and reduce India’s dependence on imported wafers and cells. This project aligns with the government’s broader ambition to achieve full value chain localisation and accelerate the transition from assembly to advanced manufacturing.

These developments mark a decisive shift in India’s industrial structure. The domestic solar manufacturing sector crossed 100GW of cumulative module manufacturing capacity under the ALMM scheme in August 2025 [12]. According to industry projections, India’s solar module capacity is expected to reach 200GW and cell capacity 100GW by 2027–28. These figures reflect a rapid scale-up driven by policy incentives, private investment and strategic integration.

The rise of such national champions has generated economies of scale, reduced cost structures and fostered technological sophistication. Companies are increasingly investing in advanced technologies—such as tunnel oxide passivated contact (TOPCon), HJT and perovskite-tandem cells—to enhance module efficiency and reliability. However, challenges persist in upstream segments, where domestic production remains limited, as well as in areas such as logistics, skilled workforce development and long-term access to low-cost finance.

The sector is also confronting an emerging concern of overcapacity. India’s solar module manufacturing capacity is projected to exceed 165GW by March 2027, while annual installations are expected to remain in the range of 45–50GW. This imbalance could lead to lower utilisation levels, pricing pressure and consolidation among manufacturers as competition intensifies. Larger integrated firms with upstream capabilities and stronger finance are better positioned to withstand these pressures, whereas smaller standalone producers may face challenges in maintaining viability. Despite these short-term headwinds, the emergence of large-scale, vertically integrated manufacturers signals India’s transition from being primarily a solar deployment market to becoming a globally competitive hub for clean energy manufacturing, built on the development of end-to-end PV value chains.

Global supply chain realignment

India’s solar manufacturing future will also depend on how effectively it can tap the global market and position itself within the rapidly shifting international supply chain. While domestic capacity expansion has been impressive, sustained growth will require deeper global integration through exports, technology partnerships and participation in transnational value chains. As countries diversify away from China-centric supply networks, India’s growing manufacturing base offers an opportunity to emerge as a reliable and competitive alternative hub for solar components.

The global photovoltaic market is undergoing a major realignment driven by trade barriers, overcapacity and geopolitical shifts. In August 2025, the Trump administration in the United States decided to impose tariffs of up to 50% on Indian solar module imports, a move that threatens to limit Indian market share in its most important export destination. In the same month, the United States Department of Commerce launched an anti-dumping and countervailing duty enquiry into imports of crystalline silicon photovoltaic cells and modules from India, Indonesia and Laos. If the Department of Commerce determines that India is not engaged in unfair trade practices, Indian manufacturers could gain a durable cost advantage in the US market, which is projected to triple in size in the coming years under the Inflation Reduction Act. Conversely, if duties are imposed, exports could face major barriers.

Another example is the case of Waaree Energies. The company is aggressively expanding its US footprint, with an initial US module manufacturing capacity of 1.6GW and plans to ramp up to 4.2GW in the face of US tariff risk. This move allows Waaree to participate in the US market under the provisions of the Inflation Reduction Act, which encourages domestic production. However, the US Customs and Border Protection has raised concerns regarding alleged evasion of solar tariffs, particularly whether Chinese made cells were labelled as Indian in origin.

This dual dynamic, expanding manufacturing to serve new markets while facing regulatory scrutiny, illustrates both the opportunities and risks confronting Indian manufacturers in global trade, highlighting the need for market diversification to reduce over-reliance on the US market.

In Europe, the Net-Zero Industry Act aims to secure at least 40% of the EU’s solar module demand domestically by 2030, although high energy and other costs limit local competitiveness [13]. The EU’s approach focuses on diversification rather than complete self-sufficiency, creating opportunities for India to become a key partner in Europe’s solar supply chain. Collaborative initiatives such as the SolarPower Europe–National Solar Energy Federation of India partnership, committing to work together to strengthen EU–India cooperation in diversifying solar supply chains, could bear fruit in the long run.

Indian exporters are also increasingly targeting emerging markets in Africa, Latin America and Southeast Asia, where affordable and reliable solar equipment is in demand. Through the International Solar Alliance, India is extending technical assistance and concessional financing to partner countries, encouraging the deployment of Indian-manufactured modules in large-scale solar projects. This South South cooperation is broadening India’s export base while also strengthening its diplomatic presence in the global clean energy transition [14].

With global solar demand projected by the International Energy Agency to exceed 500GW of new installations annually by 2030, India’s rapidly expanding module manufacturing base positions it to capture a meaningful share of global solar trade, provided it sustains competitiveness in cost, quality and reliability. However, Indian manufacturers will continue to face intense price competition, particularly from China. To remain viable in export markets, Indian firms will need to shift from competing purely on price to focusing on high-performance technologies, such as TOPCon, HJT and perovskite-tandem cells.

Ultimately, India’s solar manufacturing ambitions cannot thrive in isolation. The country’s ability to integrate with global supply chains, comply with international standards and forge long-term trade partnerships will determine whether its manufacturing expansion translates into sustainable global competitiveness.

