One of the leading solar cell manufacturers for nearly a decade, Aiko Solar entered the module manufacturing industry with an All Back Contact (ABC) product that aims to enter the residential as well as commercial and industrial (C&I) markets in Europe, where the company in 2020 established a research and development (R&D) facility, Solarlab Aiko Europe, in Germany.

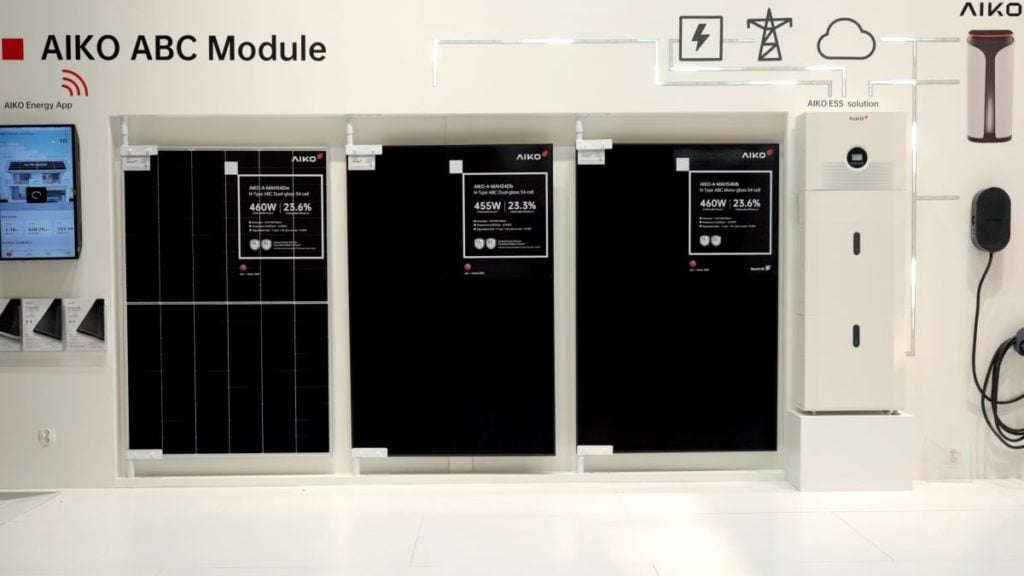

At Intersolar 2023, the Chinese company showcased several of its ABC modules, of which its 72-cell white hole series won an award at the trade show due to its high efficiency of 24% and its long lifespan with a power attenuation rate of just 0.35% per year.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

PV Tech caught up with Frank Feldmann, chief scientist at Solarlab Aiko Europe, during Intersolar 2023 in Munich to talk about the company’s election to go with ABC technology in lieu of tunnel oxide passivated contact (TOPCon) or heterojunction (HJT) and Aiko Solar’s future plans for Europe, both in terms of market targets and at the upstream level.

PV Tech: Why did Aiko Solar decide to go with ABC technology against TOPCon or HJT? And which markets is it best suited for?

Frank Feldmann: Aiko Solar has analysed different technologies. We have also looked into TOPCon and heterojunction. Ultimately, we decided for this high-performance product, the All Back Contact (ABC) cell. We think that it’s the perfect product for the residential use case, especially our black module, but we are also targeting commercial, and later also utility-scale projects. For commercial buildings, we also have larger modules, the 72-cell modules. For utility-scale, we are developing bifacial ABC modules.

What are the advantages of ABC against TOPCon or HJT? What sets it aside from other technologies?

There are several advantages. One is that you can introduce passivating contacts for both polarities. Since they are on the rear side, you don’t have much parasitic absorption losses. In heterojunction cells, you have also passivating contacts of both polarities, but one is on the front side and there you lose quite a lot of current. With ABC we don’t have this disadvantage, we still have very high VOC [voltage at open circuit] as well as high fill factor. Another advantage that we have with the ABC cell, is that the metallisation is exclusively on the rear side. It is not only good for aesthetics, but we can quite significantly reduce series resistance, and thereby achieve higher fill factor. With the metallisation on the front, you always have to balance your resistive losses and the optical losses. We don’t have to trade this in, in the ABC cell.

