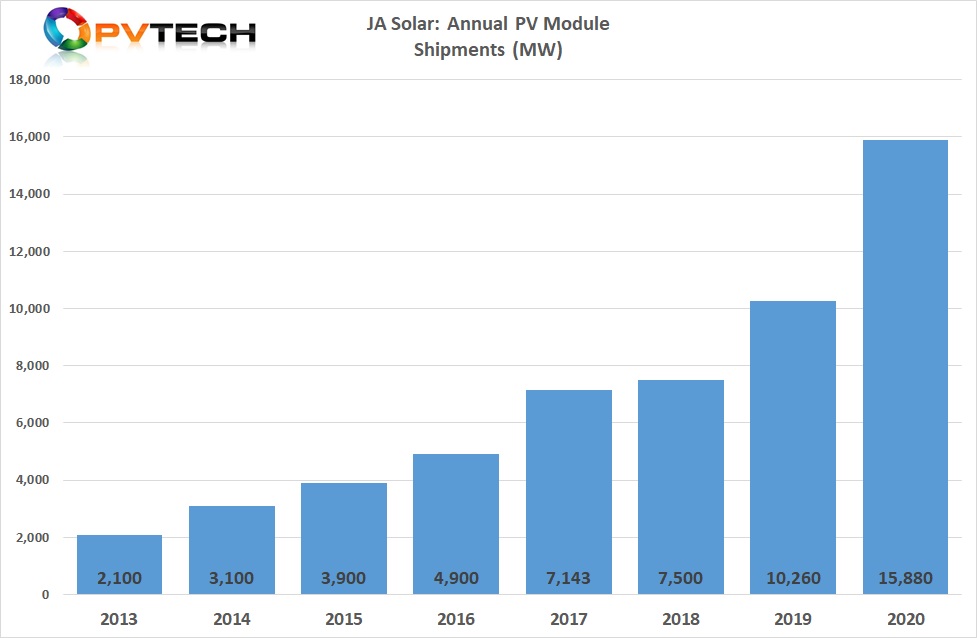

‘Solar Module Super League’ (SMSL) member JA Solar has reported PV module shipments of 15.88GW in 2020, up from 10.26GW in 2019, a 54.8% increase year-on-year, setting new records for total shipments and shipment growth.

The shipment figures were almost 1GW higher than some market research firms had forecasted. JA Solar said that the 15.88GW total shipments had included around shipments of around 500MW to its in-house downstream project business in China, although this is not a major activity for the company.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

The SMSL company reported overseas shipments accounted for 68.3% (10.84GW) of total shipments in 2020. As of the end of 2020, the company said it had a module nameplate production capacity of 23GW.

According to PV InfoLink’s statistics, JA Solar’s module shipments would rank third in the world in 2020. However, LONGi Group and JinkoSolar have yet to officially announce full-year financial results. Trina Solar, ranked fourth, could yet close the gap on JA Solar when full-year results are released.