The road ahead

India’s solar manufacturing transformation stands at a pivotal juncture. Having achieved impressive capacity expansion, the sector’s next challenge is to consolidate scale with sustainability, innovation and competitiveness. Deepening vertical integration into upstream segments, such as polysilicon and wafers, will be crucial to reducing import dependence and cost exposure. Meanwhile, stable and transparent policy frameworks will ensure investor confidence and manufacturing continuity. Access to affordable, long-term green financing through concessional loans, blended finance and climate funds will be critical to maintaining momentum in an environment of global price pressure and tightening margins.

Embedding environmental, social and governance principles and rigorous traceability systems across the value chain will reinforce India’s reputation as a responsible and transparent manufacturer. Adopting digital tools such as blockchain-based material tracking and life-cycle carbon accounting will enable compliance with global frameworks while also providing a competitive edge in export markets.

Innovation will define the next frontier, through high-efficiency cell technologies, supported by R&D partnerships and process automation. Advancing circularity by developing recycling and materials recovery systems will help manage future waste streams and align the sector with global sustainability norms. Parallel efforts in digitalisation and smart manufacturing will improve productivity, quality control and energy efficiency.

Finally, developing a technically skilled workforce through targeted training and industry–academia collaboration will ensure that this growth is both inclusive and durable. Given the current policy support and large announced investments, India is on track to become a leading global solar manufacturing hub by 2030, capable of meeting large swathes of domestic demand and supplying export markets, provided structural constraints such as upstream supply and financing are addressed. The coming decade will determine whether India can convert this momentum into an innovative and globally competitive clean energy manufacturing ecosystem.

References

[1] Ministry of New and Renewable Energy, “Year-wise Achievements”. Available at: https://mnre.gov.in/en/year-wise-achievement/

[2] Ministry of New and Renewable Energy, 2025, “Physical Achievements”. Available at: https://mnre.gov.in/en/physicalprogress/

[3] Press Information Bureau, 2025, “The Solar Surge: India’s Bold Leap Toward a Net Zero Future”. Available at: https://www.pib.gov.in/PressNoteDetails.aspx?id=155063&NoteId=155063&ModuleId=3

[4] Government of India, “Notification”. Available at: https://upload.indiacode.nic.in/showfile?actid=AC_CEN_2_45_00006_198215_1517807325366&type=notification&filename=cssg01-2018.pdf

[5] Ministry of New and Renewable Energy, “Production Linked Incentive (PLI) Scheme: National Programme on High Efficiency Solar PV Modules”. Available at: https://mnre.gov.in/en/productionlinked-incentive-pli/

[6] Government of India, 2022, “Capacity Allocation Under RfS for Selection of Solar PV Module Manufacturers for Setting up Manufacturing Capacities for High Efficiency Solar PV Modules in India Under the Production Linked Incentive Scheme (Tranche-II)”. Available at: https://cdnbbsr.s3waas.gov.in/s3716e1b8c6cd17b771da77391355749f3/uploads/2023/08/2023080844.pdf

[7] Government of India, “List of Successful Bidders Under Tranche-I of PLI Scheme ‘National Programme on High Efficiency Solar PV Modules’”. Available at: https://cdnbbsr.s3waas.gov.in/s3716e1b8c6cd17b771da77391355749f3/uploads/2023/08/2023080887.pdf

[8] Ministry of New and Renewable Energy, “Research & Development Scheme”. Available at: https://mnre.gov.in/en/researchdevelopment-scheme/

[9] Government of India, 2021, “Order”. Available at: https://cdnbbsr.s3waas.gov.in/s3716e1b8c6cd17b771da77391355749f3/uploads/2023/01/2023011018.pdf

[10] Government of India, 2019, “Order”. Available at: https://cdnbbsr.s3waas.gov.in/s3716e1b8c6cd17b771da77391355749f3/uploads/2023/08/2023080886.pdf

[11] Ministry of New and Renewable Energy, “Central Public Sector Undertaking (CPSU) Scheme Phase-II”. Available at: https://mnre.gov.in/en/central-public-sector-undertaking-cpsu-schemephase-ii-government-producer-scheme-for-setting-up-12000-mw-grid-connected-solar-photovoltaic-pv-power-projectsby-the-government-producers-with-vi/#:~:text=2019%2C%20approved%20implementation%20of%20CPSU,entities%2C%20either%20directly%20or%20through

[12] Press Information Bureau, 2025, “India Achieves Historic Milestone of 100GW Solar PV Module Manufacturing Capacity under ALMM”. Available at: https://www.pib.gov.in/PressReleasePage.aspx?PRID=2156173&utm

[13] European Commission, 2024, “Net-Zero Industry Act”. Available at: https://commission.europa.eu/topics/competitiveness/green-dealindustrial-plan/net-zero-industry-act_en

[14] Press Information Bureau, 2025, “Union Minister and President of International Solar Alliance Shri Pralhad Joshi Launches Curtain Raiser for the Eighth ISA Assembly”. Available at: https://www.pib.gov.in/PressReleasePage.aspx?PRID=2176518

Author

Shantanu Roy is Sector Coordinator for Renewables and Energy Conservation at the Center for Study of Science, Technology and Policy (CSTEP), a leading research think tank based in India. With over 15 years of experience spanning renewables, thermal power, and oil and gas, he collaborates with government and industry to accelerate renewable energy adoption in India.