Aside from the aesthetic of having a panel that is entirely black, what other advantages for the residential market does ABC offer?

We have, to my knowledge, the highest mass-produced module efficiency in the market. We showcase a module with up to 24% efficiency. Higher efficiency means more power per area which is not only advantageous in limited space scenarios such as rooftops but also reduces the balance of system costs. Moreover, the module’s very low degradation rate and good temperature coefficients guarantee higher power output over a 25-year lifespan compared to traditional PERC modules.

What are Aiko’s near and future plans in Europe both in terms of R&D and market wise, and more specifically Germany? Is a module assembly plant outside of China in the pipeline?

I work in the 2020 established R&D Center Solarlab Aiko Europe in Freiburg, where we are amongst other projects researching on the next generation of solar cells. We have a couple of projects on perovskite silicon tandem cells. In addition to that, we collaborate with research institutes all over Europe. And of course, we are in close contact with our colleagues in China at the Yiwu R&D centre. Then we founded this year AIKO Energy Germany GmbH in Duesseldorf. There is our new headquarters for our European activities regarding sales and technical support in Europe. Our sales region will be the European markets, such as Germany, Austria, the Benelux, Italy, Spain and so on.

We are also evaluating a production line in Europe. But at the moment everybody is well aware that there’s a certain cost disadvantage for a production in Europe. We are looking into this and balance the advantages and disadvantages. We will come to a decision based on our findings.

I suppose the lack of clarity from the Green Deal Industrial Plan (GDIP) does not give enough leeway to decide whether or not to build a plant in Europe?

I think the European Green Deal Industrial Plan and other frameworks associated with it, as well as the announcements of other European politicians, made it clear that Europe in the end needs a local production. Now it is evaluating how to do it best; what is a good framework? So a lot of people are lobbying for some common rules, like the Inflation Reduction Act in the US. It’s an ongoing discussion, which we observe closely. These messages are also important for us. Our investors believe that in the end, China cannot supply the worldwide demand of solar modules. There has to be also a local production in different regions, and Europe can be an attractive region.

In terms of markets, which segments is Aiko most interested in and which countries could be best suited for that?

For now we are targeting residential and C&I (commercial and industrial). There it’s the best application for our ABC product. Europe in that sense is a very attractive market. Last year in Germany we had seven gigawatts of installed solar capacity, and quite a huge share of this came from the residential segment. Other markets like Spain, which used to have more utility-scale projects, is developing a stable residential market. And of course, now with the high energy prices, there’s not only a high saving factor for home owners, but also for the companies who have to decarbonise their production and need to have solar on their rooftops.

With ABC modules not using any silver, are there any other aspects Aiko is looking to, to make its modules more eco-friendly and recyclable?

I think that it is also one of the big advantages of the ABC cell, that it’s silver free. The silver consumption in the PV industry is a huge concern. And now, with newer products, the silver consumption per watt peak increased slightly. In the long run, we need a terawatt scale market in order to reach our decarbonisation goals that cannot be sustained with silver. On that end, we are already safe. Of course, we will try to further improve the efficiency of the ABC product but also, the manufacturing process. In terms of recyclability, every solar module has the same problem that we want to have a really stable product, where we can have maybe 25-30 years lifetime or even longer. And this glass laminate construction is not ideal for recycling. We, as a community in general, should do more to improve the recyclability, because at the moment, the standard way of recycling is that we remove the aluminium frames. They are easy to recycle. We cut the cables off, we can get the copper, remove the junction boxes, and then we shred the rest. We should think of much better ways. A good way of recycling solar modules could apply to any solar module. It would be a win for everyone.