Financial results

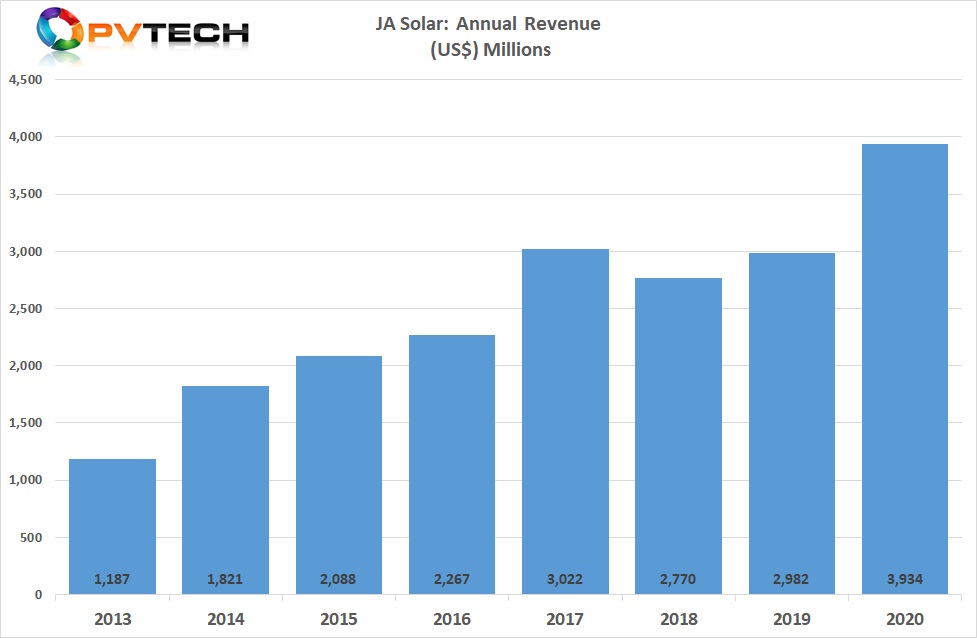

JA Solar reported full-year 2020 revenue (net income) of approximately RMB25.8 billion (US$3.93 billion), up 22.17% from the previous year. This was a new high for the company.

The manufacturer reported net profit attributable to shareholders of approximately RMB1.5 billion (US$229 million), up 20.34% from 2019.

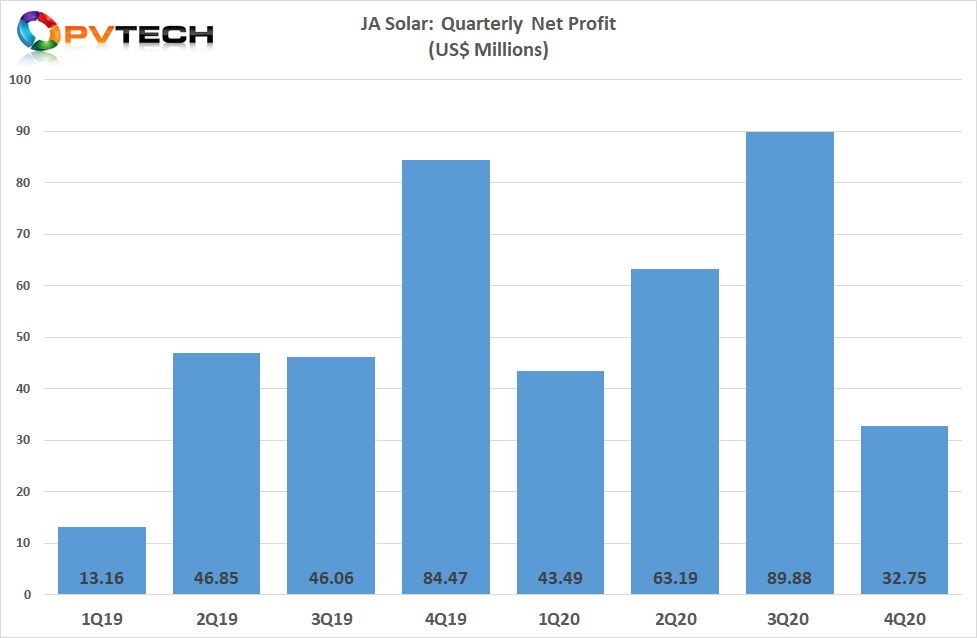

However, although fourth quarter 2020 revenue set a new quarterly record of US$1.39 billion, net profit took a significant hit coming in at around US$32.75 million, down from around US$89.88 million in the previous quarter, the highpoint of quarterly figures.

Even JA Solar’s first quarter net profit, despite being impacted by COVID-19, was higher at US$43.49 million.

Although the company did not specifically detail in its annual report why net profit in the fourth quarter of 2020 had declined 63.5% from the previous quarter, JA Solar told PV Tech that there were a number of factors at play during the quarter.

These factors included a significant increase in purchasing costs of polysilicon, PV films (encapsulants & backsheets) and solar flat glass.

But JA Solar also announced asset impairment charges in 2020 of approximately RMB169.1 million (US$25.74 million). These related to the provision for bad debts of accounts receivable, other receivables, contract assets, some impairment of construction projects in progress and fixed assets.

The key element may be the significant growth in PV module inventory levels at the end of the reporting period. JA Solar’s inventory had increased by 65.06%, compared to the prior year period. This was attributed to the overall growth of its business in 2020 and the implementation of major sales contracts signed by the company in 2020 for shipments in 2021.

The company had reported that the total sales amount of the top five customers in 2020 had reached over RMB 4.61 billion (US$701 million), equating to 17.87% of total annual sales.

Exclusive analysis of JA Solar’s manufacturing capacity expansion plans, which see the SMSL manufacturer reach a nameplate module assembly capacity of 40GW by the year’s end, is available for PV Tech Premium subscribers here.