Updated: Leading ‘Solar Module Super League’ (SMSL) member, JinkoSolar has secured new solar panel orders totalling 10.7GW in the first four months of 2019, setting a company and industry record.

The SMSL said that overseas orders with fixed terms and conditions accounted for the vast majority of the secured orders, which included the signing of several large supply agreements for PV power projects in Vietnam, Mexico, Spain and a number of other markets, according to the company.

Try Premium for just $1

- Full premium access for the first month at only $1

- Converts to an annual rate after 30 days unless cancelled

- Cancel anytime during the trial period

Premium Benefits

- Expert industry analysis and interviews

- Digital access to PV Tech Power journal

- Exclusive event discounts

Or get the full Premium subscription right away

Or continue reading this article for free

Gener Miao, Chief Marketing Officer of JinkoSolar said, “Leveraging our large geographic footprint, we were able to rapidly benefit from the accelerating shift towards high-efficiency mono panels and secure over 10.7 GW orders for 2019 in record time. With grid parity approaching, we find ourselves in a very strong position in an otherwise highly competitive industry. Our strategic foresight to expand into high efficient product markets at an early stage is paying off. Jinko will continue to support our customers and partners with over 15 GW capacity of industry leading facility.”

Although installations in China have declined rapidly without new support mechanisms, JinkoSolar said that it expected demand to pick up in China during the second half of 2019. Only 5.2GW was installed in China in the first quarter of 2019, a 46%, year-on-year decline.

JinkoSolar also noted that the record-high order book primarily consisted of high efficiency products, such as its latest Cheetah series, reinforcing the global shift to high-efficiency products.

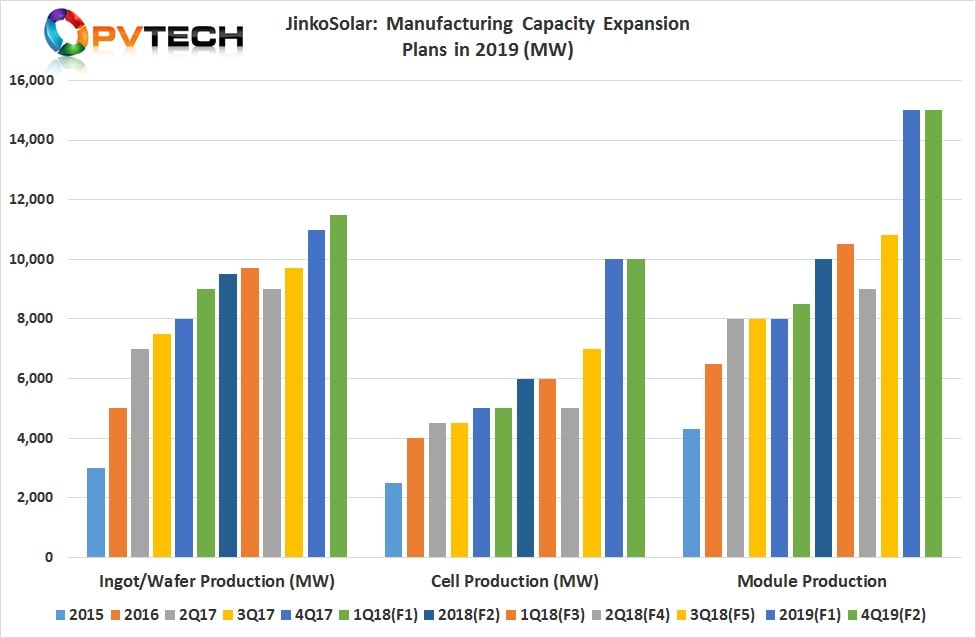

PV Tech previously reported that JinkoSolar had annual PV panel shipments in 2018 of 11.4GW a new company and industry record and planned to take panel nameplate capacity to 15GW in 2019.

New capacity expansions

Separately, JinkoSolar confirmed it was is expanding its high efficiency monocrystalline wafer production capacity with the construction of a new ‘greenfield’ facility in Leshan, Sichuan Province, China with a nameplate capacity of 5GW.

The new facility is expected to increase JinkoSolar’s mono wafer capacity from 6.5GW to 11.5GW upon completion, which is already under construction and expected to ramp production in the third quarter of 2019. The company said that it expected to reach full capacity in the fourth quarter of 2019.

JinkoSolar said that its mono wafer capacity at the end of 2018 had reached 5.7GW, although the expectation previously guided was to reach 9.7GW and 11GW by the end of 2019.

The company also noted that mono wafer capacity had reached 6.5GW at the end of the first quarter of 2019, via improvements in both production output and efficiency.

Total mono wafer capacity by the end of 2019 is expected to be 11.5GW.

JinkoSolar has been exclusively using a large oversize (158.75mm x 158.75mm) ingot for its recent spate of wafer capacity expansions, which are also used for JinkoSolar’s latest high-efficiency mono PERC Cheetah series panels.